- United States

- /

- Diversified Financial

- /

- NasdaqCM:COOP

Reassessing Mr. Cooper Group (COOP) Valuation After Major Shareholder David Nierenberg Cuts Stake by 57%

Reviewed by Simply Wall St

Mr. Cooper Group (COOP) drew attention after investor David Nierenberg cut his position in the company by 57%, selling over 169,000 shares. Moves like this from prominent shareholders often cause investors to wonder what could come next for the stock.

See our latest analysis for Mr. Cooper Group.

It’s been quite a ride for Mr. Cooper Group this year. After a remarkable stretch, including a 15.6% 1-month share price return and an eye-popping 132.4% total shareholder return over the past 12 months, recent momentum has caught plenty of attention, even as one major investor reduces his stake. All told, the impressive long-term performance is fueling fresh debates about whether the current share price reflects optimism or simply catches up to the company's underlying value.

If this kind of rapid growth sparks your curiosity, now’s a great time to broaden your perspective and explore fast growing stocks with high insider ownership

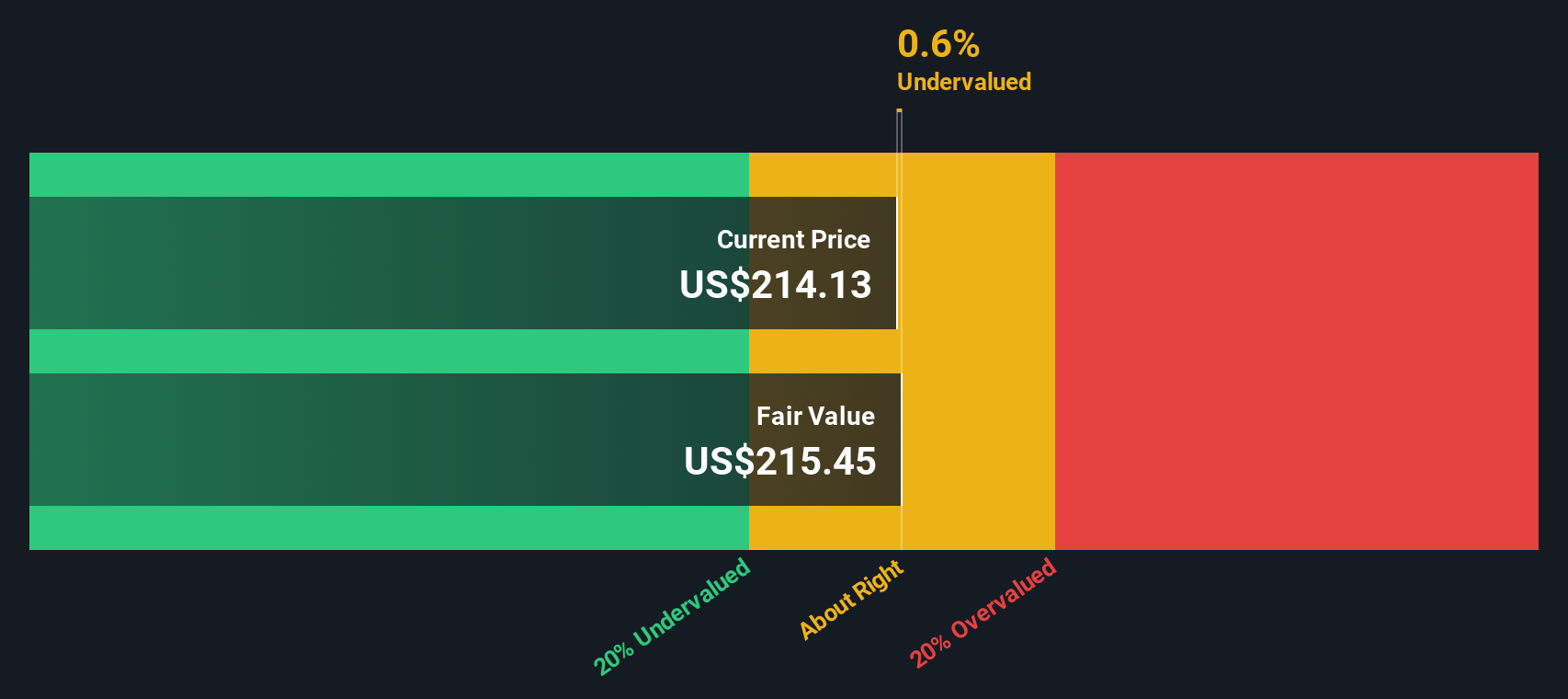

With a powerful run-up in recent months and a prominent investor stepping back, the key question now is whether Mr. Cooper Group’s shares remain undervalued, or if the market is already factoring in all the growth ahead. Is there a buying opportunity, or is future upside already priced in?

Most Popular Narrative: 19.9% Overvalued

With Mr. Cooper Group’s last close price sitting notably above the narrative’s fair value estimate, there is a clear gap to consider. Investors are now watching for what might drive the stock higher or force a reality check.

Mr. Cooper's scaled platform, combined with continued investments in AI and digital mortgage servicing tools, is resulting in dramatic operating efficiencies. Its cost to serve is now nearly 50% below the industry average and expected to improve further. This should drive sustained net margin and earnings expansion as digital adoption and scale advantages increase.

Want to know what numbers are shaping this bold fair value? The story hinges on aggressive margin improvements and game-changing revenue assumptions. Discover what else underpins this confident outlook, with further details available inside the full narrative.

Result: Fair Value of $175.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high mortgage rates and slower household formation could limit Mr. Cooper Group’s future growth. This may challenge consensus expectations for continued outperformance.

Find out about the key risks to this Mr. Cooper Group narrative.

Another View: Discounted Cash Flow Model

While analyst consensus points to a price that is already above fair value, our SWS DCF model offers a different perspective. It suggests Mr. Cooper Group may actually be undervalued, with shares trading slightly below an estimated fair value of $216.47. Valuation methods often disagree, so which approach matters more now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mr. Cooper Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mr. Cooper Group Narrative

If you think the story could unfold a different way, or prefer to dig into the numbers on your own, you can craft a personal view in minutes. Do it your way

A great starting point for your Mr. Cooper Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at one opportunity. There are countless unique stocks worth your attention. Secure your edge today by checking out what else could strengthen your portfolio before the crowd arrives.

- Spot fast-rising companies with exciting growth potential and see what makes these 3593 penny stocks with strong financials stand out among market newcomers.

- Unlock future disruptors by finding these 25 AI penny stocks driving breakthroughs in artificial intelligence and transforming entire industries.

- Harness the potential of steady cash flows and tap into exclusive value opportunities with these 879 undervalued stocks based on cash flows supported by comprehensive financial checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COOP

Mr. Cooper Group

Operates as a non-bank servicer of residential mortgage loans in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives