- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

MarketAxess Holdings (MKTX): Exploring Valuation Following Q3 Results and New U.S. Credit Auction Protocol

Reviewed by Simply Wall St

MarketAxess Holdings (MKTX) just released its third quarter results, reporting a modest uptick in revenue alongside a dip in net income. The company also announced a new market-wide auction protocol for U.S. credit trading, with the goal of strengthening liquidity and price discovery.

See our latest analysis for MarketAxess Holdings.

Despite recent product launches and a completed buyback program, MarketAxess Holdings has seen its momentum wane. The share price is down over 22% year-to-date and the total shareholder return is -32% over the past year. Long-term performance tells a similar story, suggesting the market is still cautious as the company navigates profitability challenges and introduces strategic innovations.

If you’re watching MarketAxess adapt and wondering where else opportunity may be building, now is a great moment to broaden your research and discover fast growing stocks with high insider ownership

With recent results in the spotlight and a new auction innovation on the way, investors may be asking themselves whether MarketAxess is now undervalued or if the market is already anticipating its next wave of growth.

Most Popular Narrative: 13.7% Undervalued

The narrative’s fair value lands well above the latest market close, setting up a sharp contrast between analyst confidence and recent share price weakness. This difference raises the question of whether investors are seeing the same forward momentum as the consensus.

The company is rapidly expanding into new geographies and asset classes, particularly through its growth in emerging markets (EM) and Eurobonds. These segments saw more than 20% volume growth and double-digit commission revenue increases, suggesting the addressable market is broadening and could support higher long-term revenue and earnings.

Want to know why experts see double-digit growth potential, or what international trends could rewrite the company’s earnings narrative? The consensus is betting on fresh momentum and a new profit playbook. Find out the bold predictions that fuel this fair value outlook.

Result: Fair Value of $202.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and client preference for traditional trading methods could limit MarketAxess's growth and raise questions about bullish projections.

Find out about the key risks to this MarketAxess Holdings narrative.

Another View: What Multiples Tell Us

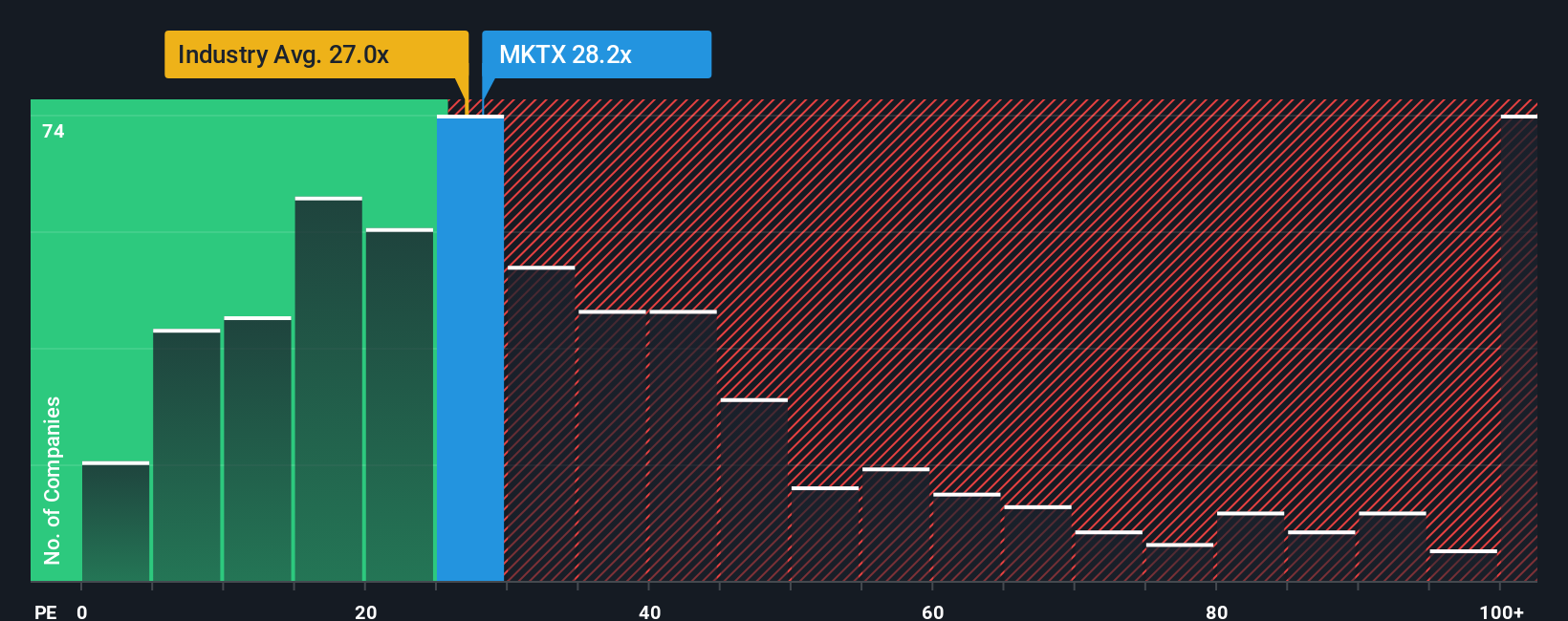

While many discussions focus on fair value estimates, a different angle comes from comparing MarketAxess's price-to-earnings ratio with the market. The company trades at 29.6 times earnings, noticeably higher than the industry average of 24 and the peer average of 26.3. The SWS fair ratio points even lower at 15, suggesting a much more modest valuation could be in play. Does this premium reflect untapped growth or signal valuation risk investors should watch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If you have a different perspective or want to dig into the details yourself, crafting your own take is quick and straightforward. Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying ahead of the curve. Don’t limit yourself to just one opportunity. Unlock a wider world of stocks that could fit your strategy now.

- Capture long-term income by targeting these 16 dividend stocks with yields > 3%, offering high yield potential and steady returns in any market environment.

- Ride the momentum in artificial intelligence by reviewing these 24 AI penny stocks, packed with innovative technology poised to shift entire industries.

- Spot unrecognized value and position yourself for upside with these 878 undervalued stocks based on cash flows, highlighted for attractive fundamentals and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives