- United States

- /

- Diversified Financial

- /

- NasdaqGS:CTLP

Cantaloupe, Inc. (NASDAQ:CTLP) Surges 28% Yet Its Low P/E Is No Reason For Excitement

The Cantaloupe, Inc. (NASDAQ:CTLP) share price has done very well over the last month, posting an excellent gain of 28%. The last 30 days bring the annual gain to a very sharp 40%.

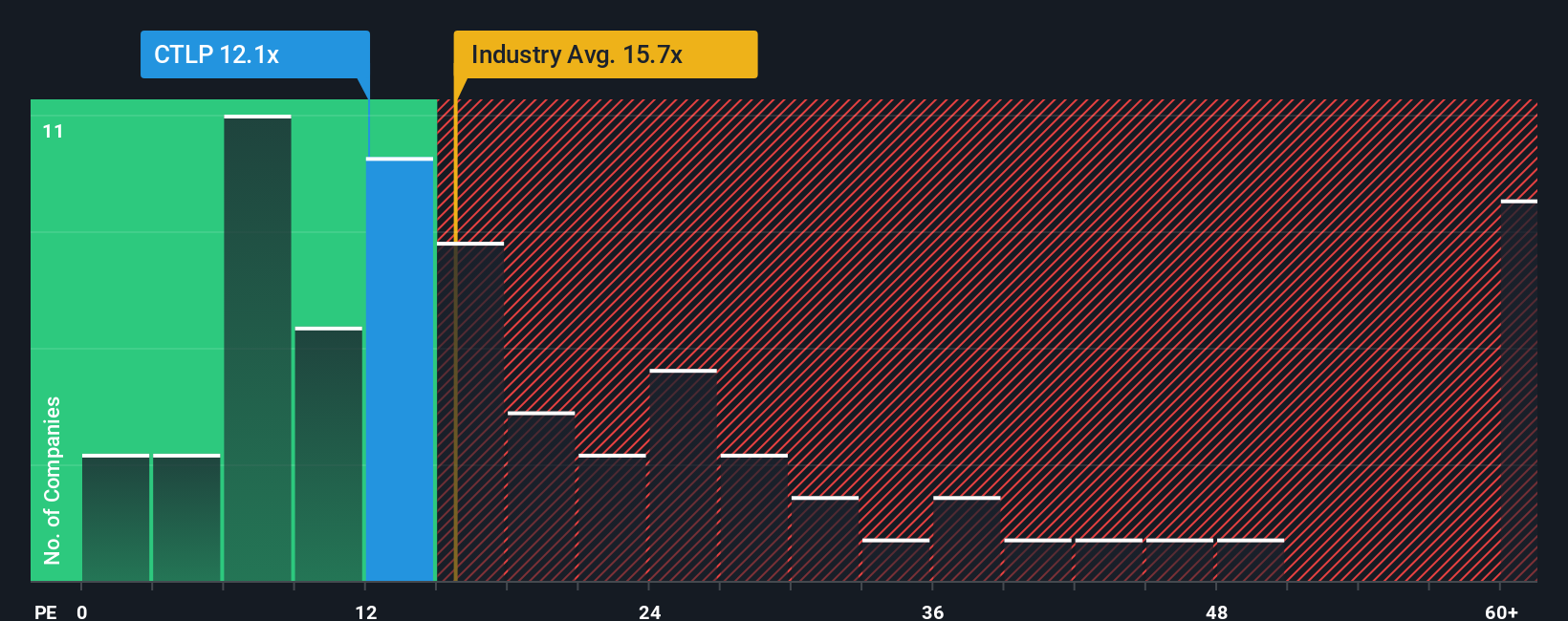

In spite of the firm bounce in price, Cantaloupe may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.1x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Cantaloupe as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Cantaloupe

Does Growth Match The Low P/E?

Cantaloupe's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 390% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 2,339% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 32% as estimated by the six analysts watching the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

In light of this, it's understandable that Cantaloupe's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Despite Cantaloupe's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Cantaloupe's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cantaloupe you should know about.

If these risks are making you reconsider your opinion on Cantaloupe, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTLP

Cantaloupe

A digital payments and software services company, provides technology solutions for the self-service commerce market.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives