- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

DLocal (DLO) Is Up 12.2% After Goldman Sachs Upgrade on Stablecoin Partnership Prospects

Reviewed by Sasha Jovanovic

- DLocal recently saw increased investor interest after Goldman Sachs upgraded its outlook, citing confidence in the company’s ability to deliver higher EBITDA growth through diversification and new partnerships.

- This shift in analyst sentiment highlights the market’s growing focus on fintechs expanding into stablecoin and alternative payment infrastructure within emerging markets.

- We’ll explore how Goldman Sachs’ optimism about DLocal’s partnerships with stablecoin operators could reshape its long-term growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DLocal Investment Narrative Recap

Owning DLocal stock means believing in the fintech’s capacity to drive sustained growth by diversifying its client base, expanding into new regions and payment methods, and managing margin pressures as it tackles competition and evolving regulation. While the Goldman Sachs upgrade and recent rally spotlight investor confidence, the most immediate catalyst remains DLocal's revenue diversification efforts, whereas heavy reliance on top merchants is still the biggest risk; this news does not materially change that risk right now.

The recently announced alliance with Western Union is highly relevant, as it expands DLocal’s reach in Latin America and further supports its geographic and product diversification, one of the main catalysts underscored by analysts and now echoed by market reactions to the Goldman Sachs upgrade. This new partnership brings increased payment flows and adds to DLocal’s ambition to reduce client concentration risk, a key focus for investors tracking short-term stability and long-term resilience.

However, investors should also keep in mind that despite these positive developments, customer churn risk remains concentrated among just a handful of DLocal’s top global clients, if even one scales back...

Read the full narrative on DLocal (it's free!)

DLocal's narrative projects $1.7 billion revenue and $346.3 million earnings by 2028. This requires 25.7% yearly revenue growth and a $200.4 million earnings increase from $145.9 million today.

Uncover how DLocal's forecasts yield a $15.94 fair value, in line with its current price.

Exploring Other Perspectives

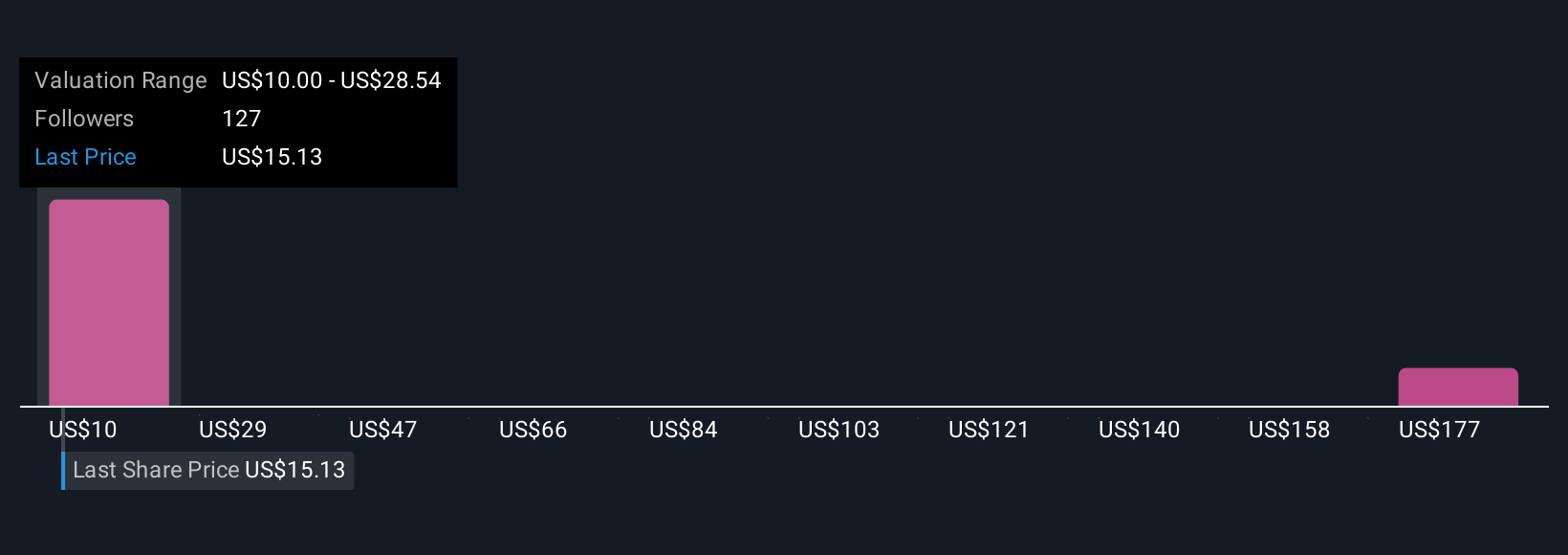

Twenty-one Simply Wall St Community members have shared fair value estimates for DLocal ranging from US$10 to US$195.39. Your peers’ views reflect how key risks like client concentration may shape returns in the eyes of different market participants, so be sure to explore several unique viewpoints.

Explore 21 other fair value estimates on DLocal - why the stock might be worth 37% less than the current price!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

No Opportunity In DLocal?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives