- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

Has Market Risk Created an Opportunity in Capital Southwest After Five Years of 130% Growth?

Reviewed by Bailey Pemberton

- Wondering if Capital Southwest is a hidden gem or overpriced? You are not alone. We are here to dig deeper into whether the numbers suggest real value.

- The stock recently closed at $20.57. While it has delivered a modest 2.5% return over the last year, the previous five years saw a dramatic 130.7% climb. This hints at shifting risk perspectives and growth potential.

- Investors have been keeping an eye on Capital Southwest after new developments in the diversified financials sector, including industry-wide consolidation and fresh regulatory conversations that could affect private credit providers. These headlines have been fueling both optimism and a bit of caution among market watchers.

- The company currently has a valuation score of 5 out of 6. This suggests it stacks up well on the major value checks. Next, we will break down the methods behind that score and, by the end, take a look at a smarter way to think about fair value beyond the usual metrics.

Find out why Capital Southwest's 2.5% return over the last year is lagging behind its peers.

Approach 1: Capital Southwest Excess Returns Analysis

The Excess Returns valuation model assesses how much value a company generates above the cost of equity capital. In essence, it goes beyond earnings to focus on how efficiently Capital Southwest reinvests its profits compared to what shareholders require as a return.

For Capital Southwest, this model calculates a Book Value of $16.62 per share and a Stable Earnings Per Share (EPS) estimate of $2.34, derived from four analysts' forecasts. The cost of equity, essentially the minimum return expected by investors, stands at $1.61 per share.

The company’s excess return, which is the profit earned above this cost, is $0.73 per share. Its average return on equity sits at a solid 14.09%. Over the past five years, the Stable Book Value has averaged $16.59 per share, providing a foundation for future value projections.

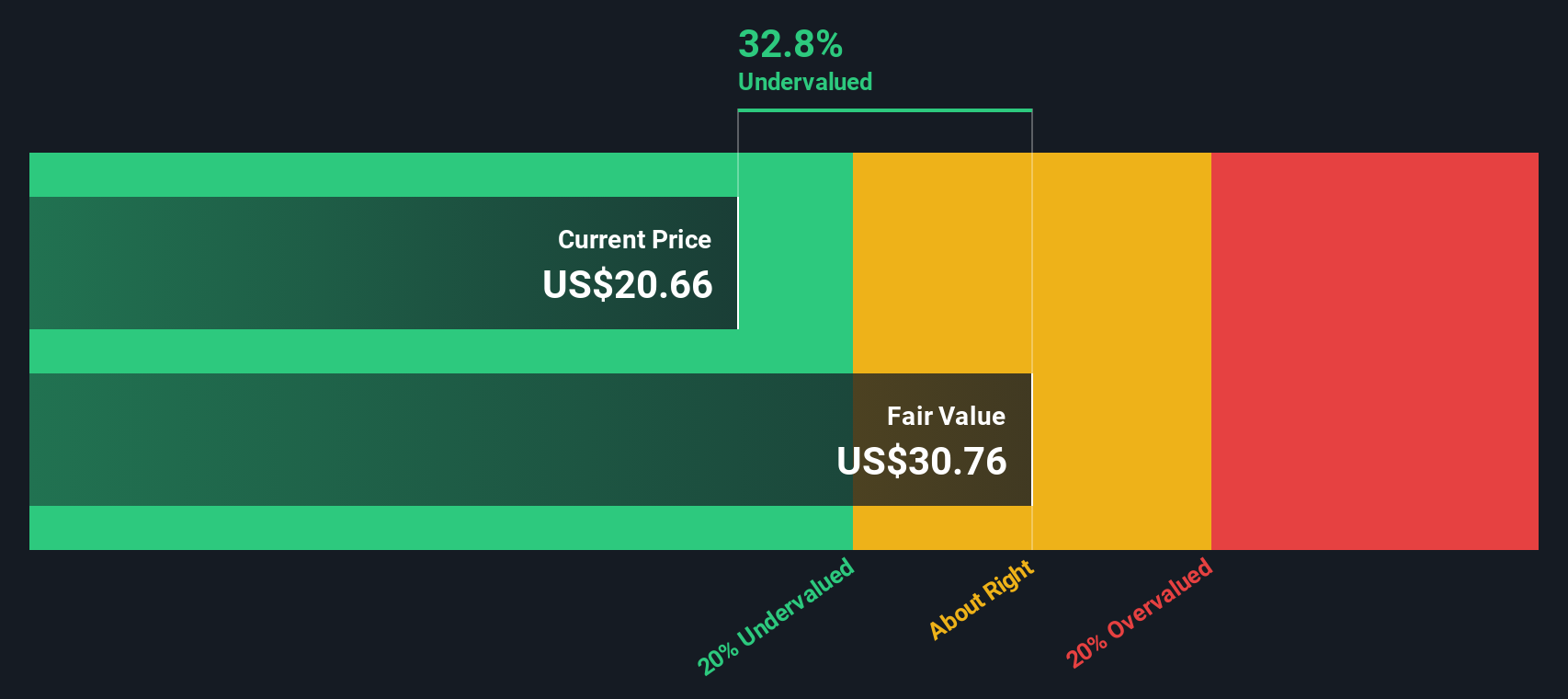

Using these factors, the Excess Returns model arrives at an intrinsic value of $27.70 per share. Given the recent closing price of $20.57, this implies the stock is trading at a 25.7% discount to its estimated value. According to this approach, the stock is considered undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital Southwest is undervalued by 25.7%. Track this in your watchlist or portfolio, or discover 845 more undervalued stocks based on cash flows.

Approach 2: Capital Southwest Price vs Earnings

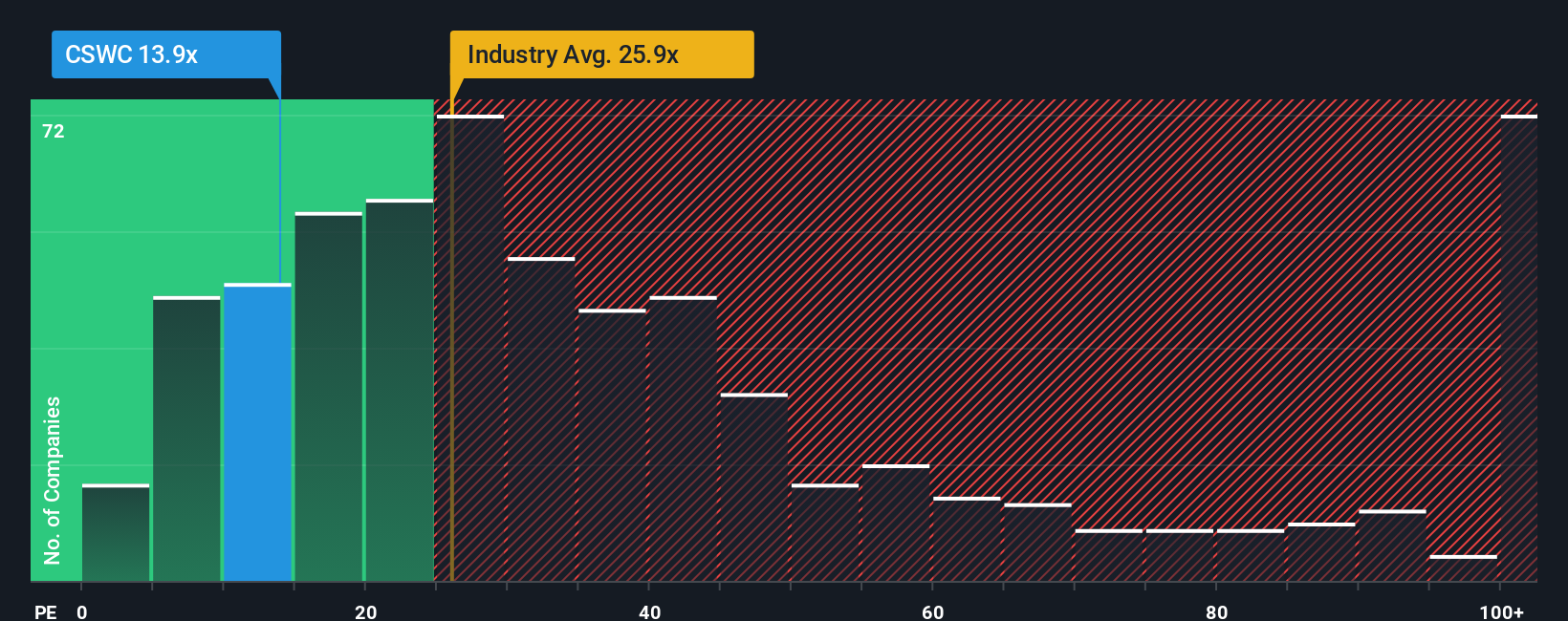

The price-to-earnings (PE) ratio is a popular and effective way to value profitable companies like Capital Southwest, as it gives investors a quick sense of how much they are paying for each dollar of earnings. Established earnings make this metric especially meaningful, helping to compare valuation across time and against both peers and the wider market.

