- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

Galaxy Digital (NasdaqGS:GLXY): Exploring Shareholder Value Following Recent Momentum

Reviewed by Simply Wall St

Galaxy Digital (NasdaqGS:GLXY) shares have made some interesting moves recently, with the stock posting a solid gain over the past month. While day-to-day swings are common in this space, investors are keeping a close eye on the broader performance trends.

See our latest analysis for Galaxy Digital.

Galaxy Digital’s recent upswing, with a 20.7% one-month share price return, follows an eventful year. This fresh momentum far outpaces prior dips. Looking at the bigger picture, the stock’s 169.5% one-year total shareholder return highlights strong long-term performance and renewed investor confidence, even despite short-term volatility.

If Galaxy’s sharp rebound piqued your interest, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But after such a dramatic surge, is Galaxy Digital undervalued at its current level, or is the market already factoring in the company’s future growth? Could this be a genuine buying opportunity, or is optimism already reflected in the price?

Most Popular Narrative: 1.3% Undervalued

Galaxy Digital's narrative fair value is slightly above its latest closing price of $37.29. This prompts investors to examine the core assumptions behind this small but meaningful gap.

Expansion of proprietary trading capabilities and operational scale is allowing Galaxy to consistently outpace industry trading volume declines, while capturing outsized share from market dislocations. This suggests the potential for sustained trading revenue growth and structurally higher net margins as institutional crypto markets mature.

Curious what aggressive growth scenario is fueling this high-stakes valuation? The narrative hinges on bold projections for revenue growth, margin expansion, and a future profit multiple that rivals market leaders. Want to uncover the exact numbers and controversial assumptions powering this price target? Dive into the full narrative for the surprising details.

Result: Fair Value of $37.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a single major client and the capital-intensive nature of expansion could quickly challenge Galaxy Digital’s growth narrative if circumstances change.

Find out about the key risks to this Galaxy Digital narrative.

Another View: Market Multiples Complicate the Undervaluation Story

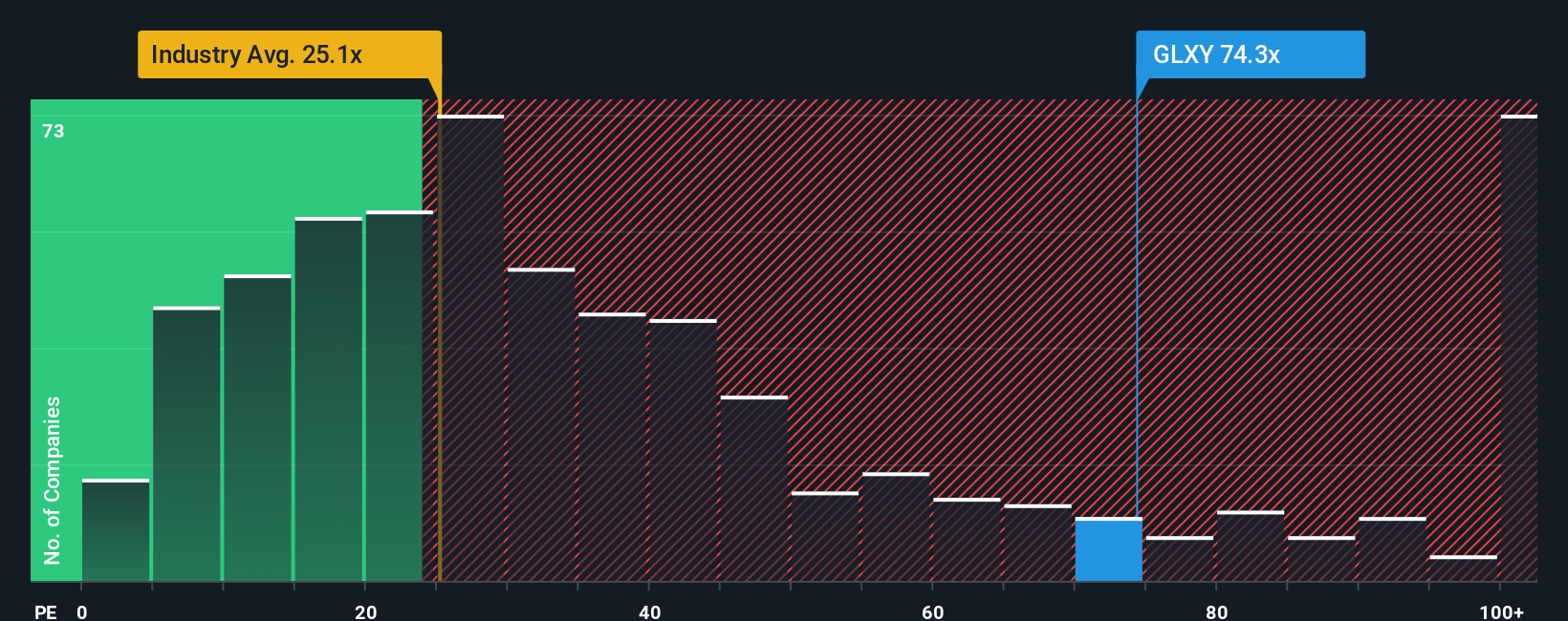

Looking from another angle, Galaxy Digital’s price-to-earnings ratio currently sits at 79.1x. This is far higher than the US Capital Markets industry average of 26.7x and the peer average of 54.1x. Even compared to its estimated fair ratio of 15.7x, the market is assigning a significant premium to growth potential. This premium could signal high expectations and a risk that the share price has run ahead of fundamentals. Does the market see value others do not, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you think there’s more to the story or want to shape your own view, it takes under three minutes to build a custom narrative for Galaxy Digital. Do it your way

A great starting point for your Galaxy Digital research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Put the odds in your favor and access unique investment opportunities beyond Galaxy Digital. These smart screens can help you capture the next breakthrough before anyone else.

- Spot income opportunities by reviewing these 21 dividend stocks with yields > 3%, offering yields many investors overlook, and build a portfolio that pays you back.

- Ride the AI wave and get ahead of the market with these 26 AI penny stocks, poised for hypergrowth thanks to game-changing artificial intelligence advancements.

- Tap into blockbuster potential with these 28 quantum computing stocks, at the forefront of the quantum computing revolution and shaping tomorrow’s digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives