- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave's Soaring Q3 Profits and Raised Outlook Could Be a Game Changer for DAVE

Reviewed by Sasha Jovanovic

- Dave Inc. recently reported third-quarter 2025 earnings, revealing sharply higher revenue of US$150.73 million and net income of US$92.07 million, while also raising its full-year revenue guidance to a range of US$544 million to US$547 million.

- The company achieved this growth without any share repurchases during its latest buyback period and bolstered its executive team with the addition of a new Chief Product Officer focused on product expansion and AI initiatives.

- We'll now examine how Dave's jump in profitability and upgraded revenue outlook further inform its investment narrative and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dave Investment Narrative Recap

To be a Dave shareholder, you need conviction in the company's ability to sustain high revenue growth through digital banking innovation and fee-driven business models, all while navigating regulatory challenges facing short-term credit providers. The latest jump in profitability and raised revenue outlook strengthens near-term optimism, but potential regulatory action on fee structures remains the most important risk and is not materially addressed by the recent financial results. In the short term, the strongest catalyst continues to be robust customer acquisition translating into improving unit economics, but the durability of those gains could be tested if user preferences or regulatory frameworks shift.

Among recent announcements, the appointment of Parker Barrile as Chief Product Officer stands out, bringing additional expertise in scaling fintech platforms and expanding AI initiatives. This addition aligns with Dave's investment in product innovation and credit capabilities, directly tied to the company's ability to capitalize on the mobile-first banking trend and sustain its revenue momentum in the face of intense sector competition.

However, even amid strong growth, investors should be aware that heightened regulatory scrutiny around fee-based revenue models could...

Read the full narrative on Dave (it's free!)

Dave's narrative projects $702.2 million revenue and $193.0 million earnings by 2028. This requires 17.5% yearly revenue growth and a $137.9 million earnings increase from $55.1 million today.

Uncover how Dave's forecasts yield a $285.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

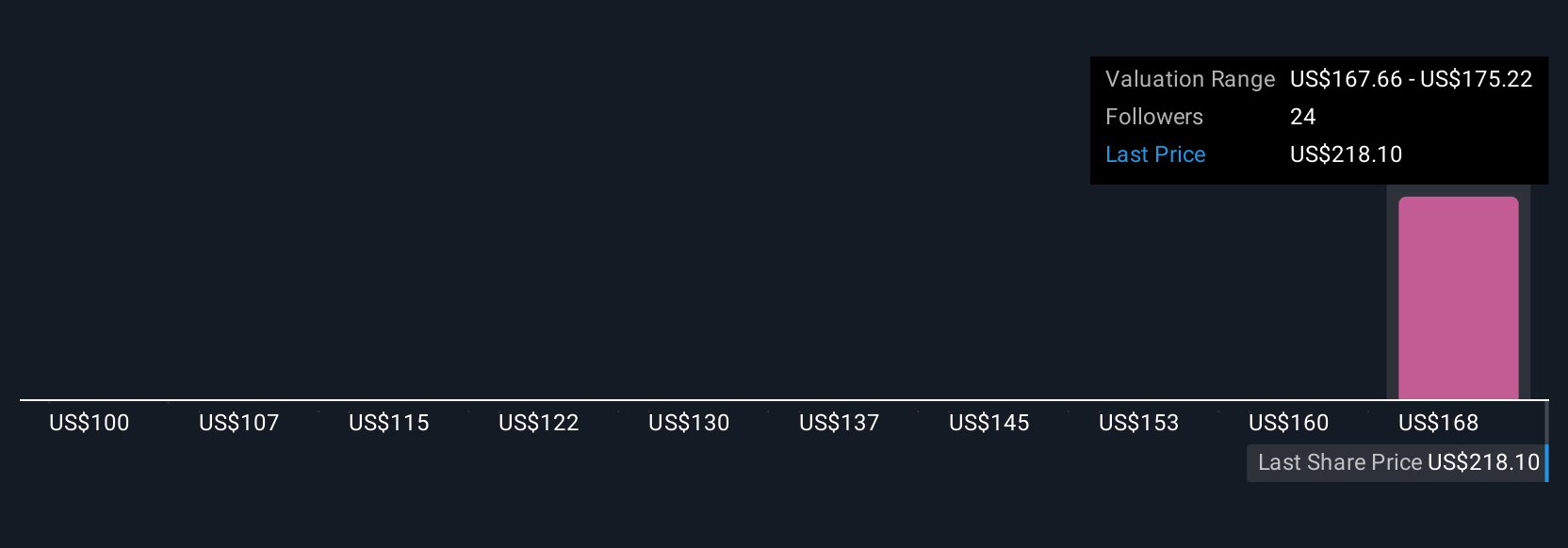

Five fair value estimates from the Simply Wall St Community range widely, from US$99.65 to US$320 per share. While some are optimistic, others signal caution, particularly as regulatory risks to Dave’s core business model remain a key concern for future performance, reminding you to consider several viewpoints before making decisions.

Explore 5 other fair value estimates on Dave - why the stock might be worth as much as 36% more than the current price!

Build Your Own Dave Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dave research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dave research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dave's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives