- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Profit Margins Fall to 33.4%, Testing Merchants Bancorp (MBIN) Narrative of Defensiveness

Reviewed by Simply Wall St

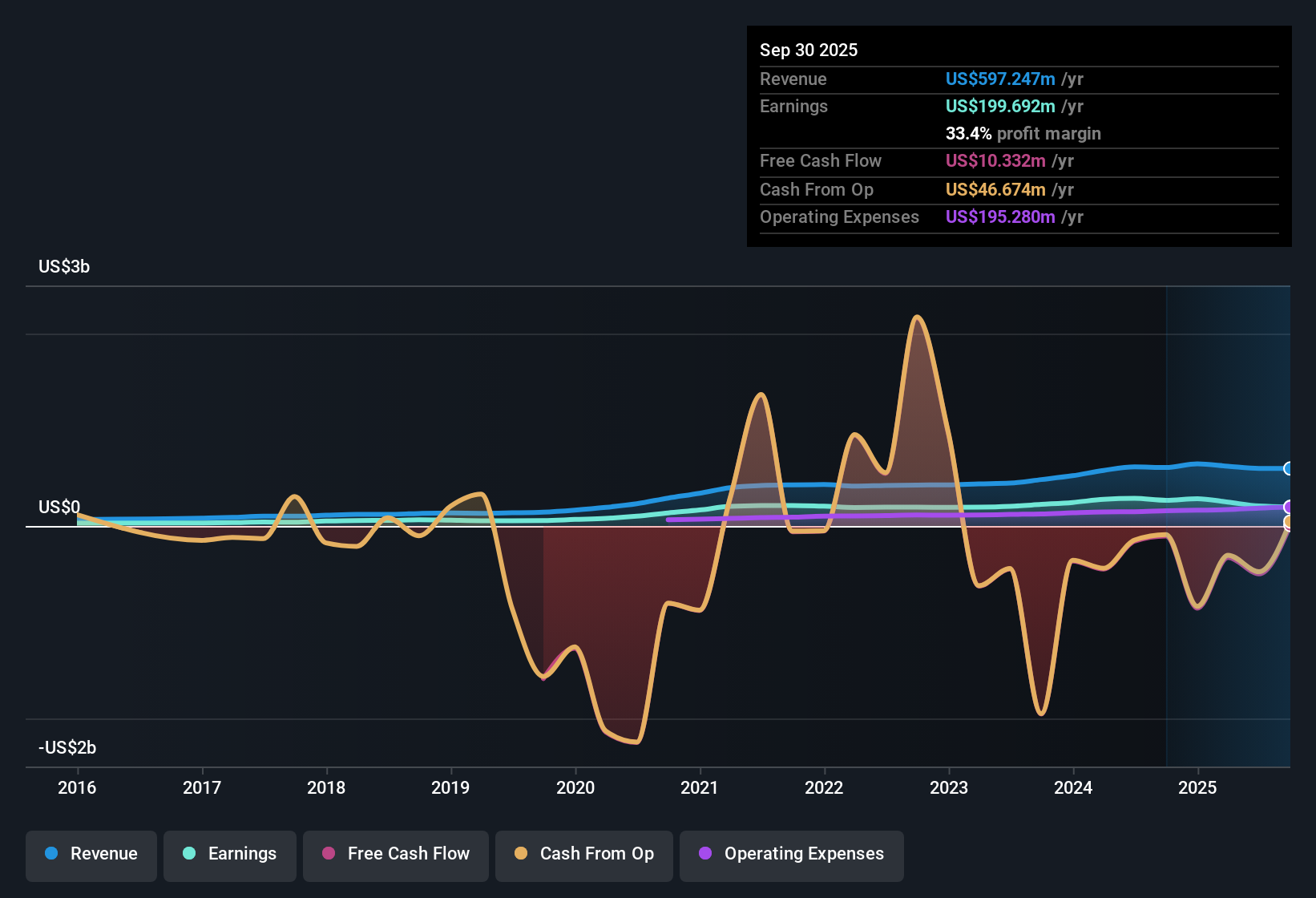

Merchants Bancorp (MBIN) is forecasting earnings growth of 15.3% per year, just shy of the US market average of 15.6%. Revenue is expected to grow at 10.1% annually, while net profit margins have slipped to 33.4% from last year’s 44%. Despite a five-year annual earnings growth rate of 7.6%, the most recent year saw negative growth, and current valuation multiples remain well below industry averages. With no major risks identified and only minor ones reported, investors are weighing the mix of steady longer-term progress against a recent dip in margins and profitability.

See our full analysis for Merchants Bancorp.Now, it's time to stack these numbers against the dominant narratives and see which stories hold up and which may be due for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide After Previous Peak

- Net profit margins are currently at 33.4%, a notable drop compared to last year's high of 44%.

- The prevailing market view highlights that while Merchants Bancorp’s specialty lending focus supports resilience during sector uncertainty, the step down in margins may dampen the perception of its defensive strengths.

- Though the industry faces margin pressure broadly, the shift from 44% to 33.4% invites a closer look at whether niche lending can sustain outperformance.

- Investors may want to weigh if stable loan growth can offset the margin decline, especially as sector peers also struggle with compressed profitability.

Valuation Remains Steeply Discounted

- At a 7.3x price-to-earnings ratio, Merchants Bancorp trades at a significant discount compared to the 18.3x peer group and 16.5x industry averages.

- The prevailing market view notes that this low valuation, combined with consistent earnings quality, strengthens the argument that shares are overlooked despite muted growth.

- Shares are also trading well below the analyst price target of $40.33, which could appeal to investors looking for potential upside.

- Unlike many regional banks with higher multiples, Merchants Bancorp’s lower pricing may present a buffer against sector-wide volatility.

Growth Forecasts Paint a Steady, Not Spectacular, Outlook

- Annual earnings growth is projected at 15.3% over the next few years, narrowly trailing the US market average of 15.6%.

- The prevailing market view recognizes that while growth rates are just below industry benchmarks, the consistency in both revenue and profit projections supports perceptions of stable management but may limit share price momentum.

- The five-year annual earnings growth rate remains at 7.6%, underlining a longer-term moderate trajectory compared to faster-growing peers.

- Recent negative growth in the latest year suggests steady progress rather than breakout performance is the realistic expectation.

To see what investors with all perspectives are saying about Merchants Bancorp, dive into the full, balanced Consensus Narrative. 📊 Read the full Merchants Bancorp Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Merchants Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Although Merchants Bancorp has stable earnings forecasts, its declining profit margins and moderate growth rates point to limited momentum compared to faster-growing peers.

If you’re looking for companies that consistently deliver robust revenue and earnings expansion even when others slow, check out stable growth stocks screener (2121 results) to find more reliable long-term performers today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives