- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

AJ Bell Asset Servicing Mandate Might Change The Case For Investing In Northern Trust (NTRS)

Reviewed by Sasha Jovanovic

- Northern Trust and Carne Group recently announced that they are providing asset servicing and Authorised Corporate Director services for AJ Bell, a leading UK investment platform, supporting AJ Bell’s in-house managed funds with custody, depositary, and fund administration services totaling about £5 billion (US$6.5 billion) in assets under management.

- This client mandate enhances Northern Trust's position in the UK asset servicing sector and highlights its increasing engagement with prominent investment platforms.

- We’ll examine how securing AJ Bell’s asset servicing mandate might influence Northern Trust’s investment narrative and future business outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Northern Trust Investment Narrative Recap

To own shares of Northern Trust, investors need confidence in its ability to win new mandates with leading platforms, deepen client relationships in asset servicing, and invest efficiently in technology amid industry fee pressures and rising competition. While the AJ Bell partnership reinforces Northern Trust’s momentum in client wins, it does not materially impact the most important short-term catalyst, achieving sustained margin expansion through operational efficiency, nor does it directly affect the key risk of ongoing fee compression from passive investing trends.

Among recent announcements, Northern Trust’s middle office outsourcing deal with Osmosis Investment Management is especially relevant for highlighting continued demand for sophisticated outsourcing services, which supports organic growth but also reflects the ongoing challenge of maintaining pricing power as competition intensifies. These developments place even greater focus on the company’s ability to execute cost controls and technology upgrades, as persistently high costs could limit margin gains in the near term.

In contrast, investors should be aware that despite new client mandates, industry-wide fee pressure remains a risk to...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's narrative projects $8.2 billion revenue and $1.4 billion earnings by 2028. This requires a 1.6% yearly revenue decline and a $0.7 billion decrease in earnings from $2.1 billion.

Uncover how Northern Trust's forecasts yield a $134.50 fair value, in line with its current price.

Exploring Other Perspectives

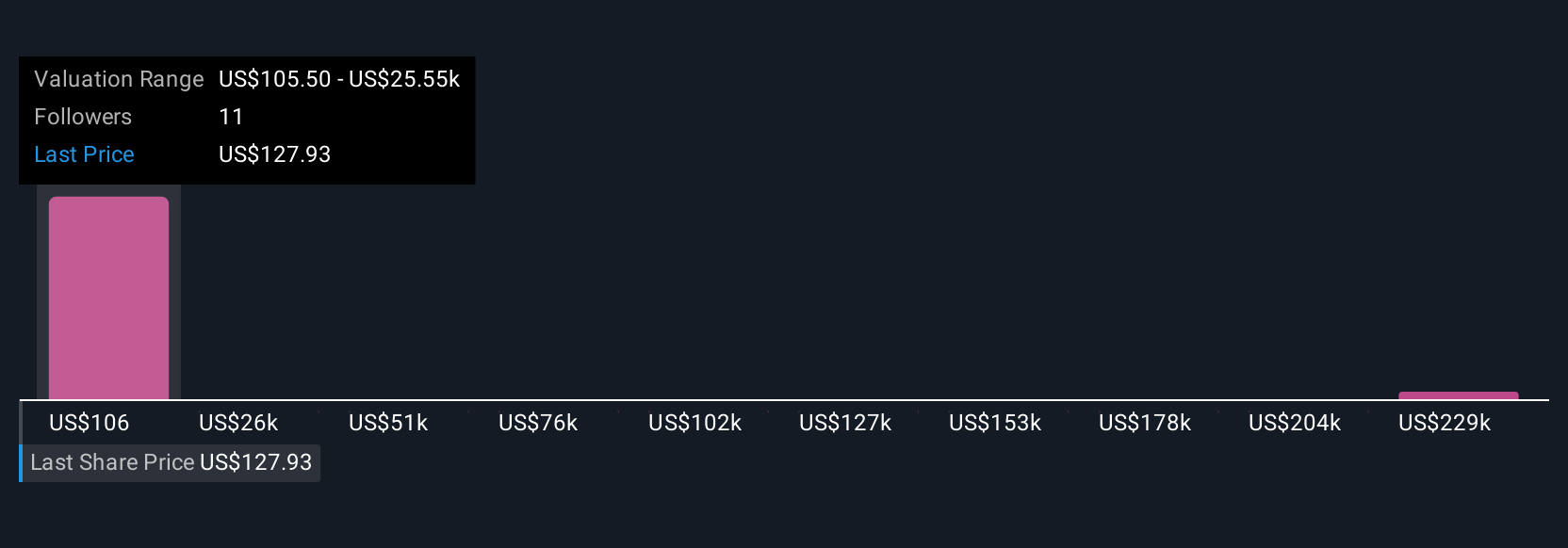

Fair value estimates for Northern Trust from four Simply Wall St Community members span from US$114 to an extreme US$254,541, emphasizing very different outlooks. While some expect robust organic growth and margin gains from operational efficiency, others question whether high costs and industry fee compression could cap future upside, explore these varied views for a broader understanding.

Explore 4 other fair value estimates on Northern Trust - why the stock might be a potential multi-bagger!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026