- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

A Look at Robinhood (HOOD) Valuation Following Recent Volatility and Surging Returns

Reviewed by Simply Wall St

Robinhood Markets (HOOD) has seen its stock performance shift over the past few months, catching the attention of investors curious about what is next for the popular trading platform.

See our latest analysis for Robinhood Markets.

Robinhood’s share price has been on a rollercoaster this year, with a recent dip of 4.09% in a day following a prolonged rally that has lifted its year-to-date share price return to an impressive 212%. Despite pockets of volatility, long-term momentum is clearly building as shown by a remarkable 1,212% total shareholder return over the past three years.

If Robinhood’s surge has you thinking about what’s next in the markets, this is a great moment to discover fast growing stocks with high insider ownership

Given Robinhood's recent gains and ongoing momentum, the key question now is whether the rally reflects underlying value or if market enthusiasm has already priced in the company's future growth. Could there still be a buying opportunity?

Most Popular Narrative: 18.5% Undervalued

Robinhood’s most widely followed narrative suggests the stock has appreciable upside based on fair value estimates far above the latest close. Investors watching from the sidelines are debating if momentum can keep up with these projections or if price expectations are already running hot.

The current valuation may be assuming continued explosive growth in young, tech-savvy trader engagement and wallet share. There are emerging signs, however, that demographic interest may shift away from traditional equities toward alternative assets, crypto, or even decentralized finance. Such a shift could constrain Robinhood's long-term revenue growth and customer base expansion.

Want to see the bold assumptions behind this call? The critical factors in play are projected growth rates and a profit margin typically reserved for top-tier innovators. Intrigued by what could drive such a premium price? Uncover the precise numbers and analyst convictions powering this valuation when you read the full narrative.

Result: Fair Value of $151.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and higher compliance costs could quickly compress Robinhood’s margins. This may put pressure on both its growth story and future earnings potential.

Find out about the key risks to this Robinhood Markets narrative.

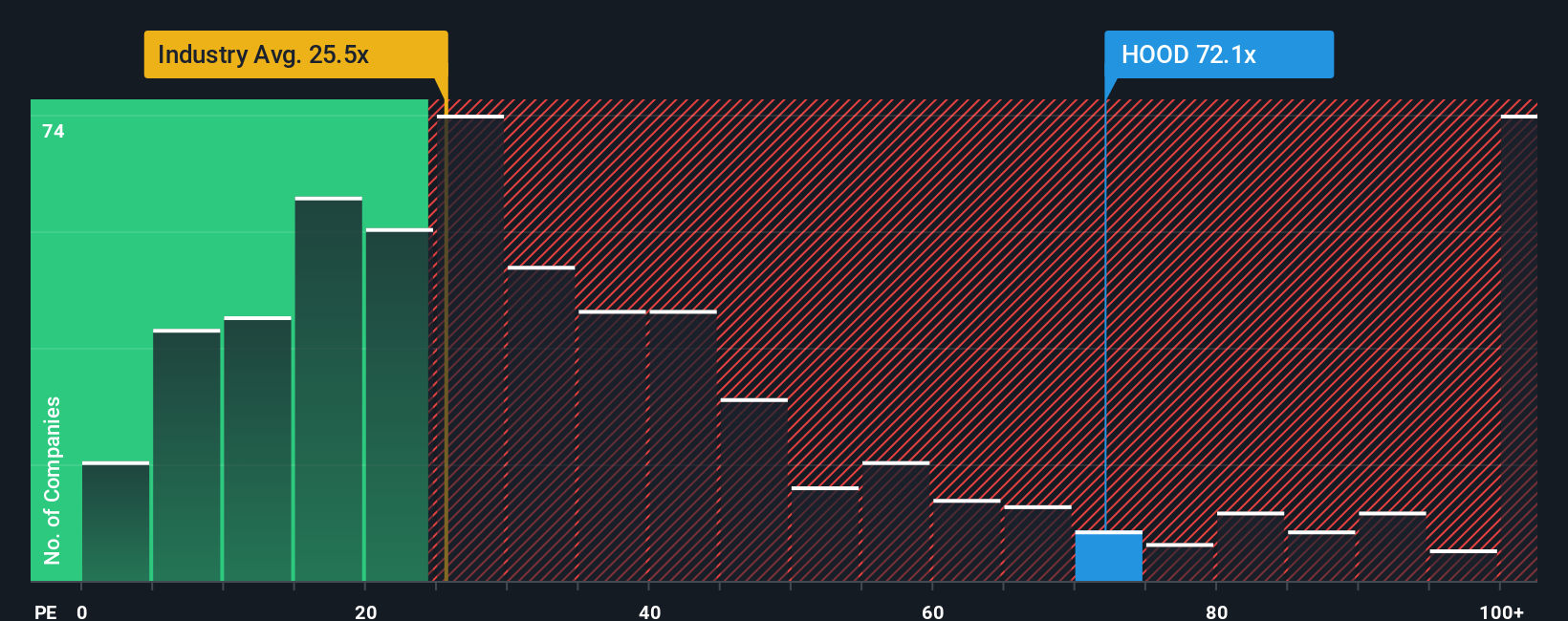

Another View: Price Ratios Tell a Different Story

Looking from a different angle, Robinhood's price-to-earnings ratio stands far above that of its industry peers and also the fair ratio our analysis suggests the market could move toward. This premium signals investors are paying a hefty price and raises questions about valuation risk and future upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robinhood Markets Narrative

If you have your own perspective or want to dive deeper into the numbers yourself, you can shape your own Robinhood Markets narrative in just a few minutes: Do it your way

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look one step ahead. Uncover unique ways to strengthen your portfolio and discover fresh opportunities you could miss if you only stick to the obvious.

- Find leading-edge opportunities in artificial intelligence by checking out these 25 AI penny stocks that are poised for potentially rapid growth.

- Boost your portfolio income by unlocking these 14 dividend stocks with yields > 3% offering robust yields and steady cash flow in changing markets.

- Get ahead of market trends and catch the next wave of innovation with these 27 quantum computing stocks before they make headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026