- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

Euronet Worldwide (EEFT) Margins Rise, Slower Profit Growth Signals Narrative Shift

Reviewed by Simply Wall St

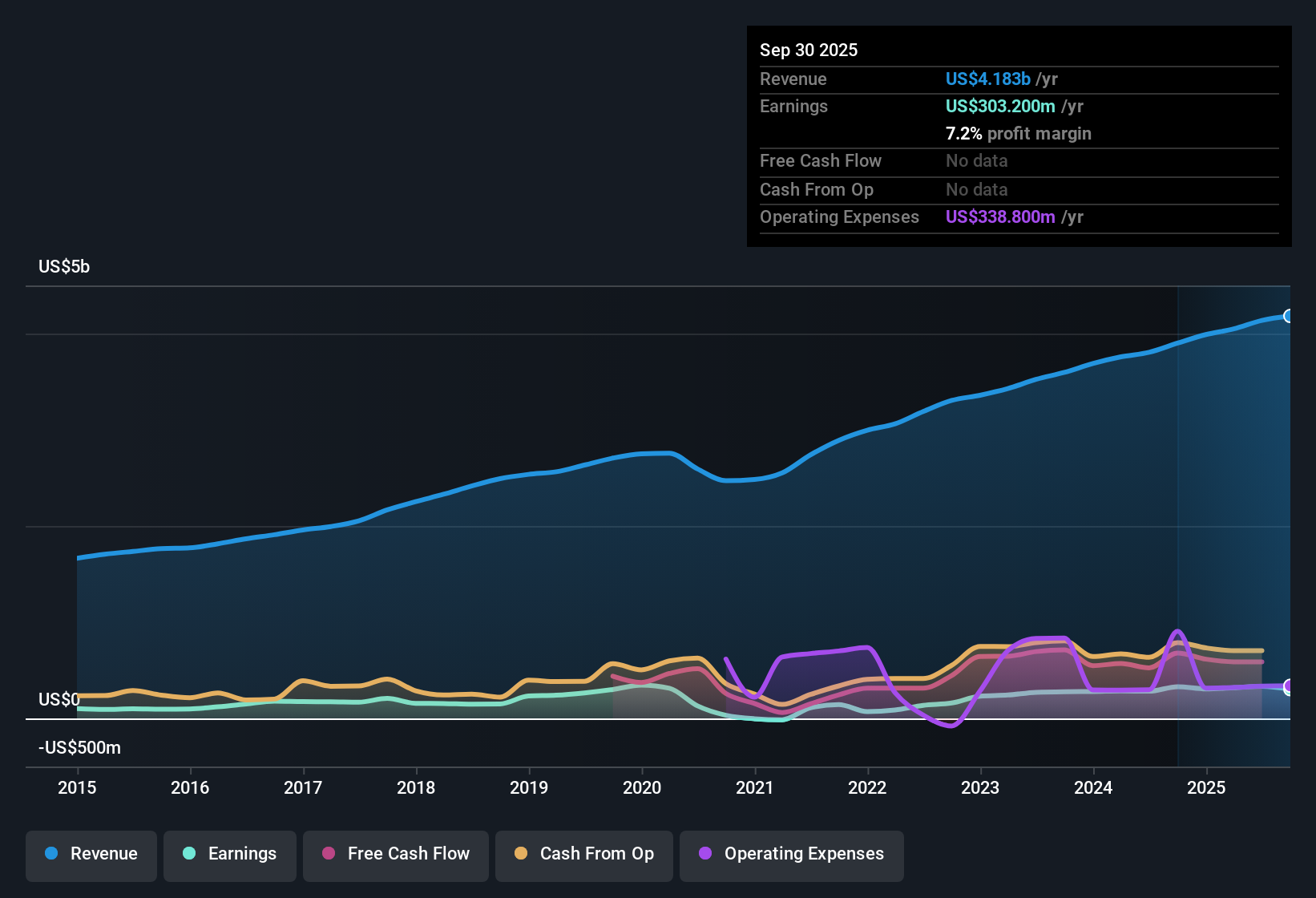

Euronet Worldwide (EEFT) posted a net profit margin of 8%, up from last year's 7.4%, while annual earnings grew by 17.6%. That said, this latest growth is less than the company's five-year average of 37.9% per year, indicating profit acceleration has slowed compared to previous periods. Investors have a lot to consider, as Euronet's strong earnings quality, improved margins, and favorable valuation multiples are balanced by forecasts for more modest earnings and revenue growth versus the broader US market.

See our full analysis for Euronet Worldwide.Up next, we will see how these results compare to the dominant narratives shaping sentiment around Euronet and whether the latest numbers reinforce or challenge expectations.

See what the community is saying about Euronet Worldwide

Digital Payments and Money Transfer Surge On

- Operating income for the Money Transfer segment soared by 33% year-over-year, outpacing other divisions and highlighting how cross-border flows are increasingly driving overall profitability.

- Analysts' consensus view finds that Euronet’s global push into high-growth markets and digital payment platforms, such as the CoreCard and Ren acquisitions, anchors recurring growth pipelines.

- 70% of epay transactions are now fully digital, and 55% of transfer volumes are digital. Both figures reflect a shift toward higher-margin activity.

- Consensus also sees strategic alliances with top-tier banks as validation for the technology’s durability and reach.

- Consensus narrative notes that Euronet's operational transformation and segment-level outperformance underpin the broader view that its recurring cash flows should continue to improve, despite sector competition and regulatory challenges.

- This aligns with expectations that profit margins may climb further, from today’s 8% to 9.1% in three years as digital revenues scale.

P/E Ratio Sits Well Below Peers

- Euronet trades at just 10x Price-To-Earnings compared to 16.2x for the US financials industry and 28.9x for its peers. This signals that investors are getting similar earnings growth at a steep discount.

- According to the consensus narrative, this valuation gap is supported by several factors,

- High earnings quality and the current share price ($83.44) trading below both DCF fair value ($90.04) and the $124.00 analyst price target strengthen the argument for relative undervaluation.

- Rewards statements and consensus analysts both emphasize that the market may not fully appreciate the durability of Euronet's profit and revenue trajectory, especially as analyst targets reflect continued growth at a bargain price.

Forward Growth Trails Broader Market

- Euronet’s forecast 11.2% annual earnings growth and 8% revenue growth fall short of the broader US market’s 15.5% and 10%, respectively, as analyst projections temper expectations for future outperformance.

- The consensus narrative draws on these projections to highlight a key tension for investors:

- Bulls see durable profit engines from new digital payment solutions; however, bears argue that lagging growth against the market could cap future share price appreciation.

- Consensus still points to a rising profit margin and declining share count, but calls out ongoing pressures from regulatory risks and intensifying industry competition as real limits on near-term upside.

- Solid results but below-market forecasted growth keep sentiment balanced. See how analysts’ expectations stack up against Euronet's story in the consensus narrative.

📊 Read the full Euronet Worldwide Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Euronet Worldwide on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Share your take in just a few minutes and contribute your own perspective. All it takes is a moment. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Euronet Worldwide.

See What Else Is Out There

Euronet faces below-market growth forecasts. Earnings and revenue are expected to lag the broader US market, despite improvements in margins and profitability.

If you want to target companies set for faster growth, check out high growth potential stocks screener (54 results) and discover established stocks forecast to deliver stronger results ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives