- United States

- /

- Diversified Financial

- /

- NasdaqGS:JKHY

Assessing Jack Henry’s Recent 11% Rally Amid Analyst Upgrades and Fintech Demand

Reviewed by Bailey Pemberton

- Wondering if Jack Henry & Associates is offering real value in today’s market? Let’s cut through the noise and examine whether this stock’s price is justified or if opportunity might be knocking.

- Shares have picked up recently, climbing 4.9% over the past week and 11.3% in the last month. This suggests growing optimism or shifts in how investors view this company’s risk versus reward.

- Much of this momentum comes alongside sector headlines that point to renewed demand for financial technology and continued digital transformation in banking. These themes have been drawing investor interest. Notably, fresh analyst upgrades and enthusiasm around software platforms have helped support this positive sentiment for Jack Henry & Associates.

- The company currently holds a value score of 1 out of 6 on our standard valuation checks, suggesting only one area where the stock looks undervalued. Next, we’ll break down how valuation experts look at a company like this. Be sure to stick around as there might be a better way to make sense of what “fair value” really means for investors.

Jack Henry & Associates scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Jack Henry & Associates Excess Returns Analysis

The Excess Returns model evaluates how much value a company generates over and above the cost of its equity capital. In other words, it looks at whether Jack Henry & Associates is putting investor money to work in a way that consistently outperforms basic ownership costs.

For Jack Henry & Associates, the average return on equity sits at 21.27%, with a stable book value of $36.33 per share as projected by two analysts. The company’s stable earnings per share are estimated at $7.73, derived from the median return on equity over the past five years. The calculated cost of equity comes out to $2.66 per share, resulting in an excess return of $5.06 per share. This means shareholders are seeing genuine value created beyond just covering the company’s cost of capital.

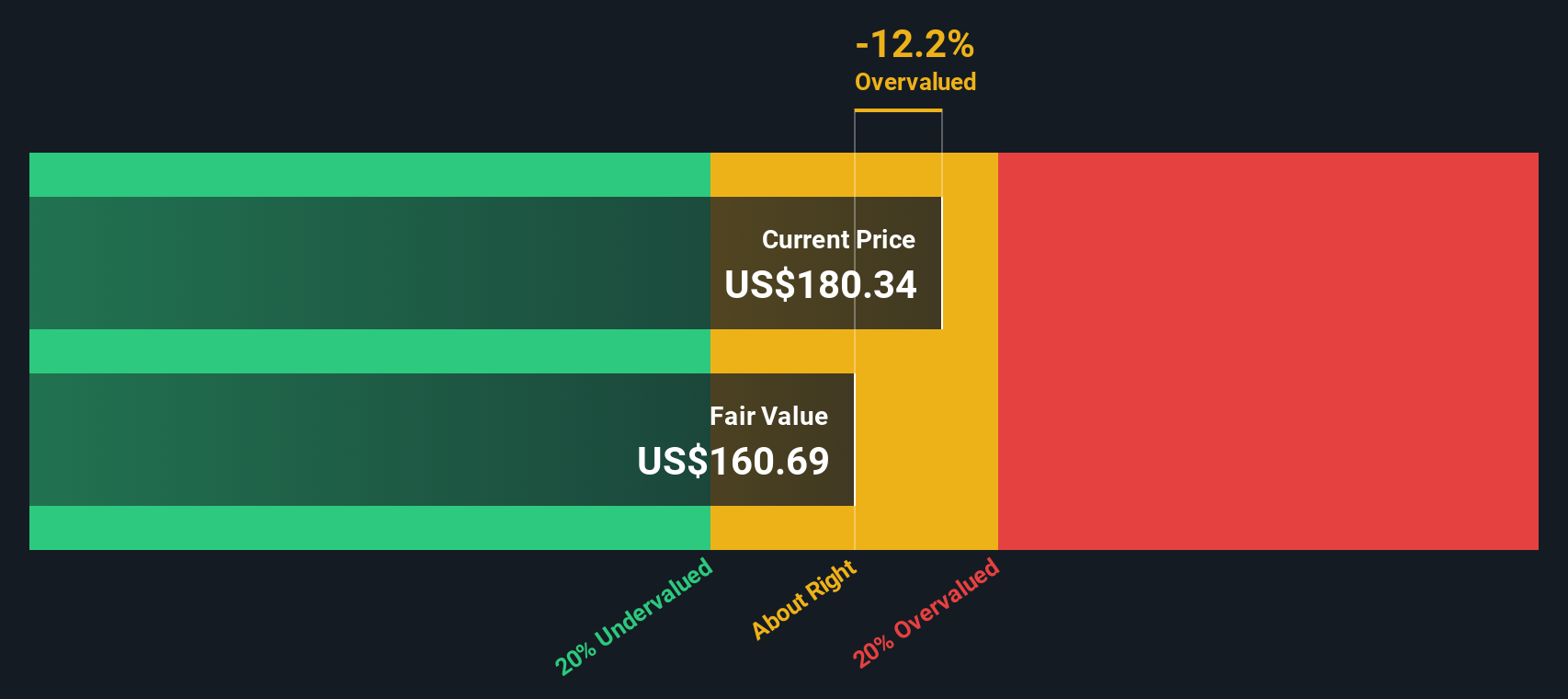

Based on these inputs, the Excess Returns model produces an estimated intrinsic value of $160.78 per share. With Jack Henry & Associates currently trading at a slight premium, about 8.2% higher than this projected value, shares appear to be close to fair value, but a touch overvalued.

Result: ABOUT RIGHT

Jack Henry & Associates is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Jack Henry & Associates Price vs Earnings

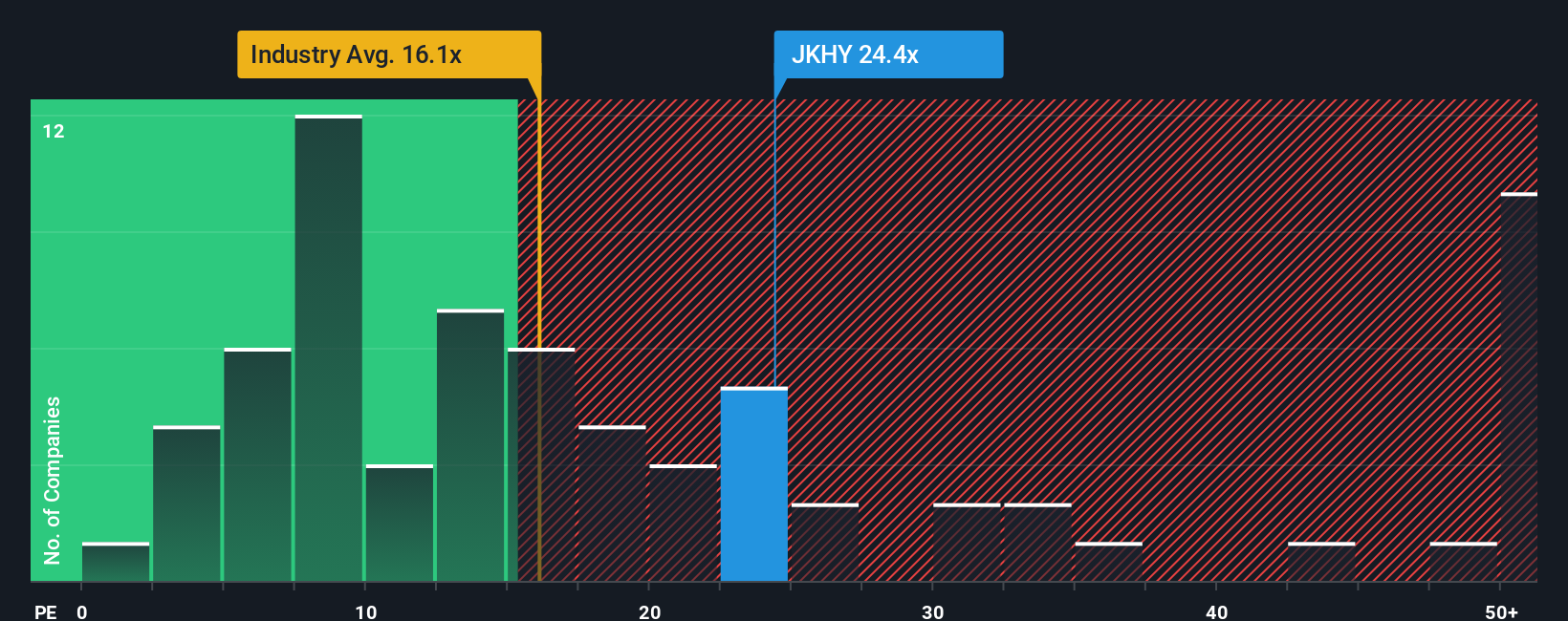

For profitable companies, the price-to-earnings (PE) ratio is one of the most effective tools to gauge valuation. The PE ratio reflects how much investors are willing to pay today for each dollar of yearly earnings, offering a clear picture of market expectations for future growth and the risks involved.

Growth prospects and associated risks significantly impact what is considered a “normal” or “fair” PE ratio. Rapidly growing, stable businesses often warrant higher multiples. Lower growth or riskier companies might trade at a discount to the market average.

Currently, Jack Henry & Associates trades at a PE ratio of 26.2x, slightly below the peer average of 27.9x, but well above the Diversified Financial industry average of 13.6x. However, context is key. Simply Wall St’s Fair Ratio, which blends factors such as profit margins, growth forecasts, market cap, and risks, suggests a fair PE of 13.4x for Jack Henry & Associates. This proprietary approach provides a more tailored benchmark than broad industry or peer comparisons since it considers the company’s unique fundamentals and operating environment.

Since Jack Henry & Associates’ actual PE is notably above the Fair Ratio suggested by these in-depth factors, the stock appears to be overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jack Henry & Associates Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own investment story, an easy and guided method that lets you set your assumptions about a company’s future revenue, earnings, and margins, and see how that story translates into fair value using live data.

Narratives connect the company’s unique business outlook to a tailored financial forecast and then calculate what you think is a reasonable price to pay, all within Simply Wall St’s Community page, trusted by millions of investors as a modern way to take control of analysis.

This tool empowers you to compare your Fair Value directly to the current share price, helping you decide if now is the right time to buy, sell, or hold. It also makes it easy to adjust your view when new news or results are released, as the forecasts and fair value update dynamically as things change.

For example, one investor might focus on Jack Henry & Associates’ robust shift to cloud services and recurring revenue, projecting strong growth and a fair value as high as $206. Another investor, cautious about stiff fintech competition and margin pressure, could set a lower fair value nearer $173. This demonstrates how Narratives bring clarity and structure to your own outlook.

Do you think there's more to the story for Jack Henry & Associates? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JKHY

Jack Henry & Associates

Operates as a financial technology company that connects people and financial institutions through technology solutions and payment processing services.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success