- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

Capital Southwest (CSWC): One-Off $35.6M Loss Challenges Bullish Margin Growth Narratives

Reviewed by Simply Wall St

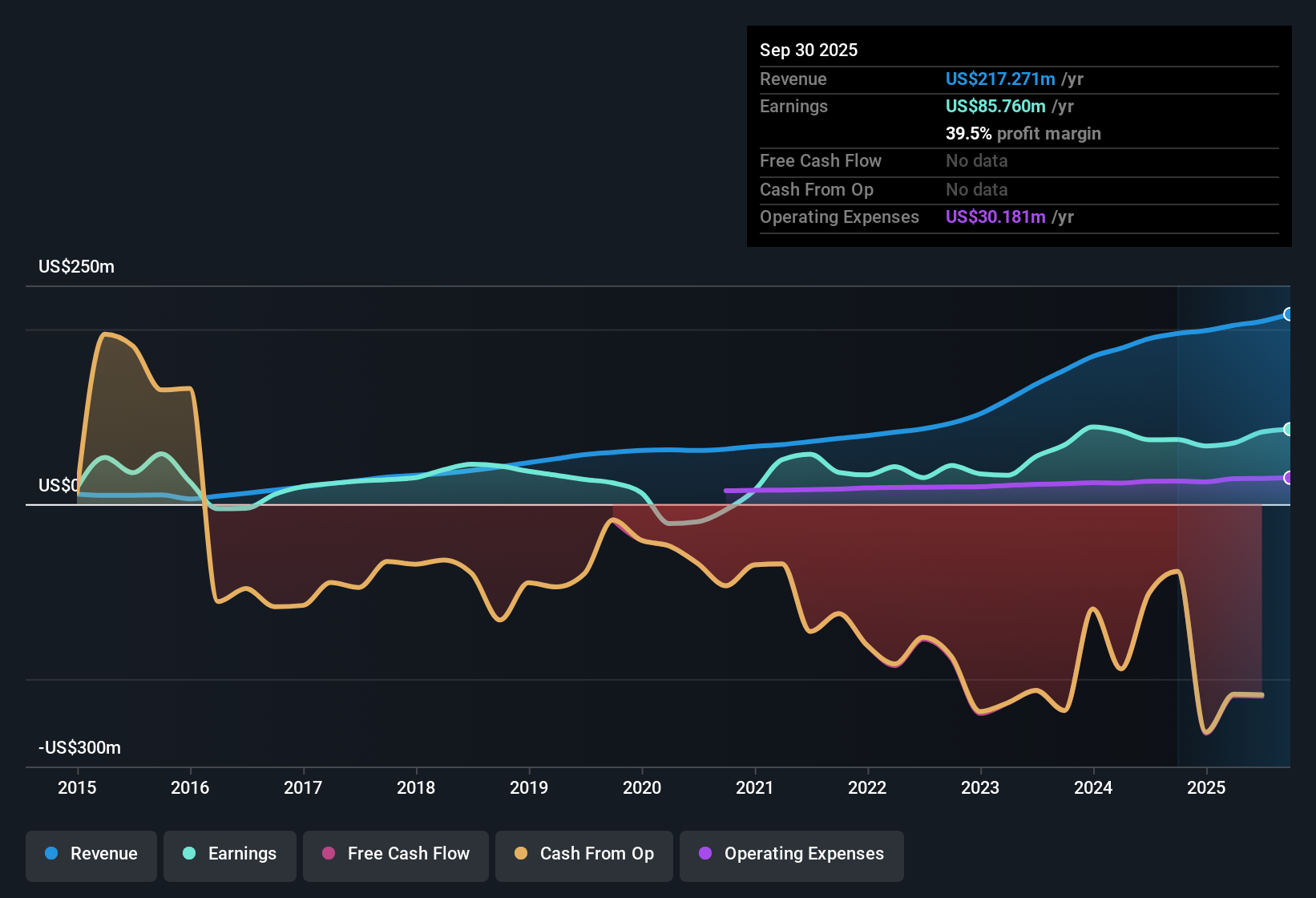

Capital Southwest (CSWC) posted net profit margins of 39.5%, up from last year’s 37.8%. The company remained profitable despite a substantial one-off loss of $35.6 million in its latest results. Over the past 5 years, earnings grew at an annual rate of 24.8%, while this year’s earnings growth slowed to 16.4%. With shares currently trading at a price-to-earnings ratio of 13x, CSWC is drawing attention from valuation-focused investors. However, the slower revenue growth and significant non-recurring loss add important context for assessing the sustainability of financial performance.

See our full analysis for Capital Southwest.Next up, we’ll see how these fresh numbers stack up against the most widely followed narratives and expectations for Capital Southwest.

See what the community is saying about Capital Southwest

Margin Expansion Gains Steam

- Net profit margins improved to 39.5%, up from 37.8% last year. This extends a multi-year trend toward higher profitability, supported by margin-expanding investments and disciplined cost controls.

- According to analysts' consensus view, robust private equity partnerships, a recently awarded second SBIC license, and further credit expansion are creating an environment where margins are expected to rise from today's level to 69.2% in just three years.

- This reinforces the view that growing deal flow and lender demand, along with flexible low-cost capital, could further accelerate sustainable margin gains unless rising competition impacts pricing power.

- Consensus narrative notes that portfolio diversification and prudent risk controls help buffer against market pressures that might otherwise limit margin improvement.

Consensus narrative highlights how margin momentum fuels optimism, but maintains a close watch on risks to sustainability. 📊 Read the full Capital Southwest Consensus Narrative.

Revenue Grows, But Lags US Market

- Annual revenue growth is forecast at 8.4% per year, which falls short of the 10.5% average for the broader US market. This suggests top-line expansion may be constrained compared to peers.

- Consensus narrative underlines how, even with slower revenue growth, Capital Southwest expects to see substantial earnings growth of 25% annually alongside positive asset expansion.

- Analysts note that private credit expansion and portfolio scaling may counterbalance slower headline growth, but warn that market share gains are essential to avoid falling further behind faster-growing competitors.

- There remains a tension between strong bottom-line prospects and the apparent ceiling on revenue momentum, highlighted by sustained competition and tight loan pricing.

Share Price Trades Below Peer Averages

- CSWC trades at a price-to-earnings ratio of 13x, notably below both the US capital markets industry average of 26.7x and its peer group, highlighting a relative valuation discount for the stock.

- Consensus narrative points out that analysts’ consensus price target is 23.58, only 18% above the latest share price of 19.97. Most view the company as fairly valued and already reflecting expected future margin and earnings growth.

- While discounted valuation metrics may attract value investors, the limited price target upside suggests the market is waiting for more evidence of sustainable growth before rerating the shares.

- This pricing gap could narrow if actual margin and earnings expansion meet or exceed consensus forecasts in the coming years. Otherwise, the stock could remain undervalued relative to peers due to ongoing concerns over revenue trajectory and risk factors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Capital Southwest on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a fresh take on these results? In just a few minutes, you can turn your perspective into a unique narrative for others to consider. Do it your way

A great starting point for your Capital Southwest research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite strong margin growth, Capital Southwest faces slower revenue expansion and limited share price upside compared to both the US market and its peers.

If you’re looking for steadier performance and consistent earnings momentum, uncover companies that deliver through every cycle by using our stable growth stocks screener (2077 results) screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives