- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS): Assessing Valuation After Q3 Earnings Beat, Buyback, and Strategic AI Investments

Reviewed by Simply Wall St

Northern Trust (NTRS) has just delivered its third quarter earnings results, meeting or slightly topping market expectations. The company’s performance was bolstered by asset growth and stronger efficiency. Management also authorized a fresh share buyback and reaffirmed its dividend.

See our latest analysis for Northern Trust.

Despite a modest pullback after earnings, Northern Trust’s share price has climbed 22.4% year-to-date, with a standout one-year total shareholder return of 29.4%. Multi-year returns continue to impress, reflecting healthy long-term growth and rising investor confidence in the firm’s innovation efforts and disciplined capital management.

If you’re curious what other financial leaders are showing strong momentum, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

The strong gains and operational progress are clear. However, with shares hovering near analyst targets, the key question now is whether Northern Trust is trading at a bargain or if the market has already priced in its future growth. Is there still a buying opportunity here?

Most Popular Narrative: 6.5% Undervalued

Northern Trust’s last close of $126.03 sits below the most popular narrative's fair value, which comes in at $134.86 per share. Tight valuation differences suggest Wall Street sees limited upside, and the story is now driven by deeper financial trends and evolving catalysts.

Strategic investment in AI, technology automation, and operational restructuring (centralization, standardization, and automation of core processes) is delivering improved operating leverage, declining headcount, and margin expansion. This is bending the cost curve and freeing resources for growth investments, strengthening both net margins and profitability over time.

Are you curious what future profit margins and growth assumptions underpin this fair value? The secret lies in forecasted earnings, shifting cost structures, and a potentially transformative approach to long-term profitability. Find out if expectations line up with reality by reading the full breakdown now.

Result: Fair Value of $134.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected growth in private markets or accelerated gains from technology investments could quickly shift the outlook and challenge the current cautious narrative.

Find out about the key risks to this Northern Trust narrative.

Another View: Digging Deeper on Valuation

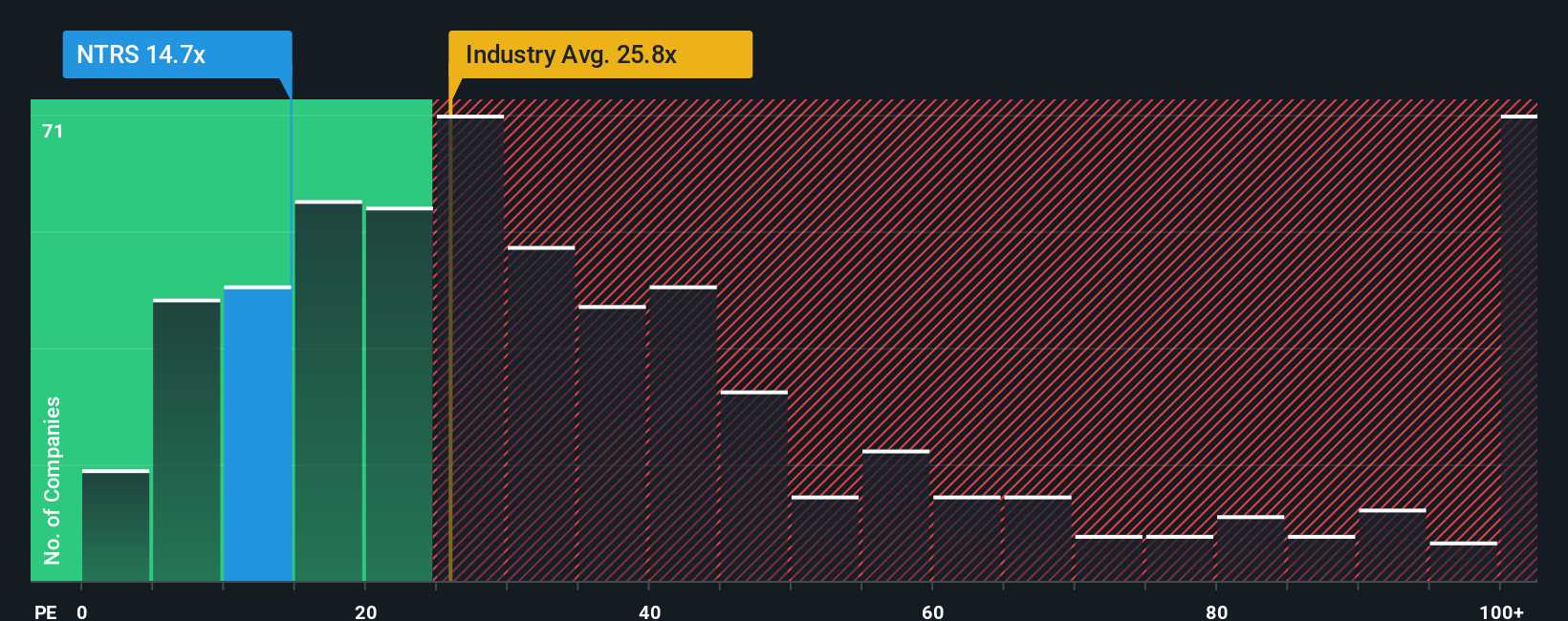

Looking from a different angle, Northern Trust’s price-to-earnings ratio stands at 14.3x, noticeably lower than the US Capital Markets industry average of 26.1x and a fair ratio of 16x. This discount might suggest a margin of safety, or it could point to lingering concerns the market has yet to resolve. Does this gap present a real opportunity, or is there more risk beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Trust Narrative

Feel free to dive into the numbers and shape your own take on Northern Trust. It takes less than three minutes to build a unique perspective. Do it your way

A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always seek the hidden gems and future winners before the crowd catches on. Give yourself that edge by checking out these tailor-made opportunities today:

- Unlock growth potential by reviewing these 27 AI penny stocks, which are at the forefront of artificial intelligence innovation, disrupting industries and changing the face of technology.

- Secure steady income with these 17 dividend stocks with yields > 3%, offering yields above 3 percent. This is ideal for those looking to strengthen their portfolios with strong dividend payers.

- Get ahead of the market trends by targeting value plays among these 878 undervalued stocks based on cash flows, which have robust cash flows and attractive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives