- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

Hamilton Lane (HLNE): Evaluating Valuation Following Strong Earnings and Industry-Leading Growth

Reviewed by Simply Wall St

Hamilton Lane (HLNE) delivered quarterly results that beat forecasts for both revenue and earnings, posting significant growth from the previous year. The company’s standout performance has placed it among the top in its sector this quarter.

See our latest analysis for Hamilton Lane.

Following this strong earnings announcement, Hamilton Lane’s share price has rebounded with a 7.4% return over the past month. Its year-to-date decline and one-year total shareholder return of -34.7% reflect a more cautious market view earlier in the year. The improved short-term momentum suggests investors are taking a fresh look at the stock’s long-term growth potential, especially after such noteworthy quarterly results.

If recent volatility has you rethinking your strategy, this could be a perfect opportunity to broaden your scope and discover fast growing stocks with high insider ownership

With shares rebounding and the company outperforming expectations, investors must now ask whether Hamilton Lane is trading at a bargain after its setback. Alternatively, they may consider if today’s price already factors in hopes for future growth.

Most Popular Narrative: 21.1% Undervalued

With consensus fair value sitting well above the latest $123.94 close, the current market price leaves room for a sizable upside, according to the most widely followed valuation narrative. This setup adds intrigue for those tracking where analyst forecasts diverge from short-term trading sentiment.

"Rapid net inflows, especially in the Evergreen platform (65% YoY AUM growth and record $1.2 billion quarterly net inflows), alongside growing global partnerships and new client wins, indicate a continually expanding addressable market and sustained topline revenue growth."

What powers this upsized fair value estimate? Part of the answer lies in the narrative’s faith in accelerating revenue and margin expansion, plus a belief in the company’s ability to leverage innovation into stronger, recurring profits. Wondering if these forecasts are realistic or outlandish? Dive into the full narrative for a peek at the specific levers and growth assumptions analysts are running with.

Result: Fair Value of $157.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges and increasing competition could quickly change the outlook. These factors could potentially undermine the optimistic growth narrative if conditions worsen.

Find out about the key risks to this Hamilton Lane narrative.

Another View: Looking Through the Lens of Multiples

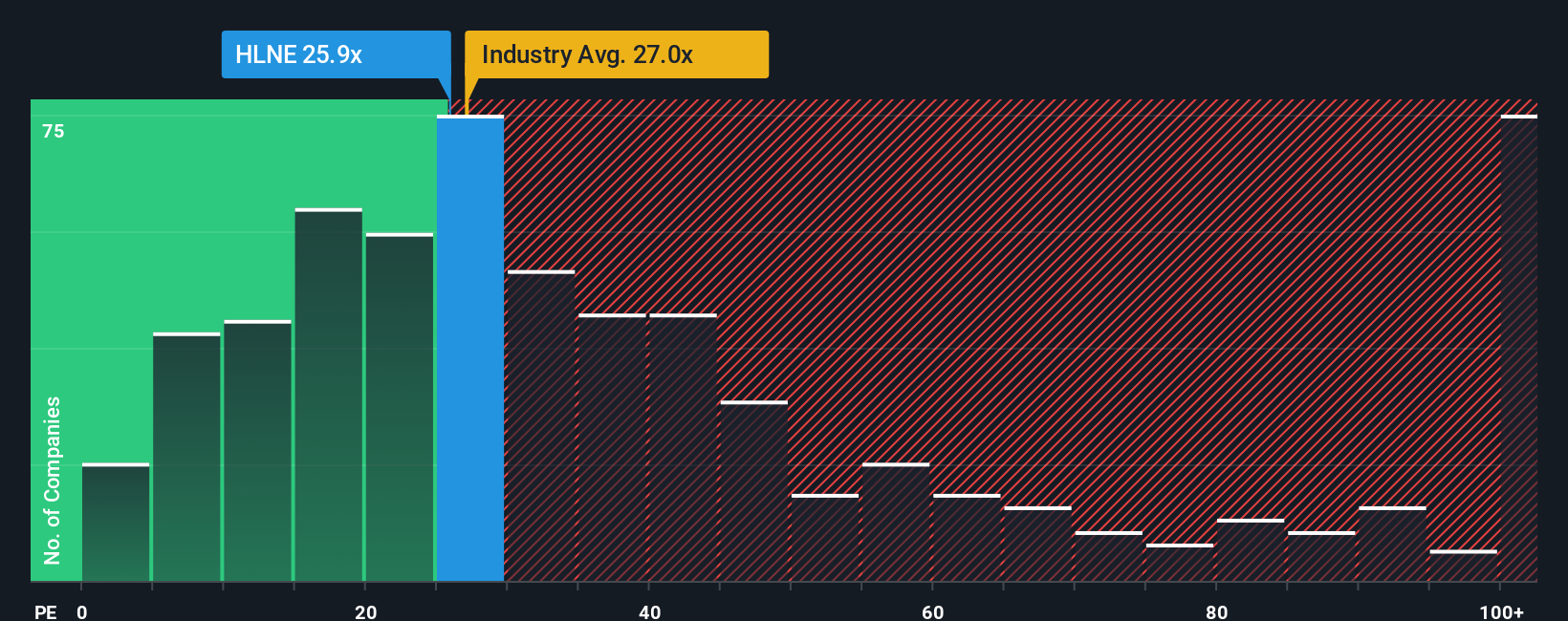

While analyst consensus sees upside, examining Hamilton Lane’s valuation through its price-to-earnings ratio paints a different picture. The stock trades at 23.9x earnings, which is higher than both the industry average of 23.6x and the peer average of 12.7x. This premium suggests the market may be pricing in a lot of future optimism. This raises the question: are expectations set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hamilton Lane Narrative

If you see these results differently or want to analyze the numbers firsthand, you can put together your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hamilton Lane.

Looking for More Investment Ideas?

Instead of waiting for the next big headline, take charge of your portfolio and seek out stocks with compelling value, growth, or unique innovation potential.

- Boost your long-term income potential by tapping into these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

- Spot tomorrow’s tech disruptors and ride the wave with these 25 AI penny stocks as they make their mark with groundbreaking artificial intelligence.

- Target deep value opportunities by checking out these 920 undervalued stocks based on cash flows, which stand out for their discounted price-to-cash-flow ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026