What makes a “fair” PE ratio varies, since investor expectations for growth and the perceived risk of a business can drive this metric higher or lower. Rapid growth or lower risk often justifies a higher PE, while slow-growing or riskier companies usually trade at a discount.

Currently, Capital Southwest trades at a PE ratio of 13.34x. This is not only well below the industry average of 23.79x, but also lower than the peer average of 29.54x. Its Fair Ratio, calculated by Simply Wall St and tailored to the company’s earnings outlook, industry, profit margins, size, and risk profile, stands at 13.99x.

The Fair Ratio offers a more nuanced benchmark than simply looking at peers or the sector. It adjusts for growth, risk, profitability, and business characteristics so the valuation assessment is specific to where Capital Southwest stands today.

With the stock’s actual PE just a fraction below the Fair Ratio, Capital Southwest appears to be priced about right according to this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capital Southwest Narrative

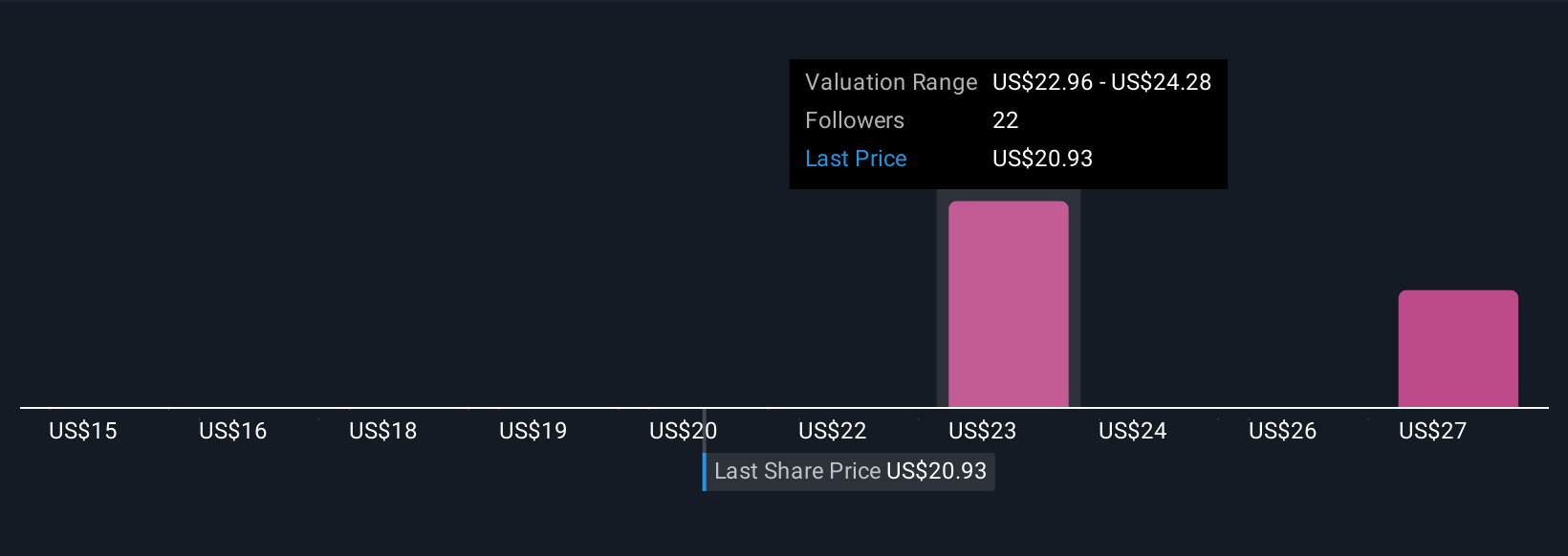

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your unique perspective or “story” about a company, which you express by shaping your own fair value estimate and projecting future revenue, earnings, and margins.

This approach goes beyond just numbers. It connects your view of a company’s prospects with a clear financial forecast that leads to a calculated fair value. Narratives are an easy and accessible tool on Simply Wall St’s Community page, trusted by millions of investors, allowing you to share or explore a range of viewpoints for any company.

By comparing each Narrative’s Fair Value with the latest share price, investors gain a simple yet powerful way to decide when a stock might be a buy, a hold, or a sell. This decision is based on their own conviction and market outlook.

Narratives are updated dynamically whenever new information is released, such as company earnings or major news, so your investment thesis can evolve as the facts change.

For Capital Southwest, for example, one investor’s Narrative might see strong private credit growth and regulatory tailwinds justifying a $27.00 price target, while another who is more cautious about margin pressures may set their fair value closer to $21.00.

Do you think there's more to the story for Capital Southwest? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives