- United States

- /

- Capital Markets

- /

- NasdaqGS:ETOR

eToro Group (ETOR) Is Up 16.1% After Q3 Earnings Beat and $150M Buyback Approval – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

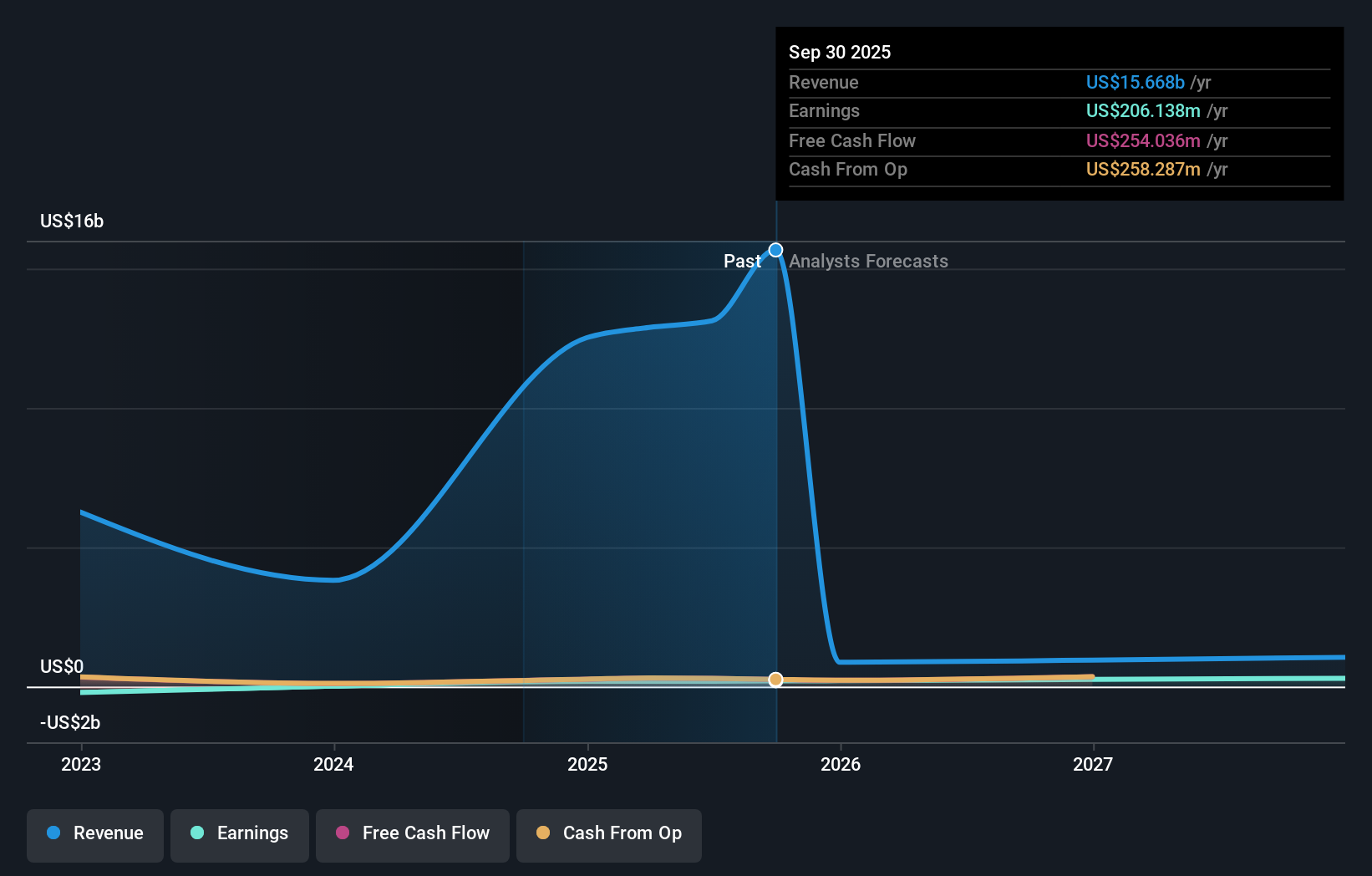

- eToro Group recently reported strong third-quarter results, with revenue rising to US$4.11 billion and net income reaching US$56.82 million, while also announcing a US$150 million share repurchase program approved by its board.

- An interesting insight is that assets under management grew by 76% to US$20.8 billion, reflecting significant user engagement and product adoption.

- Next, we’ll explore how the new buyback program underscores management’s confidence and influences eToro’s ongoing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is eToro Group's Investment Narrative?

For investors considering eToro Group, the central question is whether its recent combination of robust earnings growth and sizable buyback authorization truly resets the catalysts and risks around the stock. The third-quarter results point to powerful short-term drivers such as user engagement and new product rollouts, all underscored by the $150 million share repurchase, which signals management’s belief in the business. The news appears to have contributed to a swift recovery in the share price, but the low profit margins and exposure to volatile crypto trading remain top-of-mind risks. While some potential pitfalls, like thin margins, haven’t materially shifted, the buyback and stronger-than-expected profitability may ease concerns about immediate downside, especially after a period of sharp share price declines. Ultimately, whether these positive signals outweigh persistent risks defines the big picture story today.

However, rising competition and regulatory changes could still catch investors off guard.

eToro Group's shares have been on the rise but are still potentially undervalued by 6%. Find out what it's worth.Exploring Other Perspectives

Explore 20 other fair value estimates on eToro Group - why the stock might be a potential multi-bagger!

Build Your Own eToro Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eToro Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free eToro Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eToro Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETOR

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives