- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NTRS): Assessing Valuation After New Institutional Mandates Fuel Business Momentum

Reviewed by Simply Wall St

Northern Trust (NTRS) has secured new and expanded mandates, including a recent appointment by Osmosis Investment Management NL B.V. and enhanced fund services for Avanda Investment Management as part of an initiative by the Monetary Authority of Singapore.

See our latest analysis for Northern Trust.

The string of new mandates and a substantial bond issuance highlight how Northern Trust is building momentum. Its institutional business is seeing a boost, and short-term confidence is reflected in its 2.1% monthly share price return. Over the longer term, investors have enjoyed a 20.3% total shareholder return over the past year, with strong gains stretching further back. This suggests both recovery and long-term potential.

If recent client wins have you thinking about what else is gaining traction, this could be a timely moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets and a record of consistent returns, the question now is whether Northern Trust offers hidden value at today’s levels or if the market has already accounted for further growth.

Most Popular Narrative: 5.3% Undervalued

With Northern Trust’s most widely followed narrative estimating a fair value of $134.50, the current price of $127.39 suggests room for upside if these projections hold true. To understand what’s driving this premium, consider the following excerpt from the narrative:

"Strategic investment in AI, technology automation, and operational restructuring (centralization, standardization, and automation of core processes) is delivering improved operating leverage, declining headcount, and margin expansion, thus bending the cost curve and freeing resources for growth investments. This strategy is strengthening both net margins and profitability over time."

How much credit is due to smarter automation for Northern Trust’s improved margins? There’s a bold forecast hidden in the narrative, one that blends shrinking costs, richer margins, and a projected profit profile that stands apart from many in its sector. Want to unravel the key assumption that could be driving Northern Trust’s potential? Dive in to see what’s fueling analyst conviction behind these numbers.

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global interest rates or increased technology spending could undermine margin gains and challenge the upbeat narrative around Northern Trust’s long-term outlook.

Find out about the key risks to this Northern Trust narrative.

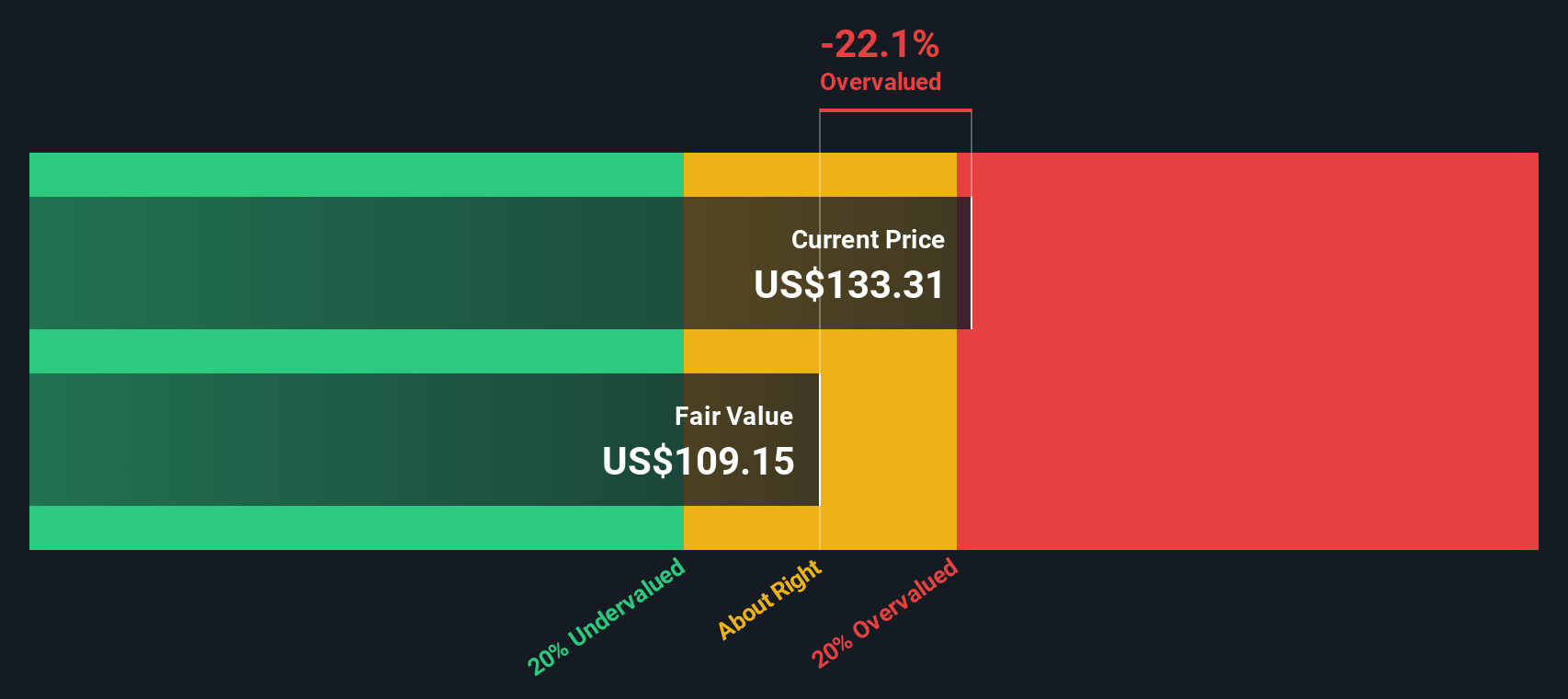

Another View: SWS DCF Model Offers a Cautious Perspective

While traditional metrics point to value, our SWS DCF model presents a different angle for Northern Trust. According to its cash flow analysis, shares are actually trading above estimated fair value. This suggests the stock could be more expensive than it seems. Is the market pricing in too much optimism, or does the DCF miss the mark when it comes to cyclical players like Northern Trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Trust Narrative

If you’re the type who likes to follow your own trail of insights or think you can spot something others have missed, it only takes a few minutes to craft a narrative from the ground up. Do it your way

A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while others seize fresh opportunities. Use these dynamic stock ideas to put your money to work in the market’s most compelling themes.

- Tap into growth by scanning for these 26 AI penny stocks that are transforming industries with the latest artificial intelligence breakthroughs.

- Lock in reliable income streams by checking out these 16 dividend stocks with yields > 3% offering strong yields above 3% to strengthen your portfolio.

- Stay ahead of tomorrow’s tech trends by browsing these 26 quantum computing stocks at the forefront of quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives