- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

How Coinbase’s Valuation Stacks Up After Bitcoin ETF Headlines and 594% Three-Year Surge

Reviewed by Bailey Pemberton

- Curious if Coinbase Global is still a buy after all the recent volatility? Let’s break down what really matters when it comes to the company’s value.

- Coinbase shares have given investors a wild ride, soaring over 594% in three years, sliding 8.4% last week, and still holding onto a year-to-date gain of 24.1%. This pattern shows both big potential and higher perceived risk.

- Much of this price action has been tied to headlines around spot bitcoin ETF approvals, regulatory crackdowns on crypto, and shifting sentiment for digital asset platforms. The combination of regulatory news and growing institutional interest has kept Coinbase front and center in market discussions.

- If you’re tracking value, Coinbase Global scores just 1 out of 6 on key undervaluation checks. Let’s explore which valuation methods paint the clearest picture, and keep an eye out for a smarter way to look at value later in the article.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

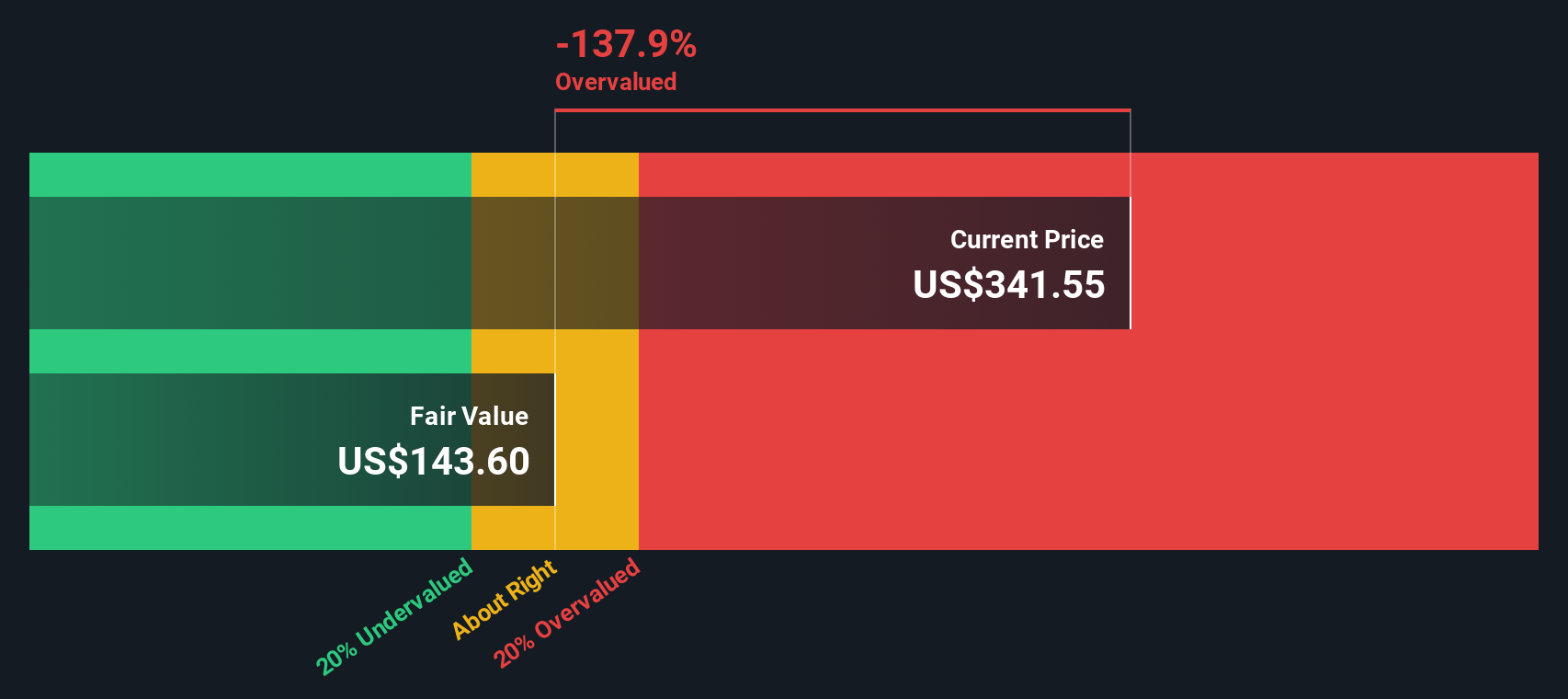

The Excess Returns model estimates the value of a company based on how effectively it generates returns above its cost of equity. This approach closely examines what Coinbase Global earns for every dollar invested compared to the actual cost of providing shareholders with those returns.

For Coinbase Global, the data shows a book value of $59.62 per share and a stable earnings per share (EPS) of $8.90, which is sourced from the weighted future Return on Equity estimates by seven analysts. The company's cost of equity is $4.87 per share, while its excess return is $4.03 per share. Notably, Coinbase averages a Return on Equity of 15.00%, suggesting efficient use of its shareholders' capital. Analysts estimate a stable book value of $59.36 per share for the company in the future.

Based on this analysis, the calculated intrinsic value is $137.94 per share. However, Coinbase currently trades 131.5% above this estimate, which suggests that the stock is overvalued according to the Excess Returns model.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 131.5%. Discover 850 undervalued stocks or create your own screener to find better value opportunities.

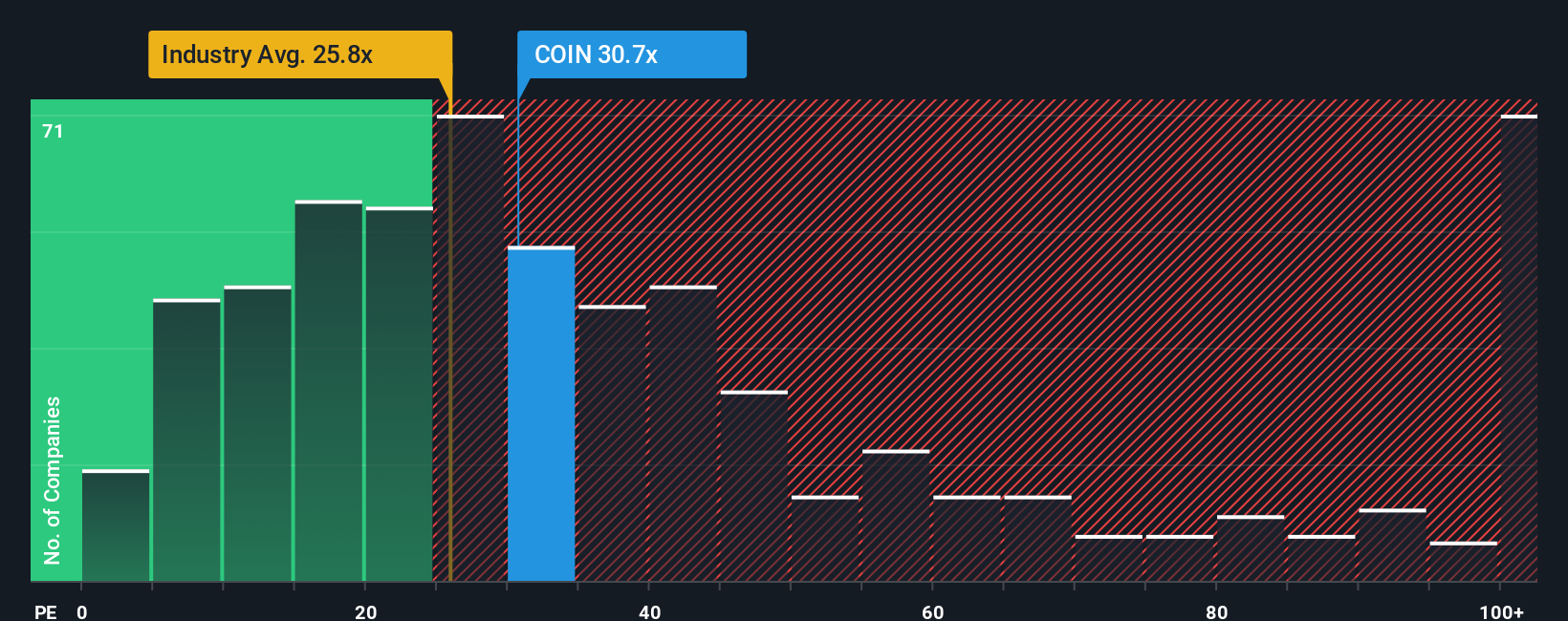

Approach 2: Coinbase Global Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Coinbase Global because it directly links a company’s stock price to its actual earnings performance. It offers investors a quick way to gauge how much they are paying for each dollar of earnings, making it especially relevant for established companies with consistent profits.

It is important to recognize that a “normal” or “fair” PE ratio is not fixed. Expectations for future growth, the predictability of those earnings, and potential business risks all play a role. A higher PE might be justified if investors expect rapid growth or believe the company is relatively safe compared to its peers. Lower growth prospects or higher risks usually lead to a lower ratio.

Currently, Coinbase trades at a PE ratio of 26.8x. When compared to the Capital Markets industry average of 23.8x and a peer average of 31.7x, Coinbase is somewhat in the middle, suggesting that the market does not see it as the most expensive or the cheapest among its peers.

Simply Wall St's proprietary “Fair Ratio” helps cut through the noise by factoring in not just industry norms, but also Coinbase’s specific growth outlook, profitability, market size, and risk profile. This approach is more nuanced than a simple peer or industry comparison because it takes into account the unique drivers and challenges facing Coinbase right now.

Coinbase’s fair PE ratio is calculated at 20.3x, meaning the current market PE is notably higher than what would be justified by its fundamentals using this metric. This makes Coinbase look overvalued when considering its growth prospects and risk, as reflected by Simply Wall St’s Fair Ratio analysis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

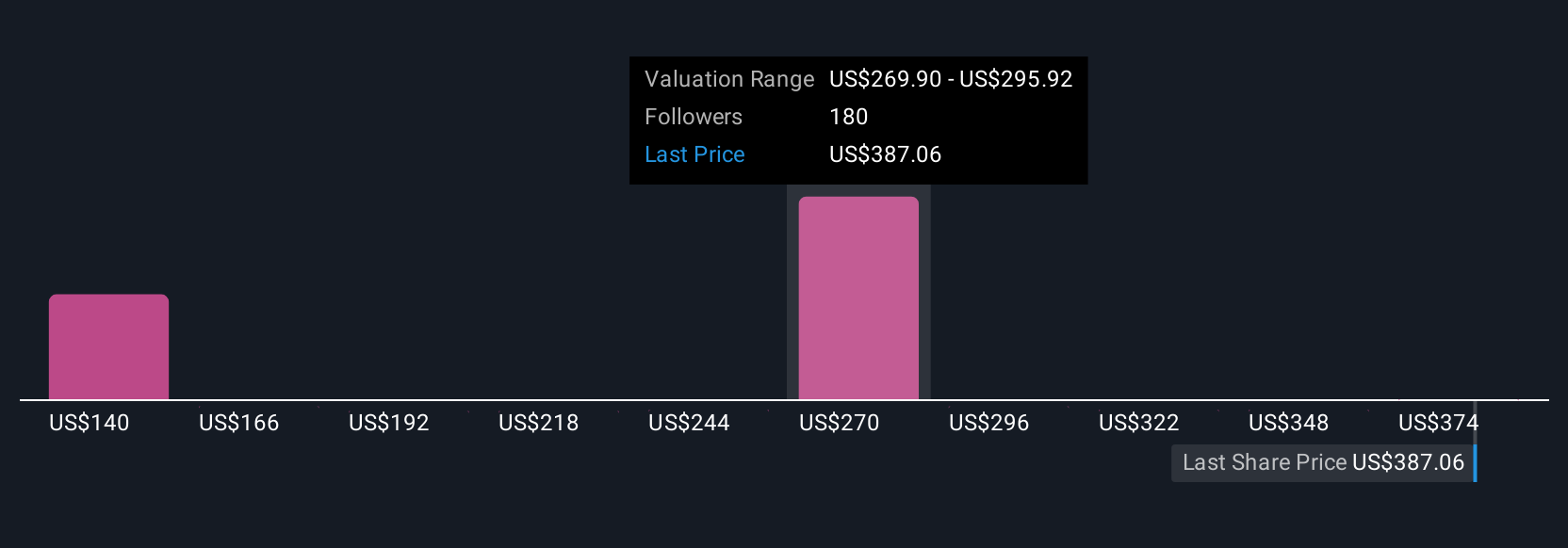

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, user-created story that explains your personal perspective on a company. It shows why you think a business like Coinbase Global might succeed or struggle, told through the lens of your key financial assumptions such as estimates for future revenue, profit margins, and fair value.

Unlike traditional models or ratios, Narratives connect the company’s story, your forecast for its financial future, and the price you would pay. This makes your investment rationale both clear and actionable. On Simply Wall St’s Community page, you’ll find millions of investors using Narratives to share their viewpoints. These tools allow you to see at a glance whether your fair value lines up with the current market price, helping you decide when to buy or sell with more confidence.

What makes Narratives especially powerful is that they update automatically when new earnings, news, or figures emerge. This ensures your perspective evolves with the company’s reality. For example, while one investor might focus their Narrative on Coinbase’s expanding institutional partnerships and forecast a fair value of $510, another could see regulatory risks and narrowing profit margins, arriving at a fair value of $185. Both are valid stories that guide unique investment decisions.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives