- United States

- /

- Capital Markets

- /

- NasdaqGM:GCMG

Here's Why GCM Grosvenor Inc.'s (NASDAQ:GCMG) CEO Is Unlikely to Expect A Pay Rise This Year

Key Insights

- GCM Grosvenor's Annual General Meeting to take place on 6th of June

- Salary of US$4.28m is part of CEO Michael Sacks's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, GCM Grosvenor's EPS grew by 33% and over the past three years, the total shareholder return was 2.3%

CEO Michael Sacks has done a decent job of delivering relatively good performance at GCM Grosvenor Inc. (NASDAQ:GCMG) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 6th of June. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for GCM Grosvenor

Comparing GCM Grosvenor Inc.'s CEO Compensation With The Industry

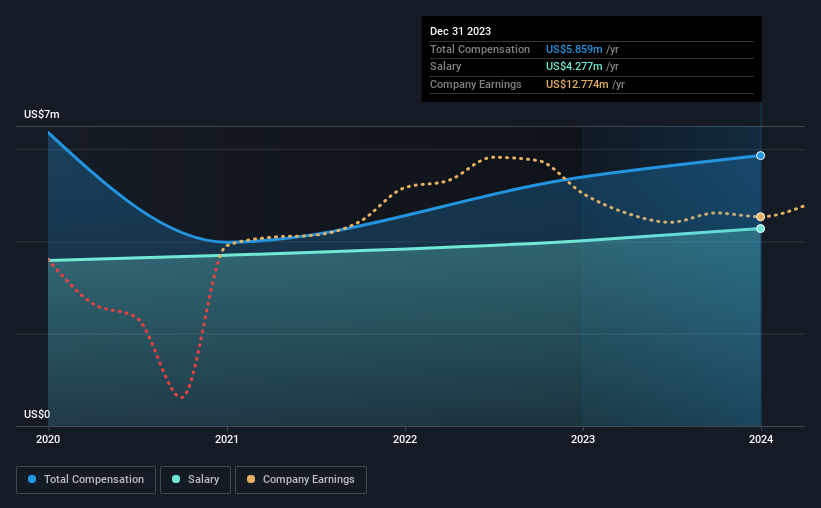

Our data indicates that GCM Grosvenor Inc. has a market capitalization of US$1.9b, and total annual CEO compensation was reported as US$5.9m for the year to December 2023. Notably, that's an increase of 8.6% over the year before. We note that the salary portion, which stands at US$4.28m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the American Capital Markets industry with market capitalizations ranging between US$1.0b and US$3.2b had a median total CEO compensation of US$6.5m. So it looks like GCM Grosvenor compensates Michael Sacks in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$4.3m | US$4.0m | 73% |

| Other | US$1.6m | US$1.4m | 27% |

| Total Compensation | US$5.9m | US$5.4m | 100% |

On an industry level, roughly 10% of total compensation represents salary and 90% is other remuneration. According to our research, GCM Grosvenor has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

GCM Grosvenor Inc.'s Growth

Over the past three years, GCM Grosvenor Inc. has seen its earnings per share (EPS) grow by 33% per year. Its revenue is up 2.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has GCM Grosvenor Inc. Been A Good Investment?

GCM Grosvenor Inc. has generated a total shareholder return of 2.3% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which makes us a bit uncomfortable) in GCM Grosvenor we think you should know about.

Switching gears from GCM Grosvenor, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GCMG

GCM Grosvenor

GCM Grosvenor Inc. is global alternative asset management solutions provider.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success