- United States

- /

- Diversified Financial

- /

- NasdaqGS:FISV

How Investors Are Reacting To Fiserv (FISV) Lawsuit Alleging Misleading Financial Disclosures

Reviewed by Sasha Jovanovic

- Earlier this month, a class action lawsuit was filed against Fiserv, Inc. and certain executives, alleging violations of federal securities laws due to false and misleading statements about the company’s business and financial outlook during the summer and early fall of 2025.

- This legal challenge follows significant leadership changes and questions about the company's reporting practices, casting a spotlight on Fiserv's governance and investor trust.

- We will explore how high-profile allegations of misleading financial statements may impact Fiserv’s previously optimistic investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fiserv Investment Narrative Recap

To be a shareholder in Fiserv, you need to have confidence in the company’s ability to benefit from the ongoing shift to digital payments and financial automation, particularly through the growth of its Clover and next-generation platform businesses. However, the recent class action lawsuit alleging misleading statements about financial health has created a near-term focus on corporate governance and transparency, which now stands as the most important risk to watch, even as product innovation remains the primary catalyst for recovery or renewed growth.

Among recent company announcements, the Q3 2025 earnings report is especially relevant: despite revenue growing to US$5,263 million and net income to US$792 million, these results were overshadowed by management’s downward revision of future guidance and subsequent stock volatility, which were central issues in the lawsuit. How the company resolves concerns about accurate reporting and forward-looking statements may influence the pace at which business catalysts, such as international expansion and digital product launches, can gain traction.

But while investors may be monitoring new platform rollouts, it is the question of governance and financial disclosure that may matter most if...

Read the full narrative on Fiserv (it's free!)

Fiserv's narrative projects $24.7 billion revenue and $5.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $2.5 billion earnings increase from $3.4 billion today.

Uncover how Fiserv's forecasts yield a $95.84 fair value, a 58% upside to its current price.

Exploring Other Perspectives

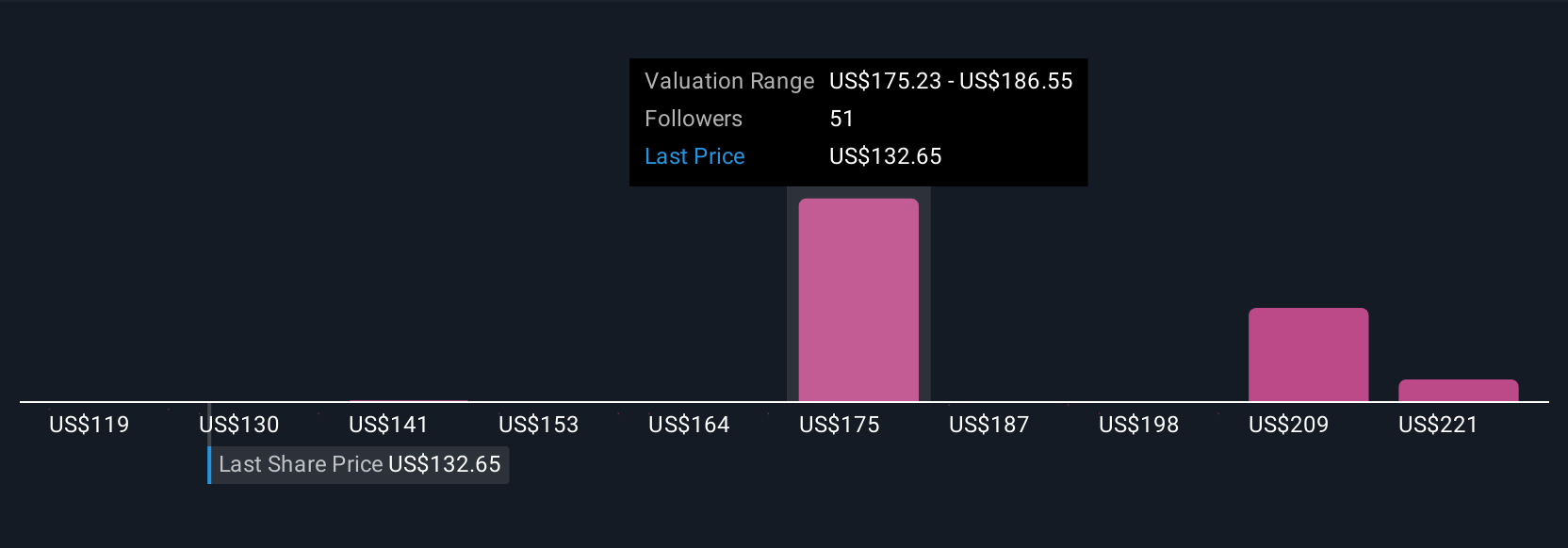

Private investors in the Simply Wall St Community placed fair value estimates for Fiserv between US$95.84 and US$231.84, with 17 opinions represented. Still, with recent legal scrutiny of financial reporting, you might find that assessing the true outlook requires considering all sides of the debate.

Explore 17 other fair value estimates on Fiserv - why the stock might be worth just $95.84!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FISV

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives