- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Is Coinbase (COIN) Balancing Regulation and Innovation With Its Canceled Deal and UK Savings Push?

Reviewed by Sasha Jovanovic

- Coinbase Global and stablecoin infrastructure startup BVNK have called off their planned US$2 billion acquisition, according to Fortune, after it entered the due diligence stage in October; the deal’s termination reason was not immediately disclosed and came as Coinbase launched an interest-bearing savings account in the UK offering 3.75% annual interest, powered by ClearBank and covered by the country’s deposit protection scheme.

- The simultaneous cancellation of a major acquisition and the launch of a traditional financial product highlight Coinbase’s dual focus on expanding its core crypto services while building out regulated, mainstream offerings abroad.

- We’ll examine how Coinbase’s move into UK savings accounts could reshape its growth prospects beyond volatile crypto trading.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Coinbase Global Investment Narrative Recap

To consider Coinbase Global as an investment, you must believe in the long-term shift of financial assets onto blockchain platforms, with Coinbase leveraging its regulatory compliance and institutional reach. The cancelled US$2 billion BVNK deal is not expected to materially impact the biggest near-term catalyst: new revenue streams from global products like the UK interest-bearing account. However, the core risk, a prolonged crypto market downturn causing sustained declines in trading volumes, remains front and center.

Among recent announcements, Coinbase’s UK savings account launch stands out for its relevance. By offering a 3.75% annual yield and deposit protections, Coinbase is aiming to diversify beyond volatile transaction revenues, which aligns directly with investor hopes for more predictable, recurring earnings. These early global moves could help offset crypto market swings, but also highlight the challenge of achieving sustainable, non-trading income in practice.

By contrast, investors should be aware that if trading volumes remain subdued for an extended period, revenue and earnings could be pressured as...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global's narrative projects $8.5 billion in revenue and $2.1 billion in earnings by 2028. This requires 8.3% yearly revenue growth and a $0.8 billion decrease in earnings from $2.9 billion today.

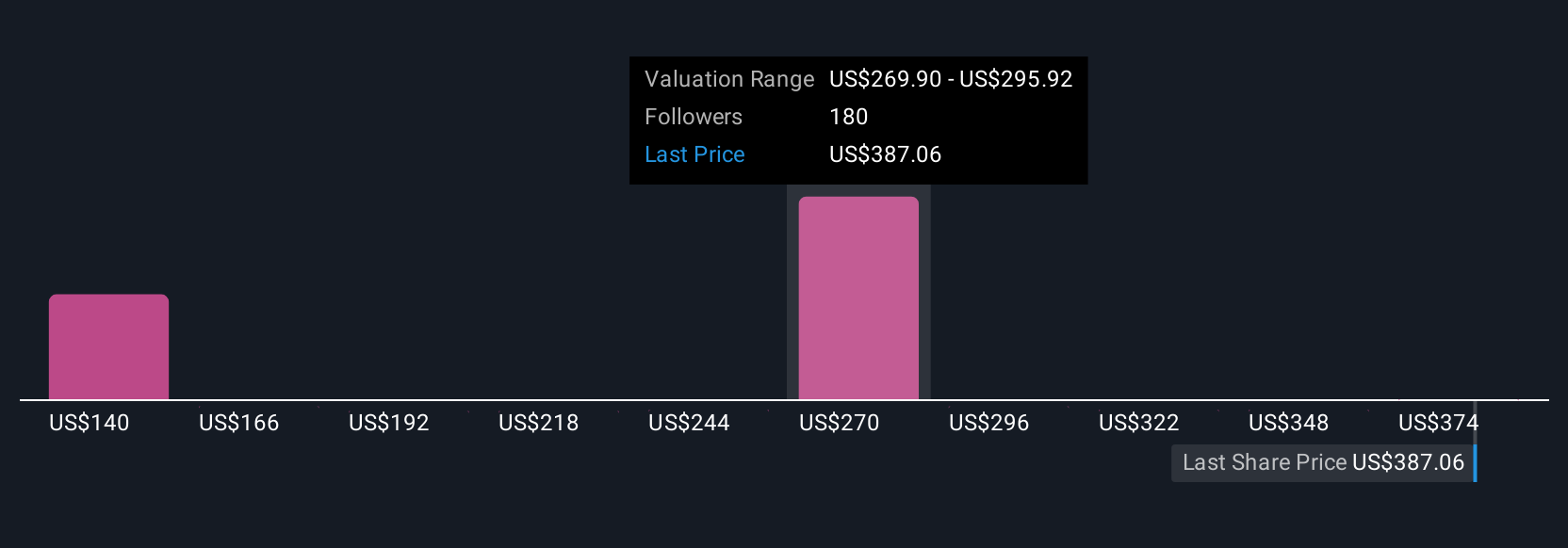

Uncover how Coinbase Global's forecasts yield a $385.27 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set Coinbase’s fair value anywhere from US$137,600 to US$510,000 across 28 estimates. With trading volume risks still top of mind, it is worth seeing how different views stack up on the company’s future trajectory.

Explore 28 other fair value estimates on Coinbase Global - why the stock might be worth 47% less than the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives