- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Is Robinhood’s (HOOD) Expanding Product Suite Reshaping Its Core Investment Narrative?

Reviewed by Sasha Jovanovic

- Robinhood Markets recently reported robust third-quarter earnings, with revenue of US$1.27 billion and net income of US$556 million, and announced new product expansions including cash delivery services in partnership with Gopuff and the growth of its prediction markets business.

- These developments reflect Robinhood’s ongoing shift beyond traditional brokerage into an expanding ecosystem of financial services and growing recurring revenue streams.

- We'll now examine how Robinhood's strong user growth and expanding product offerings influence its investment narrative and future outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Robinhood Markets Investment Narrative Recap

To be a Robinhood Markets shareholder today, you need conviction in the company’s ability to turn its rapid user expansion, innovative new products, and robust earnings into sustainable, recurring revenue growth. Recent news, including strong third-quarter results and ongoing buybacks, reinforces the importance of continued user engagement and successful product diversification as the key catalyst, while regulatory actions and competition remain the most significant risks at present. Short-term, these developments do not materially shift the immediate risk profile or growth narrative.

Among recent announcements, Robinhood’s launch of its prediction markets business, where trading contract volume has doubled each quarter, stands out as especially pertinent to the company’s growth story. This move illustrates how Robinhood is leveraging new, engaging products to deepen relationships with its user base and develop additional revenue streams, which underpins the broader bull case for further network effects and monetization.

However, in contrast to these expansion efforts, investors should be aware that ongoing regulatory scrutiny around event trading could quickly shift sentiment and impact...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets' outlook anticipates $5.3 billion in revenue and $1.8 billion in earnings by 2028. This scenario is based on annual revenue growth of 14.0%, with earnings remaining unchanged from the current level of $1.8 billion.

Uncover how Robinhood Markets' forecasts yield a $151.71 fair value, a 31% upside to its current price.

Exploring Other Perspectives

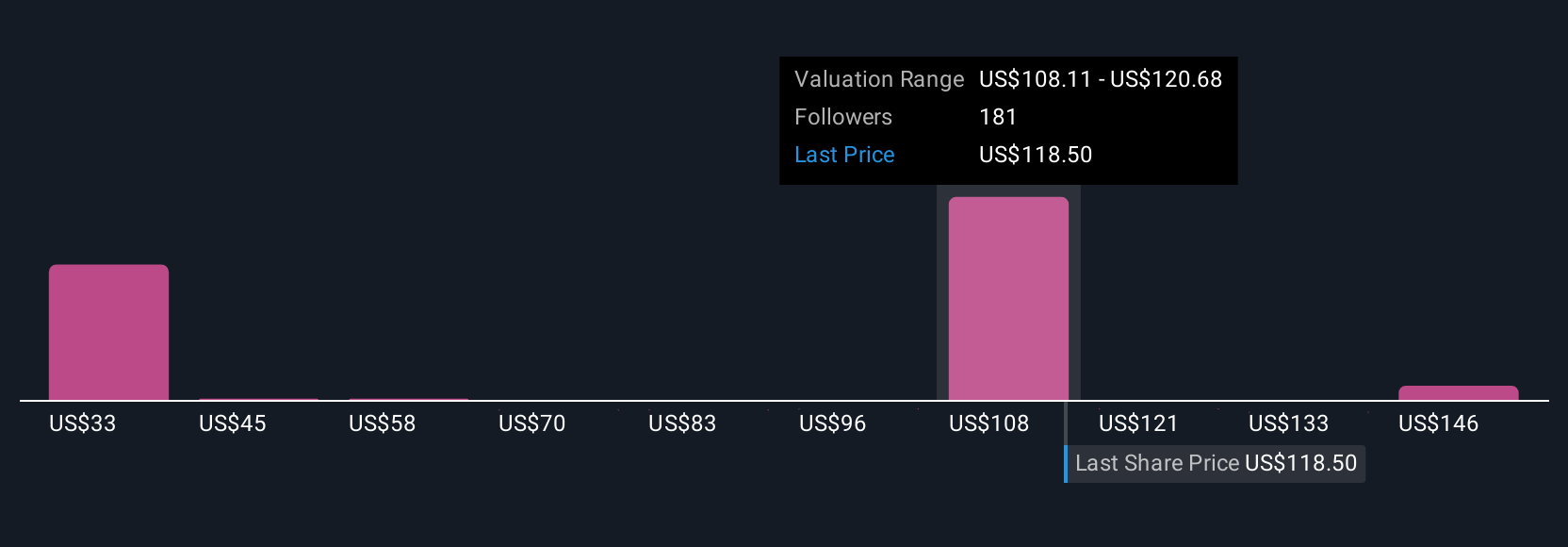

Thirty-seven fair value estimates from the Simply Wall St Community range from US$47.26 to US$158.37 per share. As you consider these varying perspectives, remember that regulatory shifts could have far-reaching consequences for Robinhood’s evolving platform.

Explore 37 other fair value estimates on Robinhood Markets - why the stock might be worth as much as 37% more than the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives