- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Is Morningstar’s (MORN) Evergreen Fund Index Move Strengthening Its Private Market Data Edge?

Reviewed by Sasha Jovanovic

- Morningstar, Inc. has announced the upcoming launch of the Morningstar PitchBook US Evergreen Fund Indexes, scheduled for release in the first quarter of 2026 to benchmark semiliquid or evergreen funds across private equity, real estate, infrastructure, and other strategies.

- This initiative addresses the growing demand for transparency and peer comparisons in the expanding US evergreen fund market, which managed about US$450 billion in mid-2025 and is projected to exceed US$1 trillion by decade's end.

- We'll explore how Morningstar's new evergreen fund benchmarks could influence its investment narrative amid rising interest in private market data solutions.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Morningstar's Investment Narrative?

The big idea behind Morningstar’s appeal is its enduring role as a trusted source of data and analytics, especially for institutional investors seeking clarity in both public and private markets. The recent announcement of the Morningstar PitchBook US Evergreen Fund Indexes further strengthens this narrative, suggesting an intent to lead in transparency for evolving investment vehicles like semiliquid or evergreen funds. While the long-term significance of this move aligns well with the surge in US evergreen fund assets, the impact on Morningstar’s most crucial short-term catalysts, such as revenue growth and profit margins, may be limited at first. Factors like slow revenue growth compared to the wider US market and recent share price declines still set the tone for immediate investor sentiment. However, the launch could be a meaningful differentiator over time, helping address one of the bigger risks: how quickly Morningstar can adapt to shifting industry demands and sustain its edge in value-added solutions for clients. On the other hand, the rapid changes in private markets create both opportunities and new competitive threats investors should watch closely.

Morningstar's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

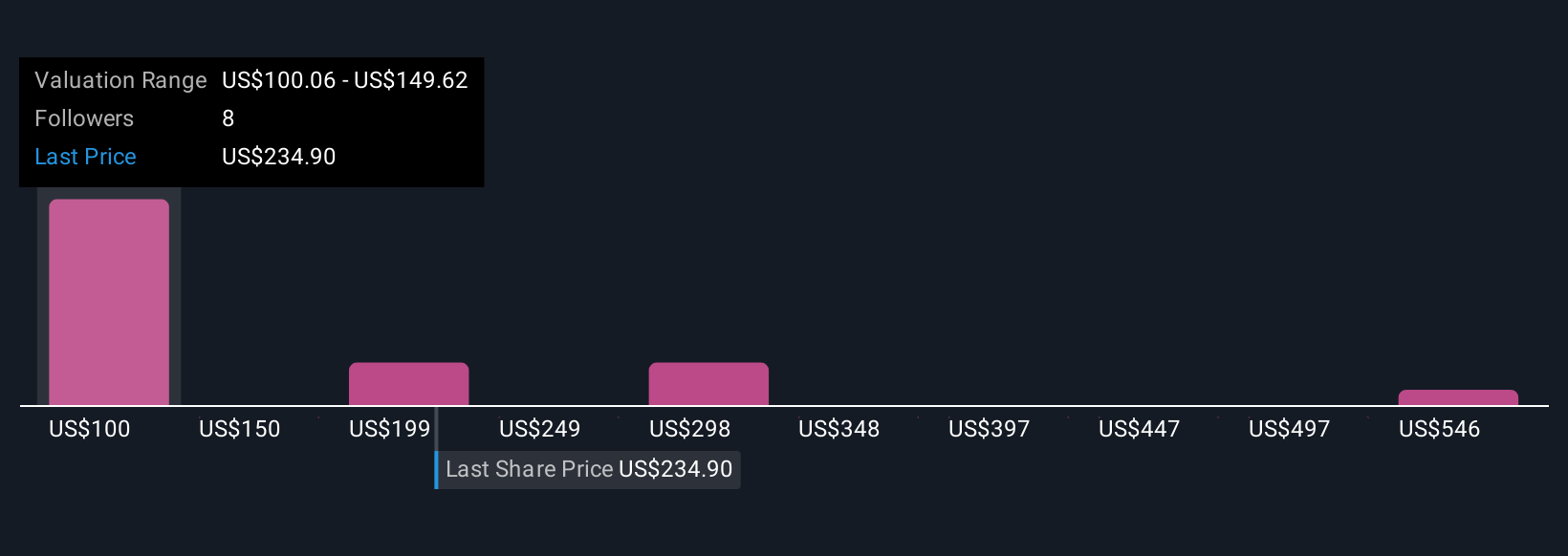

Explore 8 other fair value estimates on Morningstar - why the stock might be worth less than half the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives