- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

New CPO Parker Barrile’s Arrival Might Change the Case for Investing in Dave (DAVE)

Reviewed by Sasha Jovanovic

- In October 2025, Dave Inc. announced the appointment of Parker Barrile as Chief Product Officer, with Barrile bringing experience from Prosper, LinkedIn, and as a former partner at Norwest who led Dave’s Series B fundraise and served on its board.

- Barrile’s investor background and fintech expertise are expected to play a central role in advancing Dave’s roadmap for expanding its product suite and enhancing AI and credit capabilities.

- As Barrile steps in to lead product, design, and operations, we'll explore what his appointment could mean for the company’s growth strategy and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Dave Investment Narrative Recap

To be a shareholder in Dave Inc., you need to believe in the company's ability to scale its digital banking platform and monetize new products as it faces regulatory and competitive pressures. The recent appointment of Parker Barrile as Chief Product Officer aligns with key catalysts around product innovation but does not materially change the most immediate risk, regulatory scrutiny on fee-based models that could impact margin growth. Among other recent announcements, the full rollout of CashAI v5.5 in September speaks directly to the short-term catalyst of improved risk segmentation and credit performance. This technology upgrade is central to Dave’s efforts to reduce credit losses and potentially enables growth in ExtraCash advances, which ties into the broader push for higher efficiency and profitability as the company expands its product suite. However, with new leadership in place, investors should also consider the ongoing risk that tighter regulations on short-term credit and data use may...

Read the full narrative on Dave (it's free!)

Dave's outlook calls for $702.2 million in revenue and $193.0 million in earnings by 2028. Achieving these projections implies a 17.5% annual revenue growth rate and a $137.9 million increase in earnings from the current $55.1 million.

Uncover how Dave's forecasts yield a $271.86 fair value, a 14% upside to its current price.

Exploring Other Perspectives

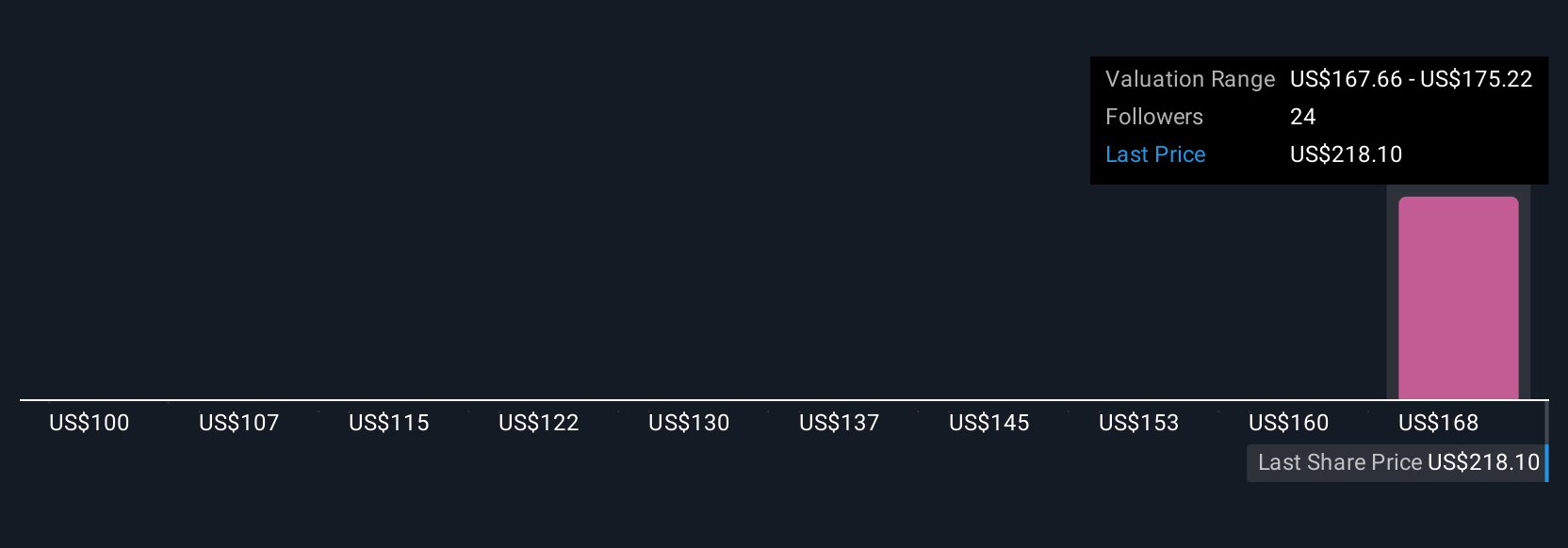

Four individual fair value estimates from the Simply Wall St Community range from US$99.65 to US$320 a share. While opinions vary, the community’s outlook contrasts with analyst focus on margin pressures driven by potential regulatory changes, encouraging you to consider diverse risk factors influencing Dave Inc.’s future performance.

Explore 4 other fair value estimates on Dave - why the stock might be worth less than half the current price!

Build Your Own Dave Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dave research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dave research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dave's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives