- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

A Fresh Look at DLocal (NasdaqGS:DLO) Valuation Following Alchemy Pay Partnership in Latin America

Reviewed by Simply Wall St

See our latest analysis for DLocal.

Recent momentum in DLocal’s share price has been strong, with a 37.7% rise over the past 90 days and a 29.5% gain year-to-date. This performance has outpaced many fintech peers. Long-term shareholders will note a striking 12-month total return of 79.5%, though the three-year total return still reflects earlier volatility with a net decline. The Alchemy Pay partnership highlights DLocal’s progress in expanding its payments ecosystem, and the market seems to be recognizing this strategic shift.

If news like this has sparked your curiosity, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

But with shares up nearly 80% over the past year and profitability accelerating, the key question now is whether DLocal is still undervalued or if the market has already priced in its growth potential.

Most Popular Narrative: 92% Undervalued

DLocal’s last close of $15.13 stands in sharp contrast to the narrative’s estimated fair value of $195.39. According to WynnLevi’s in-depth perspective, this steep difference is rooted in expectations of rapid expansion and margin gains, setting an ambitious backdrop for the company’s outlook.

DLocal emphasizes continuous investment in developing new products and services. The company’s pipeline is closely tied to expanding into new geographic markets, integrating new payment methods, developing advanced tools for merchants, especially for managing collections and disbursements, and innovating solutions for complex transactions, such as cross-border payments and compliance with local regulations. DLocal highlights that these efforts are not just incremental but necessary to remain competitive amid rapid technological change, the entrance of new competitors, and evolving client demands.

Want to know what bold financial forecasts could justify such an eye-popping valuation? This narrative credits DLocal with scaling margins and targeting expansion moves that could transform its growth trajectory. Eager to see the headline metrics behind the story? Get the details that underpin this potentially game-changing outlook.

Result: Fair Value of $195.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution challenges or technology delays remain key risks. These issues could quickly dampen DLocal’s growth outlook and shift market sentiment.

Find out about the key risks to this DLocal narrative.

Another View: Market Multiples Tell a Different Story

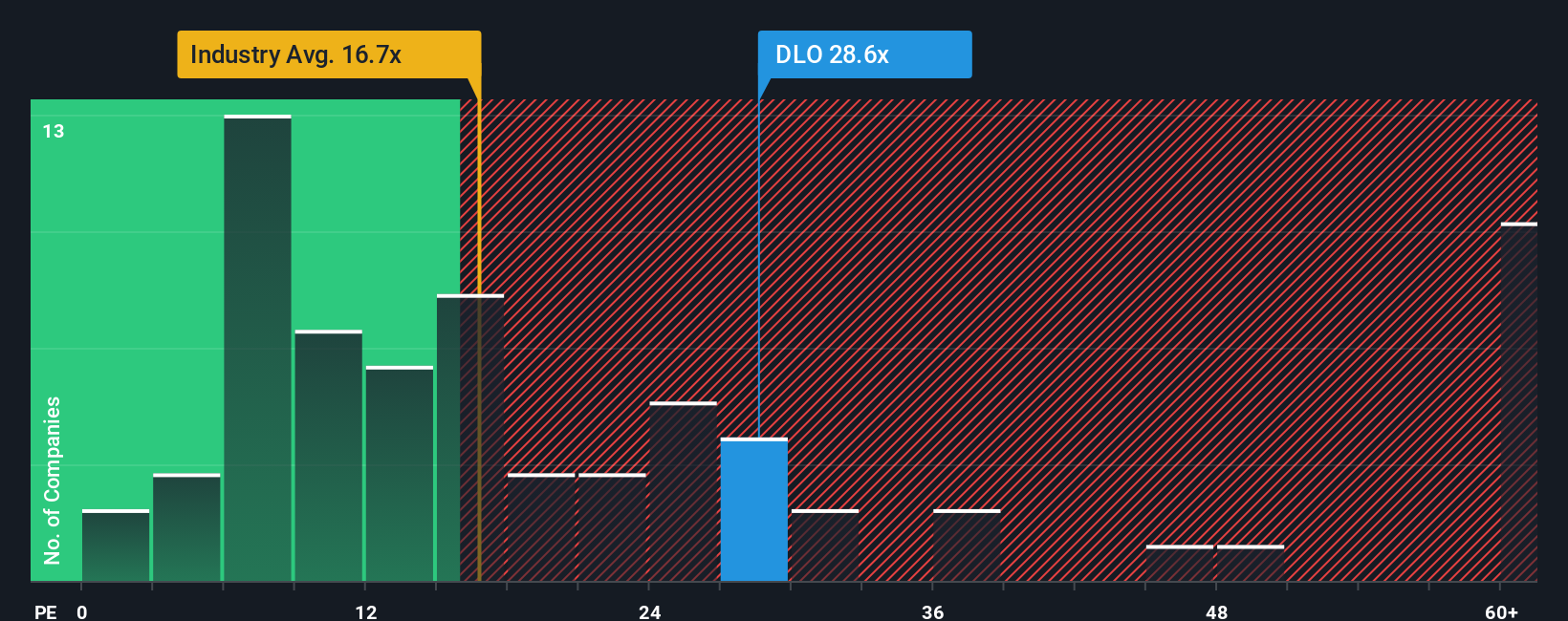

While the narrative-based estimate points to DLocal being massively undervalued, a closer look at the market’s chosen valuation ratio raises caution. DLocal trades at 30.5 times earnings, which is far above both the industry average of 16.6 and a fair ratio of 21.2. This premium suggests the market sees more risk or demands strong growth to justify the price. Does the real upside still outweigh the potential for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DLocal Narrative

If you see things differently or want to dig into the numbers for yourself, you can assemble your own narrative in just a few minutes, your way. Do it your way

A great starting point for your DLocal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment moves?

Take advantage of the latest market insights and stay ahead of the crowd by checking out these unique opportunities waiting in the Simply Wall Street Screener.

- Spot earnings growth and future stars with these 3559 penny stocks with strong financials that are shaking up global markets with fresh potential.

- Boost your portfolio’s stability and enjoy attractive yields by checking out these 17 dividend stocks with yields > 3% designed for income-focused investors seeking long-term returns above 3%.

- Capitalize on AI’s explosive upside and explore new tech frontiers by selecting from these 27 AI penny stocks that lead advances in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives