- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Should Morningstar's (MORN) $1 Billion Buyback and AI Focus Prompt a Closer Look From Investors?

Reviewed by Sasha Jovanovic

- Morningstar, Inc. recently announced a new US$1 billion share repurchase program to be executed over the next three years, while emphasizing its focus on AI-driven improvements for data delivery and operational efficiency.

- This move highlights the company's intention to return capital to shareholders while also investing in technology to refine its business model.

- We'll explore how Morningstar's balance between AI investments and its aggressive buyback authorization shapes its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Morningstar's Investment Narrative?

To be a shareholder in Morningstar, you need to believe in its potential to keep innovating amid a complex financial data sector and pursue steady growth through both new products and operational efficiency. The recent announcement of a US$1 billion share repurchase program is significant, combining direct capital returns to shareholders with a clear commitment to ramp up AI-driven capabilities across its platform. This dual approach could shift the short-term focus toward rewarding shareholders and building future competitiveness, while also signaling confidence from management despite recent revenue headwinds and weaker bottom-line results. However, this increased capital allocation, together with a new credit facility, introduces new risks such as higher leverage if execution stumbles or market conditions tighten. At the same time, expansion into private market indices and APAC credit ratings may serve as the next big catalysts, but cost discipline and successful AI integration remain the most important levers for value creation. The latest news on reduced short interest appears immaterial for the broader investment thesis. On the other hand, Morningstar's higher leverage from recent moves is something investors should not overlook.

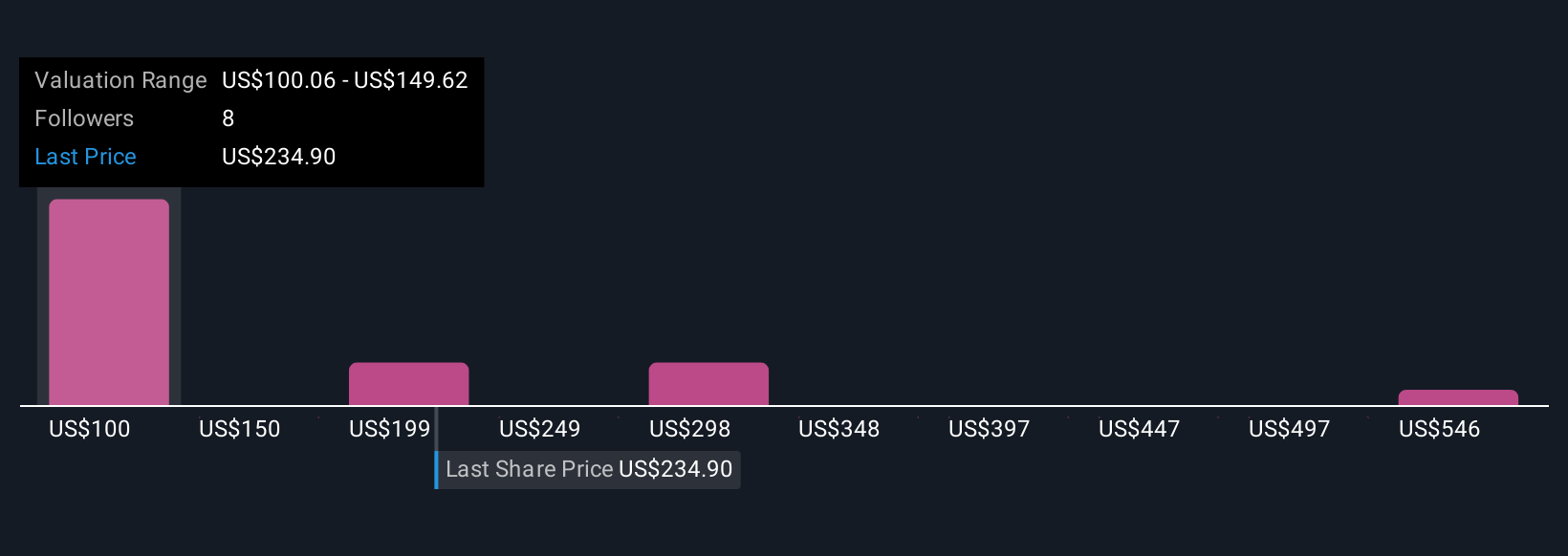

Morningstar's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 8 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success