- United States

- /

- Diversified Financial

- /

- NasdaqCM:COOP

Will David Nierenberg's Major Share Sale Shift Mr. Cooper Group's (COOP) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, David Nierenberg reduced his position in Mr. Cooper Group Inc by 169,933 shares, amounting to a 57.4% decrease in his holdings.

- This substantial move, which had a material impact on his portfolio, highlights how shifts by concentrated investors can influence broader market perceptions of a company.

- With a large investor cutting their stake, we'll explore what this development could mean for Mr. Cooper Group's investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mr. Cooper Group Investment Narrative Recap

To be a shareholder in Mr. Cooper Group, you need to believe in the company’s ability to drive operating efficiencies through digital mortgage servicing, benefit from household formation trends, and capitalize on a strong home equity base despite industry headwinds. The recent large reduction in holdings by David Nierenberg is a visible shift, but it does not materially impact the primary short-term catalyst, the anticipated synergies and revenue expansion tied to the Rocket Companies acquisition. The greatest immediate risk remains pressure on mortgage origination from affordability challenges and high interest rates, neither of which are significantly affected by this ownership change.

The finalization of Rocket Companies’ US$9.4 billion acquisition of Mr. Cooper Group is the most relevant recent development, marking a transformative event for the company and its shareholders. This transaction underpins the current investment story, providing fresh potential for cost synergies and operational scale that could offset near-term risks around home affordability or origination volume, as integration proceeds under the Rocket brand. In contrast, investors should be mindful that concentrated share sales can signal changing expectations just as competitive and rate pressures...

Read the full narrative on Mr. Cooper Group (it's free!)

Mr. Cooper Group's narrative projects $3.3 billion revenue and $1.3 billion earnings by 2028. This requires 13.4% yearly revenue growth and a $730 million earnings increase from $570 million today.

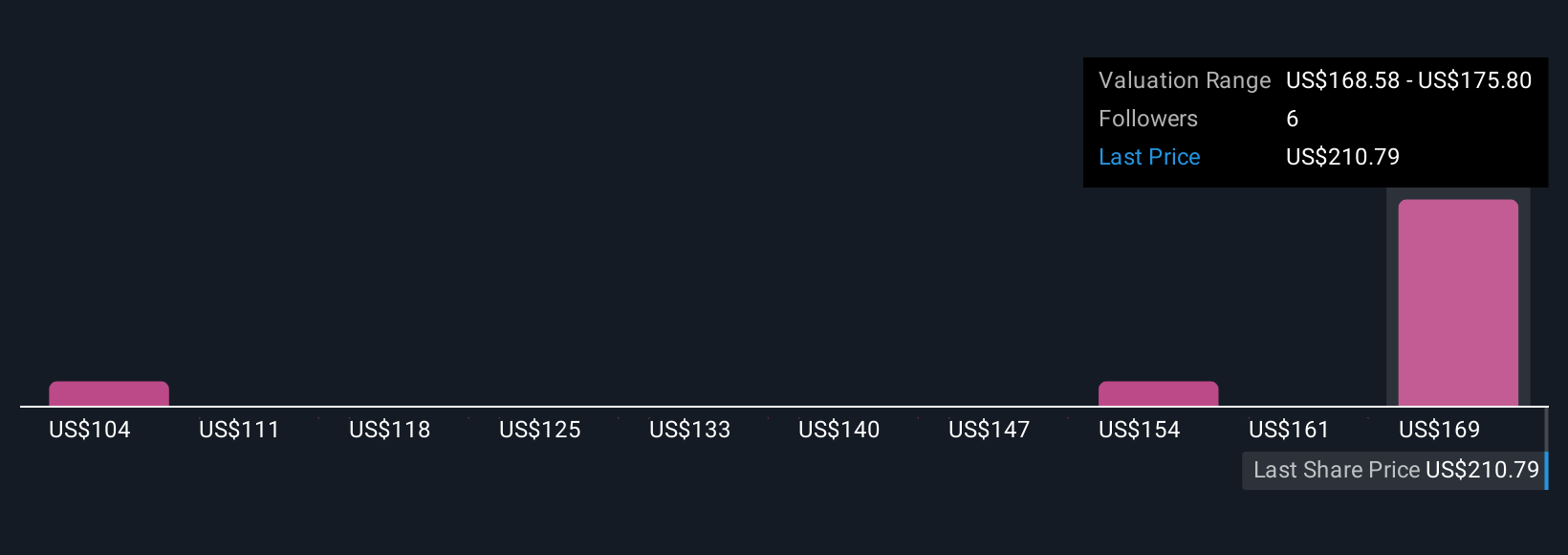

Uncover how Mr. Cooper Group's forecasts yield a $175.80 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$103.64 to US$175.80 per share. With mortgage origination and servicing volumes closely tied to market rates and affordability, it’s clear that investor views can differ widely, take a look at the full spectrum of forecasts to inform your own outlook.

Explore 3 other fair value estimates on Mr. Cooper Group - why the stock might be worth as much as $175.80!

Build Your Own Mr. Cooper Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mr. Cooper Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mr. Cooper Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mr. Cooper Group's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COOP

Mr. Cooper Group

Operates as a non-bank servicer of residential mortgage loans in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives