- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

How Morningstar's (MORN) NPPG Partnership Could Transform Retirement Solutions for Small Businesses

Reviewed by Sasha Jovanovic

- Morningstar Retirement recently announced a collaboration with NPPG Plan Professionals to integrate its advisor managed accounts into Pooled Employer Plans, expanding access to personalized retirement offerings for small and mid-sized employers.

- This partnership brings Morningstar's managed account capabilities to a wider group of businesses through NPPG's oversight, potentially changing the landscape for small business retirement solutions.

- We'll examine how expanding personalized retirement plan access for smaller employers could shape Morningstar's investment narrative moving forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is Morningstar's Investment Narrative?

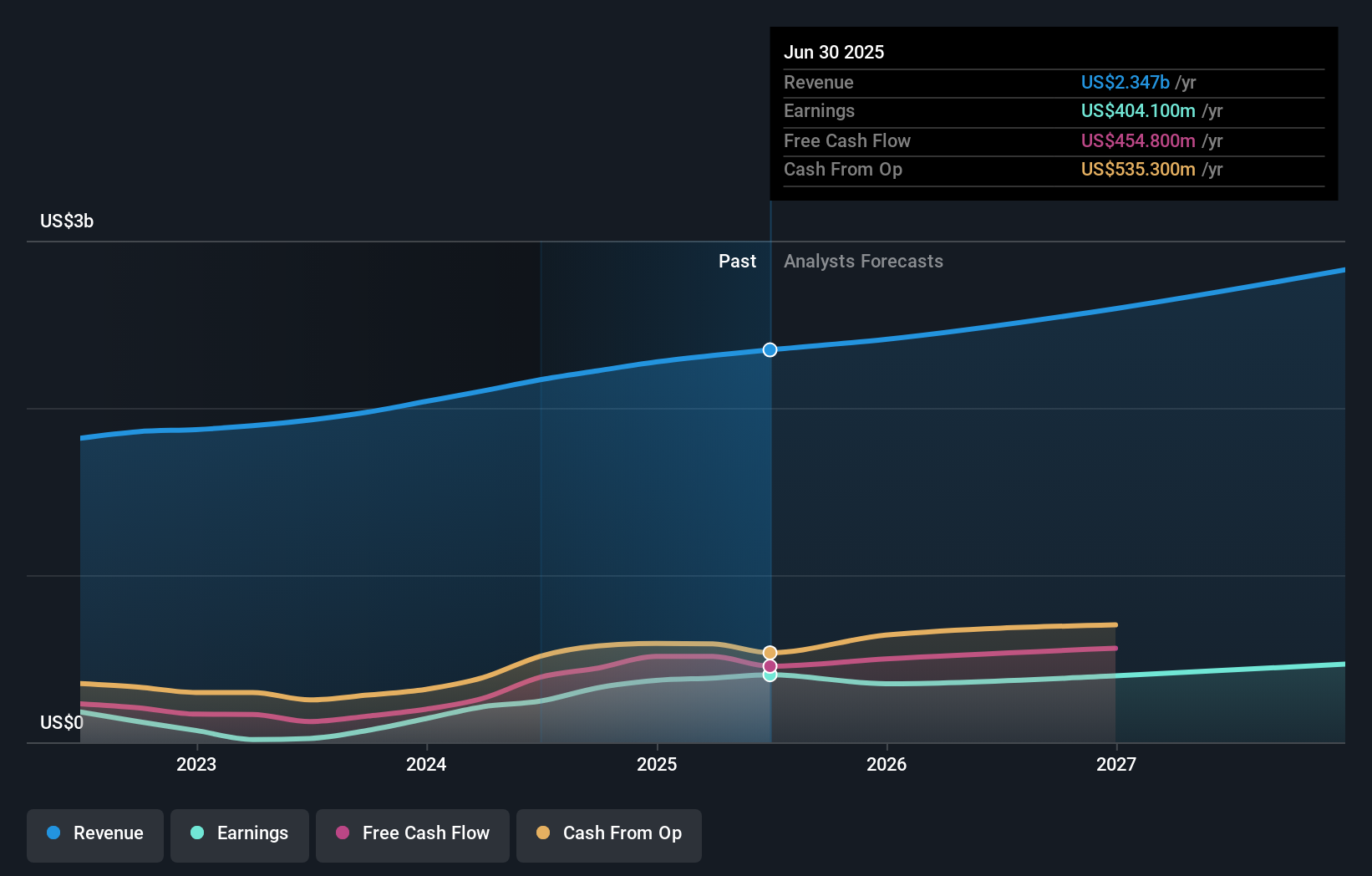

To be a Morningstar shareholder today, you need to believe in the company’s ability to maintain steady growth while expanding its core services into new verticals like retirement solutions for smaller businesses. The recent partnership with NPPG Plan Professionals marks a clear effort to broaden Morningstar’s reach in retirement platforms, which could enhance its value proposition and advisor network in coming quarters. This could act as a positive near-term catalyst, particularly if it helps reignite interest after shares have lagged the broader market over the year. However, risks remain around consistent execution and integrating new offerings amid recent leadership changes, especially given the experienced but static board composition and the profit boost from one-off items last year. The impact of this partnership is promising but likely not material enough to instantly shift the company’s biggest risks, which are continued underperformance versus peers and justifying its premium share price.

In contrast, the company’s evolving competitive position is something investors should be watching closely.

Exploring Other Perspectives

Explore 8 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives