- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood (HOOD): Assessing Valuation After Recent Volatility and Strong Long-Term Gains

Reviewed by Simply Wall St

Robinhood Markets (HOOD) has caught investors' attention this month as the stock has moved noticeably despite a lack of major news events driving the activity. Market watchers are now assessing recent trends and shifts in performance.

See our latest analysis for Robinhood Markets.

Robinhood’s share price has pulled back 23.2% over the last month after a strong run through 2024. Even with recent volatility, it shows an impressive year-to-date share price return of 172%. Long-term investors are still sitting on a substantial 1,067% three-year total shareholder return. This suggests momentum remains strong over the broader term, even though the pace may be cooling in the near term.

If you’re watching shifts in fintech stocks, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock cooling from its highs but still trading well above analyst targets, the key question emerges for investors: is Robinhood undervalued at these levels, or is the market already factoring in more growth ahead?

Most Popular Narrative: 29% Undervalued

Robinhood’s most followed valuation narrative points to a fair value that is well above the last close, suggesting the market may not be capturing the company’s full momentum and financial projections.

The current valuation may be assuming continued explosive growth in young, tech-savvy trader engagement and wallet share. However, there are emerging signs that demographic interest may shift away from traditional equities toward alternative assets, crypto, or even decentralized finance, which would constrain Robinhood's long-term revenue growth and customer base expansion.

Curious how much of Robinhood's bold future is built on record revenue growth, compressed margins, and a high future earnings multiple? The narrative relies on an aggressive profit blueprint and sector-defining assumptions. Want to see if these bets are realistic or risky? Dive in to explore the quantitative logic behind this ambitious valuation.

Result: Fair Value of $151.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as delays in regulatory progress or shrinking profit margins due to aggressive competition could quickly challenge Robinhood’s current growth assumptions.

Find out about the key risks to this Robinhood Markets narrative.

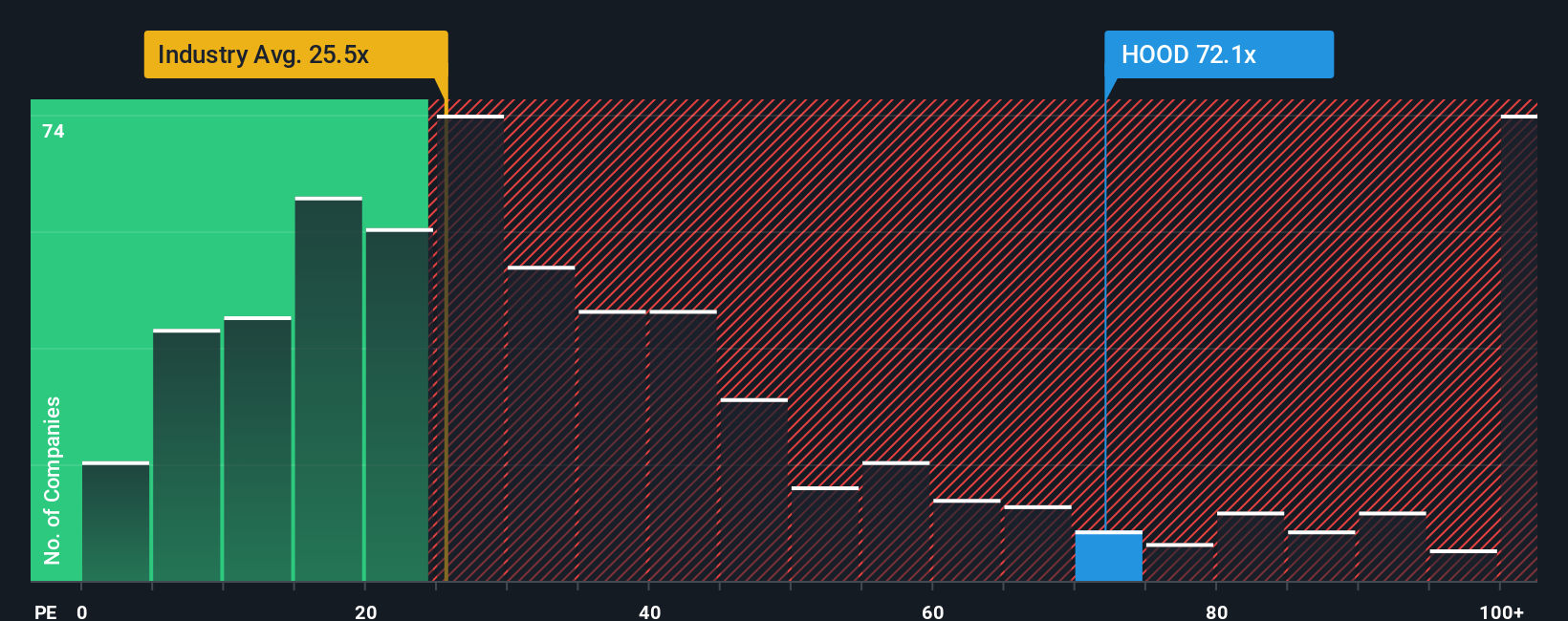

Another View: Is Robinhood Overpriced Based on Its Earnings?

While the popular narrative calls Robinhood undervalued, a closer look at its price-to-earnings ratio tells a more cautious story. The stock trades at 44x earnings, which is much higher than both its industry peers at 20.9x and the broader US Capital Markets average at 23.6x. Even compared to a fair ratio of 24.3x, the current premium signals substantial valuation risk. Could the market be running ahead of underlying performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robinhood Markets Narrative

For those keen to take a hands-on approach or offer a different perspective, you can shape your own analysis in just a few minutes, and Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Supercharge your portfolio by seeing what else stands out on Simply Wall Street. Your next great investment could be just a click away.

- Generate steady income and strengthen your portfolio by considering these 15 dividend stocks with yields > 3% with yields greater than 3% to boost returns.

- Tap into future tech trends by checking out these 26 AI penny stocks. You’ll be on the frontline of the AI revolution before the crowd catches on.

- Capitalize on emerging financial opportunities by reviewing these 81 cryptocurrency and blockchain stocks leading the charge in blockchain innovation and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives