- United States

- /

- Consumer Finance

- /

- NasdaqGS:EZPW

A Look at EZCORP (EZPW) Valuation as Analyst Confidence Builds Following Citizens' Market Outperform Rating

Reviewed by Simply Wall St

EZCORP (EZPW) has caught investor interest after Citizens initiated coverage with a Market Outperform rating. Several brokers now share this positive view on EZCORP’s future prospects, which contributes to a broader wave of analyst confidence.

See our latest analysis for EZCORP.

EZCORP’s latest analyst coverage has coincided with robust share price momentum, especially in recent months. After a 45.9% share price return year to date, confidence hasn’t faded, with the 1-year total shareholder return reaching 53.9% and the 3-year figure standing at a very strong 87.3%. The recent shelf registration filing is another sign of ongoing corporate activity but hasn’t slowed the stock’s upward trend.

If the positive analyst buzz around EZCORP has you interested in fresh ideas, consider expanding your search and discover fast growing stocks with high insider ownership

But with shares riding high and confidence near a peak, the real question for investors now is whether EZCORP is still undervalued or if the current price already reflects all its potential. Is there more upside, or is future growth already priced in?

Most Popular Narrative: 24.8% Undervalued

EZCORP’s most widely followed narrative sets a fair value ($23.50) that stands well above the last close ($17.68), highlighting a significant upside opportunity based on analyst conviction and improving business fundamentals.

"Digital innovations, operational efficiencies, and continued Latin American expansion enhance customer acquisition, margin leverage, and geographic diversification."

Curious why analysts think EZCORP could break out even higher? Discover which financial levers, such as robust growth rates and margin expansion, underpin this ambitious valuation. The real surprise is what’s fueling these bullish expectations. Uncover the catalysts detailed in the full narrative.

Result: Fair Value of $23.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower adoption of digital platforms or declining gold prices could limit EZCORP’s earnings and challenge the bullish outlook shared by analysts.

Find out about the key risks to this EZCORP narrative.

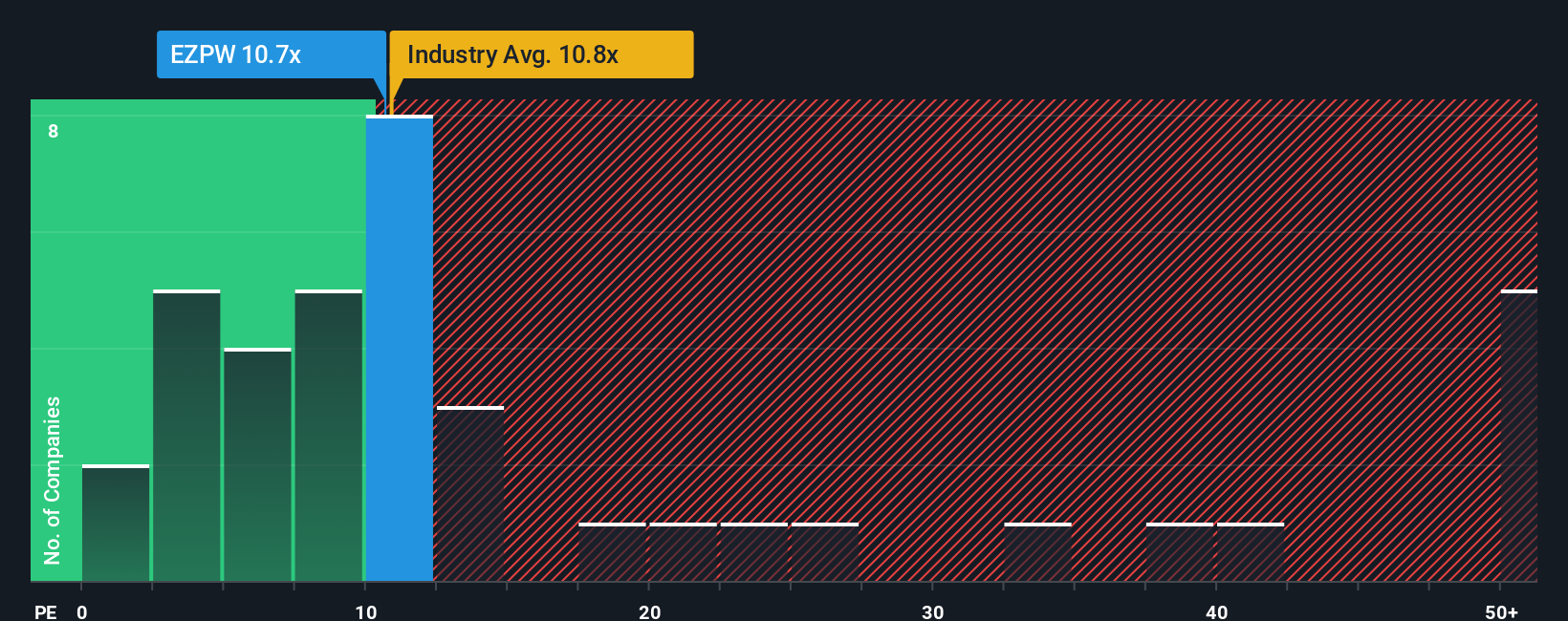

Another View: Market Multiples Tell a Cautionary Story

While analyst models suggest notable upside, a glance at EZCORP’s price-to-earnings ratio (11x) reveals it is actually higher than both the Consumer Finance industry average (10.7x) and its closest peer group (8.9x). This premium means the market already expects above-average results, raising the bar for future performance.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EZCORP Narrative

Feel free to challenge these perspectives and dig into the underlying numbers yourself. Crafting a personalized narrative for EZCORP takes just a few minutes. Do it your way

A great starting point for your EZCORP research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let a winning idea pass you by. Step up your portfolio and check out unique ways to gain an edge with these expert-curated stock ideas:

- Target companies generating strong income and outperforming with consistent payments by tapping into these 100+ dividend stocks with yields > 3% offering yields above 3%.

- Get early access to innovation by hunting among these 26 AI penny stocks that are transforming industries with artificial intelligence breakthroughs.

- Seize rare chances to pick up seriously these 100+ undervalued stocks based on cash flows stocks that trade below what their cash flows suggest they are truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZCORP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EZPW

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives