- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

A Look at Interactive Brokers (IBKR) Valuation Following Launch of New Karta Visa Card

Reviewed by Simply Wall St

Interactive Brokers (IBKR) just rolled out its new Karta Visa card, giving eligible clients the ability to make global purchases directly from their brokerage accounts. This addition is designed to streamline everyday spending and enhance the company's cash management offerings.

See our latest analysis for Interactive Brokers Group.

This isn’t the first move Interactive Brokers has made to expand its global reach or technology edge. In recent months, the company has completed a four-for-one stock split, introduced new digital products, and seen steady institutional buying. The share price has climbed 55.9% so far this year, while the total shareholder return over the past year sits at an impressive 59.4%. This reflects ongoing confidence in IBKR’s growth story and ability to innovate in a competitive sector.

If you’re watching how financial innovators are shaking up the status quo, it’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Interactive Brokers shares are trading at a discount relative to their growth prospects, or if the recent surge in price means the market has already factored in future gains.

Most Popular Narrative: 7.2% Undervalued

With a last close price of $71.13 and a fair value estimate of $76.64, the current narrative sees more upside potential for Interactive Brokers shares in the months ahead. The backdrop? Analysts are calling for ongoing gain, stemming from robust new products and major global expansion initiatives.

The introduction of new products and international market expansions are expected to drive higher trading activity, commission revenue, and attract a broader investor base.

Want to unlock the thinking behind that fair value? There is a bold call at the core of this narrative, driven by ambitious top line projections, surprisingly resilient profit margins, and a substantial earnings multiple forecasted for the coming years. Which future numbers are analysts betting on, and why does Wall Street think this broker can command a premium? Dive in for the full story.

Result: Fair Value of $76.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and the potential for lower interest rates could quickly challenge these positive expectations for Interactive Brokers’ future growth and profitability.

Find out about the key risks to this Interactive Brokers Group narrative.

Another View: Gauging Value Through Earnings Multiples

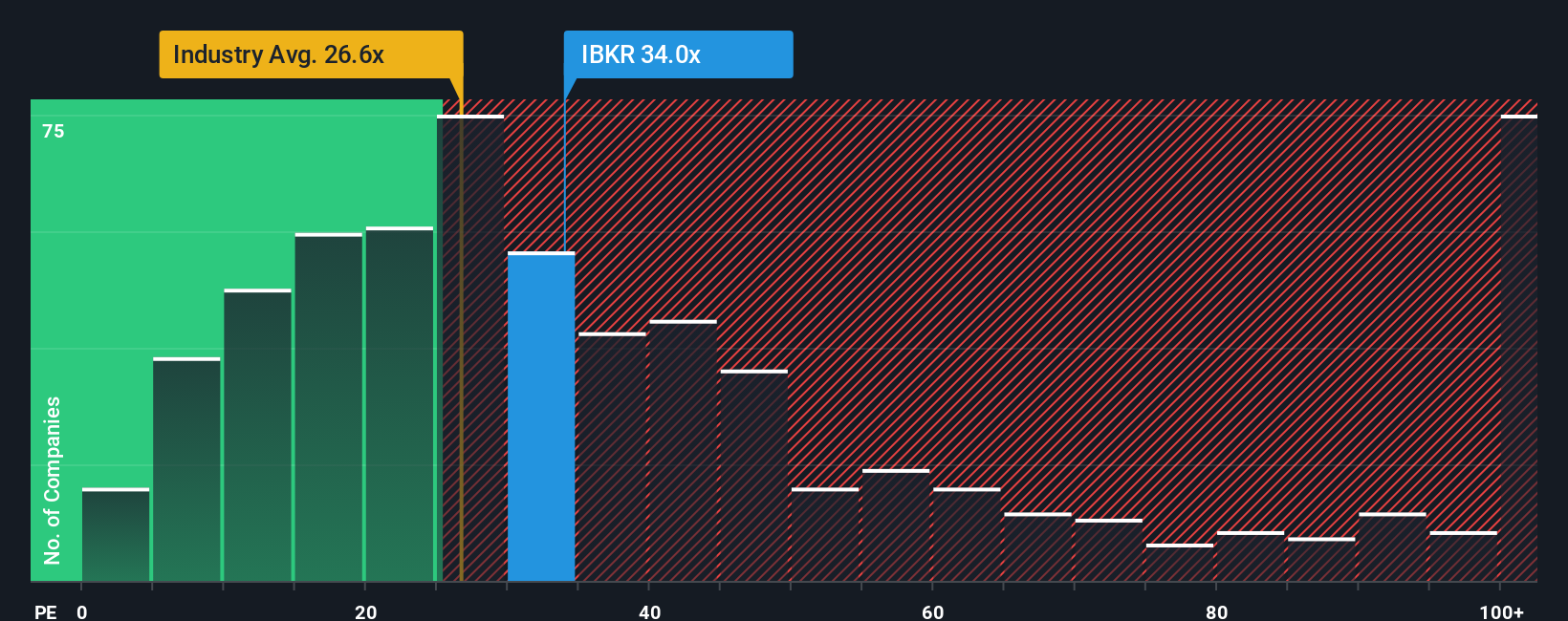

Looking at Interactive Brokers from an earnings perspective reveals a different picture. The company trades on a ratio of 34.5 times earnings, which is notably higher than both its industry average of 24 and its peers at 27.6. Even the fair ratio, estimated at 21.1, suggests the current pricing leans toward the expensive side. This gap means investors face greater risk if the market shifts expectations. However, it could also signal confidence in IBKR’s growth staying power.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interactive Brokers Group Narrative

If you see things differently or want to form your own view, it only takes a few minutes to explore the numbers and shape your perspective. Do it your way

A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s opportunities slip by. Sharpen your next move and get ahead of market shifts by checking out hand-picked ideas driven by expert-powered data insights:

- Unlock the potential of companies redefining digital payments, fintech, and blockchain by scanning through these 82 cryptocurrency and blockchain stocks with proven innovation in the sector.

- Tap into future healthcare winners with robust growth prospects by browsing these 32 healthcare AI stocks delivering game-changing innovation in diagnostics, automation, and personalized medicine.

- Zero in on companies boasting strong financials yet trading below their fair value using these 863 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives