- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ) Valuation: Assessing the Impact of Strong Earnings and AI Upgrades on Future Growth

Reviewed by Simply Wall St

Nasdaq (NDAQ) delivered a jump in both revenue and net income for the third quarter, highlighting operational momentum. The company also reported progress with advanced AI in its market surveillance platform, which strengthens its global technology offering.

See our latest analysis for Nasdaq.

Nasdaq’s recent AI product rollout and strong quarterly profits have arrived against a backdrop of steady share price progress. Year to date, the share price has climbed 14.7%, while total shareholder return for the past year sits at a robust 19.3%. Longer-term investors have seen even greater rewards, with a total shareholder return exceeding 130% over five years. This reflects sustained momentum and growing confidence in Nasdaq’s evolving business model.

If you’re interested in seeing how other tech-driven financial firms are innovating and growing, check out the full list in our curated See the full list for free..

With all this positive momentum, a key question remains for investors: do Nasdaq’s recent gains and innovation leave the stock undervalued, or is the market already pricing in the company’s next round of growth?

Most Popular Narrative: 13.5% Undervalued

According to the most widely followed narrative, Nasdaq's fair value is estimated at $102.67, representing a notable premium to the last close price of $88.78. This suggests the market may not be fully capturing the company's prospects or recent performance improvements.

Nasdaq's strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100. They also support long-term earnings performance.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and bold financial projections. Curious to see which ambitious forward assumptions push that target even higher? Dive in to uncover the numbers and strategies that underpin this compelling fair value estimate.

Result: Fair Value of $102.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, external volatility or delays in client decision-making could quickly challenge optimistic projections and impact Nasdaq's near-term growth narrative.

Find out about the key risks to this Nasdaq narrative.

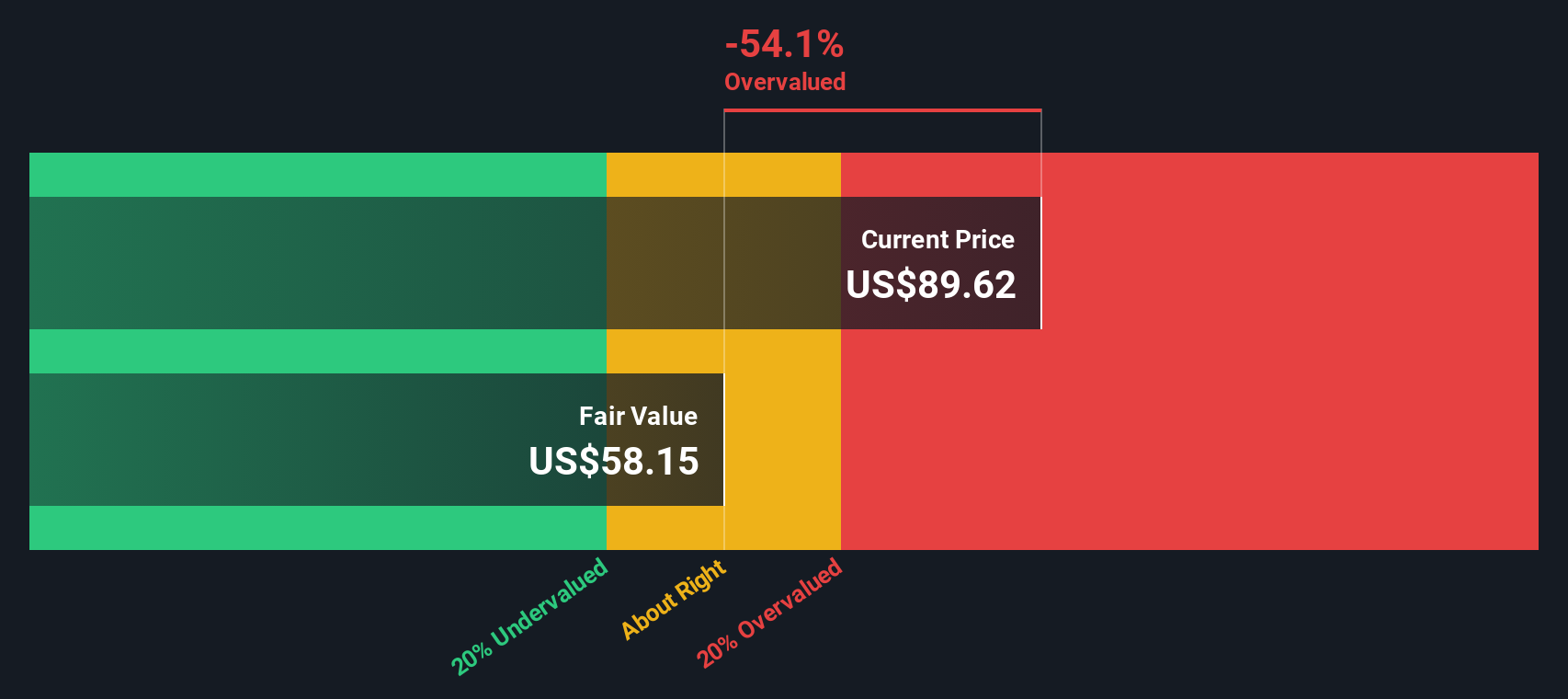

Another View: Caution from the SWS DCF Model

While analyst consensus sees Nasdaq as undervalued, our SWS DCF model tells a different story. According to this approach, Nasdaq's current share price of $88.78 looks expensive compared to its estimated fair value of $59.30. This challenges the bullish outlook and raises the question: could optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nasdaq for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nasdaq Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Step up your research and take charge of your portfolio with these powerful screens. Act now to uncover growth stories, hidden value, and future game-changers that could help supercharge your returns.

- Accelerate your hunt for market bargains by checking out these 869 undervalued stocks based on cash flows with compelling upside and strong fundamentals.

- Capture income potential by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% for steady cash flow and dependable payouts.

- Ride the next wave of innovation as you scan these 27 AI penny stocks leading the artificial intelligence revolution and paving the way in tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives