- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

How Investors Are Reacting To Capital Southwest (CSWC) Approving New Monthly and Supplemental Dividends for 2026

Reviewed by Sasha Jovanovic

- Capital Southwest Corporation’s Board of Directors has declared monthly dividends of US$0.1934 per share payable in January, February, and March 2026, alongside a supplemental quarterly dividend of US$0.06 per share in March 2026; the dividends will be available to shareholders of record as of the corresponding ex-dates each month.

- The company’s dividend reinvestment plan and these regular distributions reinforce its focus on providing shareholder returns, even as recent earnings results showed strong revenue growth but a significant earnings per share miss relative to expectations.

- We’ll examine how the reaffirmed monthly and supplemental dividends support Capital Southwest’s investment narrative and outlook for shareholder returns.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Capital Southwest Investment Narrative Recap

To believe in Capital Southwest, it’s important to see the company as a long-term lender with deep relationships in the middle market and an internally managed structure designed to generate sustainable income. The just-reaffirmed monthly and supplemental dividends reinforce the company’s income focus but do not materially change the current short-term catalyst: continued growth in originations, nor do they offset the biggest risk, ongoing spread compression from competitive lending markets.

The announcement that Capital Southwest maintained its US$0.1934 per share monthly dividend alongside a US$0.06 per share supplemental dividend for the March 2026 quarter stands out, especially given the recent earnings report that showed revenue growth but a notable earnings per share miss. This regular payout highlights management’s commitment to consistent returns, but shareholder caution endures as profit margins remain pressured by tough loan pricing.

However, it’s important to consider that if dividend sustainability comes under pressure due to...

Read the full narrative on Capital Southwest (it's free!)

Capital Southwest's narrative projects $283.9 million revenue and $196.4 million earnings by 2028. This requires 10.7% yearly revenue growth and a $113.9 million earnings increase from $82.5 million currently.

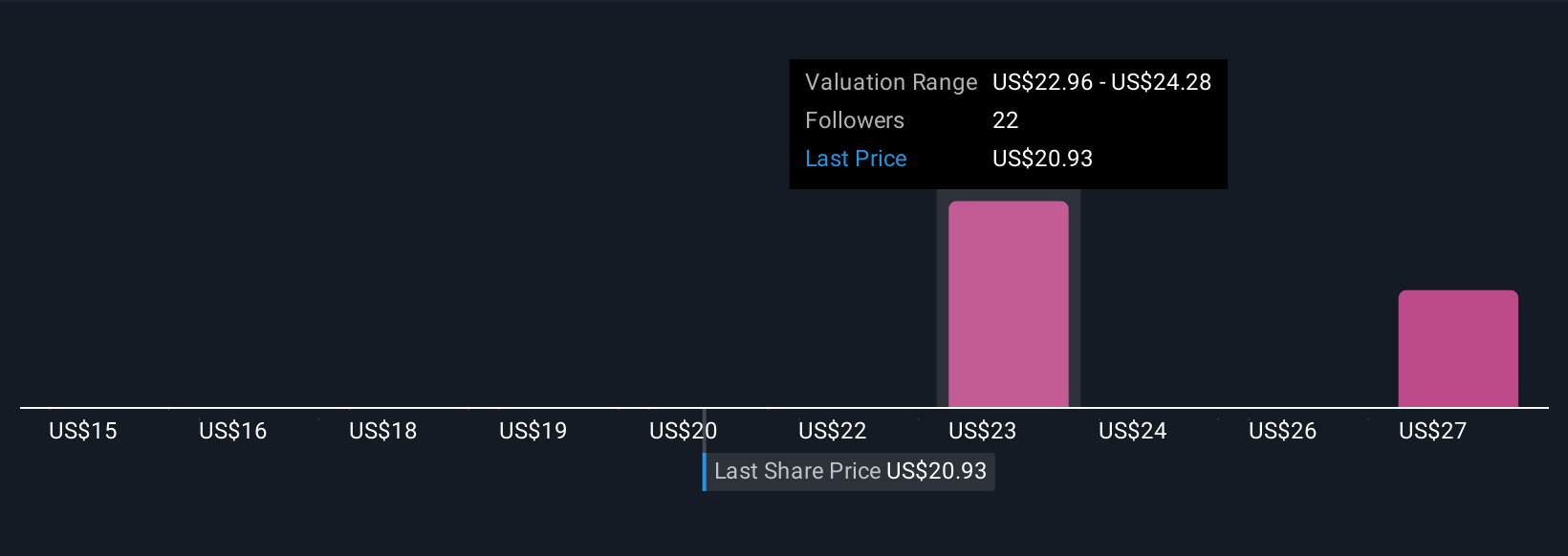

Uncover how Capital Southwest's forecasts yield a $24.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community ranged from US$18.95 to US$28.26 per share. As you compare these viewpoints, note that ongoing competition for new deals may continue to pressure lending spreads and net investment income.

Explore 6 other fair value estimates on Capital Southwest - why the stock might be worth as much as 35% more than the current price!

Build Your Own Capital Southwest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Southwest research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Capital Southwest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Southwest's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives