- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Morningstar (MORN): Evaluating Valuation Following New Retirement Partnership With NPPG Plan Professionals

Reviewed by Simply Wall St

Morningstar (MORN) just announced a collaboration with NPPG Plan Professionals that will bring its advisor managed accounts service to NPPG’s pooled retirement plans. The partnership aims to offer personalized retirement solutions for small and mid-sized employers, which could expand Morningstar’s reach in the retirement sector.

See our latest analysis for Morningstar.

Morningstar’s new partnership comes after recent leadership changes, with a new Chief Revenue Officer set to take over in November. While these moves signal a strategic shakeup, the share price has retreated this year, posting a year-to-date drop of nearly 34% and a 1-year total shareholder return of -33.7%. That is a clear sign of fading momentum, even as the company pursues new growth channels.

If you’re weighing what else is gathering attention, consider expanding your search and discover fast growing stocks with high insider ownership

With shares trading more than 30% below their 52-week highs and at a notable discount to analyst targets, the question arises: is this a rare value opportunity for Morningstar, or is the market already accounting for any future growth?

Price-to-Earnings of 22.9x: Is it justified?

Morningstar’s current share price implies a price-to-earnings (P/E) multiple of 22.9x, yet this sits above both its estimated fair value and recent price momentum. This higher multiple puts Morningstar in a tricky valuation spot compared to historical benchmarks and its competitive set.

The P/E ratio indicates how much investors are willing to pay for each dollar of Morningstar’s earnings. It offers a quick snapshot of market expectations for growth versus the company’s actual performance. At 22.9x, investors are paying more for current earnings than what broader analysis suggests would be fair (15x). This raises questions about whether upside is already priced in.

Despite posting impressive recent profit growth, the P/E ratio of 22.9x overshoots both the Capital Markets industry average of 26.6x and its peers’ average of 29.2x. However, it is still labeled as expensive relative to fair value estimates. If the market reverts to the calculated fair ratio, the stock could face further pressure.

Explore the SWS fair ratio for Morningstar

Result: Price-to-Earnings of 22.9x (OVERVALUED)

However, slowing revenue growth and recent share price volatility could challenge Morningstar’s upside, particularly if market conditions remain uncertain.

Find out about the key risks to this Morningstar narrative.

Another View: What Does the SWS DCF Model Say?

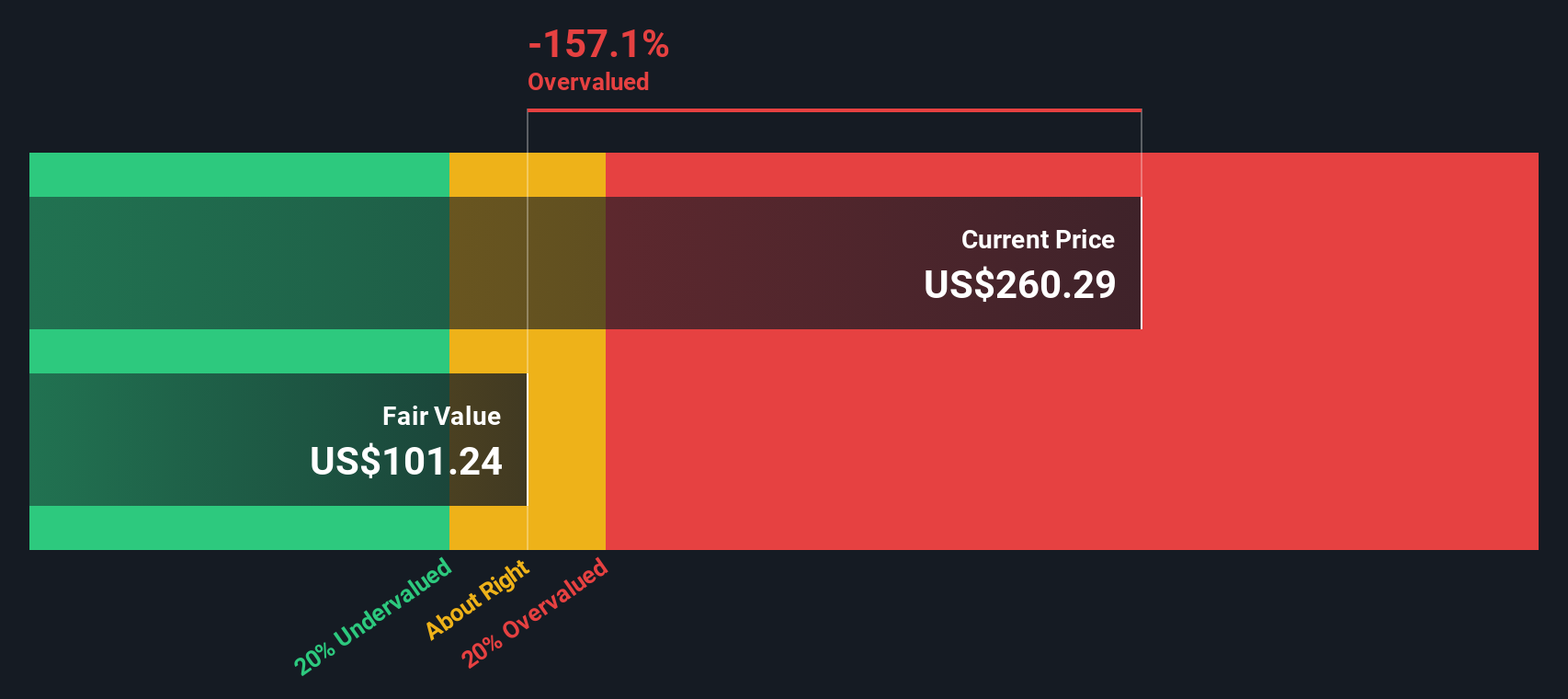

Taking a different approach, our DCF model estimates Morningstar’s fair value at just $99.22 per share, which is far below its current market price of $219.54. While multiples suggest the stock is on the expensive side, DCF raises a much bigger red flag. Could the market be missing some downside risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morningstar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morningstar Narrative

If you see things differently or want to shape your own story around Morningstar’s outlook, it only takes a few minutes to start. Do it your way

A great starting point for your Morningstar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now if you want to spot standout companies before everyone else. The Simply Wall Street Screener unlocks investment themes most investors overlook. Let’s move smart together.

- Capture the potential for significant returns and track momentum with these 3557 penny stocks with strong financials that punch above their weight in today’s market.

- Benefit from the reliability of passive income streams as you browse these 17 dividend stocks with yields > 3% offering attractive yields for long-term growth and stability.

- Tap into the future of medicine and technology by checking out these 33 healthcare AI stocks, where AI innovation is transforming healthcare possibilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives