- United States

- /

- Diversified Financial

- /

- NasdaqGM:NMIH

How Surging Premium Growth and Rising Book Value Will Impact NMI Holdings (NMIH) Investors

Reviewed by Sasha Jovanovic

- In recent news, NMI Holdings reported that its net premiums earned have grown at a 9.8% annualized rate over the past two years, exceeding the pace of the broader insurance sector.

- This growth has also contributed to a significant increase in the company's book value per share, pointing to a stronger asset base and enhanced value creation for shareholders.

- To better understand what this means for investors, we'll explore how the gains in net premiums and book value influence NMI Holdings' investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NMI Holdings Investment Narrative Recap

To feel confident as a shareholder in NMI Holdings, you need to believe in the company’s ability to sustain premium growth and strengthen its asset base despite shifts in the housing market. The latest report of 9.8% annualized net premium growth and increased book value is positive, but it does not materially change that home price trends remain a critical short term catalyst, while macroeconomic risks like potential downturns or rising delinquencies are still the biggest threats to the underlying business model.

Among recent updates, the Q2 2025 results are particularly relevant given revenue and net income both climbed year over year, supporting the narrative that growth in premiums is translating into stronger financial performance. However, with net profit margins slightly softer than the previous year and broader market risks evident, the connection between earnings trends and external housing conditions remains key for investors tracking catalysts like revenue expansion and claims volatility.

Yet, even with strong growth, investors should not lose sight of the reality that, if macroeconomic conditions shift....

Read the full narrative on NMI Holdings (it's free!)

NMI Holdings' forecast points to $812.2 million in revenue and $410.6 million in earnings by 2028. This scenario assumes annual revenue growth of 6.1% and an increase in earnings of about $32.9 million from the current $377.7 million level.

Uncover how NMI Holdings' forecasts yield a $44.14 fair value, a 21% upside to its current price.

Exploring Other Perspectives

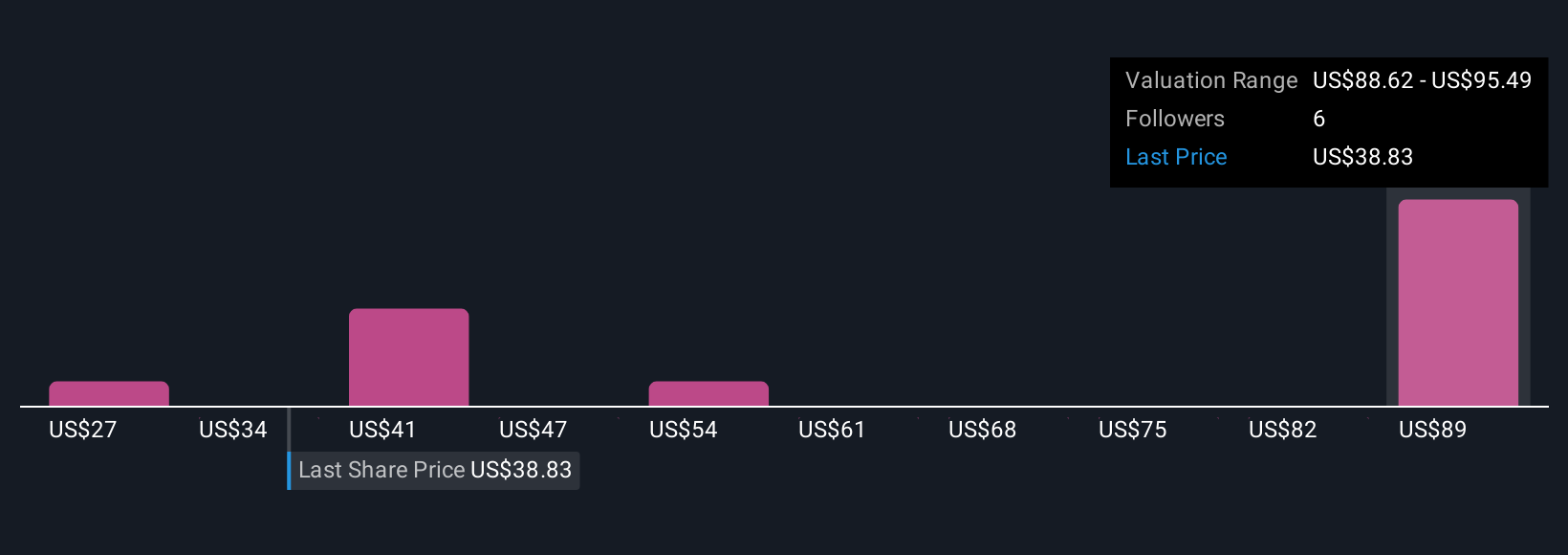

Simply Wall St Community members gave four fair value estimates for NMI Holdings, spanning from US$26.80 to US$96.75 per share. While these show wide variations in outlook, the persistent macroeconomic risks discussed above may weigh on these valuations if market conditions change, considering multiple viewpoints can help you assess all potential outcomes.

Explore 4 other fair value estimates on NMI Holdings - why the stock might be worth 26% less than the current price!

Build Your Own NMI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NMI Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NMI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NMI Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NMI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NMIH

NMI Holdings

Provides private mortgage guaranty insurance services in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives