- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

What Hamilton Lane (HLNE)'s $5 Billion Guardian Partnership Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, The Guardian Life Insurance Company of America announced a long-term strategic partnership with Hamilton Lane, under which Hamilton Lane will manage Guardian's nearly US$5 billion private equity portfolio and benefit from future investment commitments of approximately US$500 million per year over the next decade.

- This collaboration further advances Hamilton Lane's Insurance Solutions platform, with Guardian investment professionals expected to join the firm and new products poised to reach a wider range of institutional and high-net-worth investors.

- Now, we'll explore how this expanded insurance partnership may enhance Hamilton Lane's recurring revenues and long-term growth prospects within the investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hamilton Lane Investment Narrative Recap

As a Hamilton Lane shareholder, you need to believe in strong recurring revenue growth from expanding private markets solutions and ongoing product innovation. The landmark Guardian partnership could strengthen this narrative by expanding fee-earning AUM and client reach, potentially acting as a positive catalyst for future earnings. However, it does not materially mitigate existing risks, such as potential fee compression or operational complexity as the business scales.

Among recent announcements, the company's robust second-quarter earnings revealed annual revenue growth from US$150 million to US$190.88 million and a net income increase to US$70.89 million. This financial momentum highlights that core growth drivers remain intact, supporting investor attention on recurring revenues and management’s ability to deliver consistent results.

In contrast, investors should be aware of the potential for escalating compliance costs as Hamilton Lane increases its breadth of offerings and global footprint…

Read the full narrative on Hamilton Lane (it's free!)

Hamilton Lane's narrative projects $1.0 billion revenue and $426.8 million earnings by 2028. This requires 13.2% yearly revenue growth and a $214.6 million earnings increase from $212.2 million.

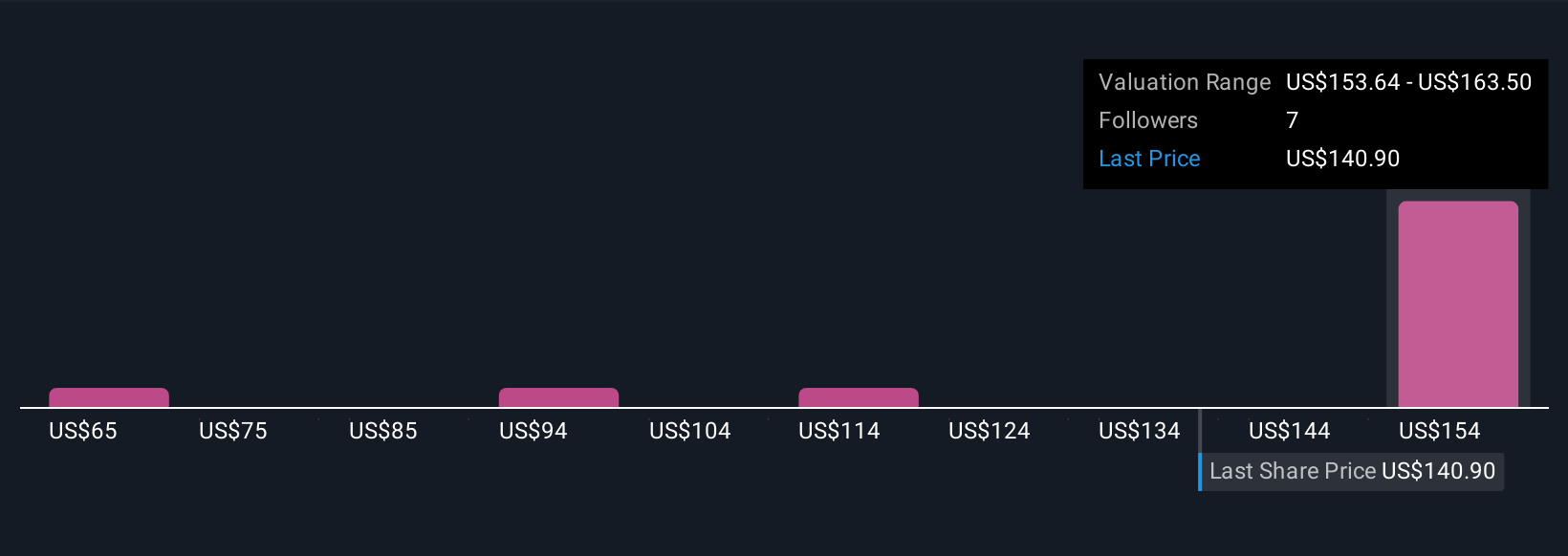

Uncover how Hamilton Lane's forecasts yield a $157.17 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Six retail investors in the Simply Wall St Community estimate fair values for Hamilton Lane between US$60.44 and US$164.82, showing wide-ranging opinions. As you review these perspectives, remember the baseline catalyst of accelerating evergreen platform inflows fueling topline growth and consider how that could affect differing market outlooks.

Explore 6 other fair value estimates on Hamilton Lane - why the stock might be worth as much as 26% more than the current price!

Build Your Own Hamilton Lane Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Lane research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hamilton Lane research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Lane's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives