- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN) Profit Margin Beat Reinforces Bullish Narratives, But Outlook Flags Rising Risk

Reviewed by Simply Wall St

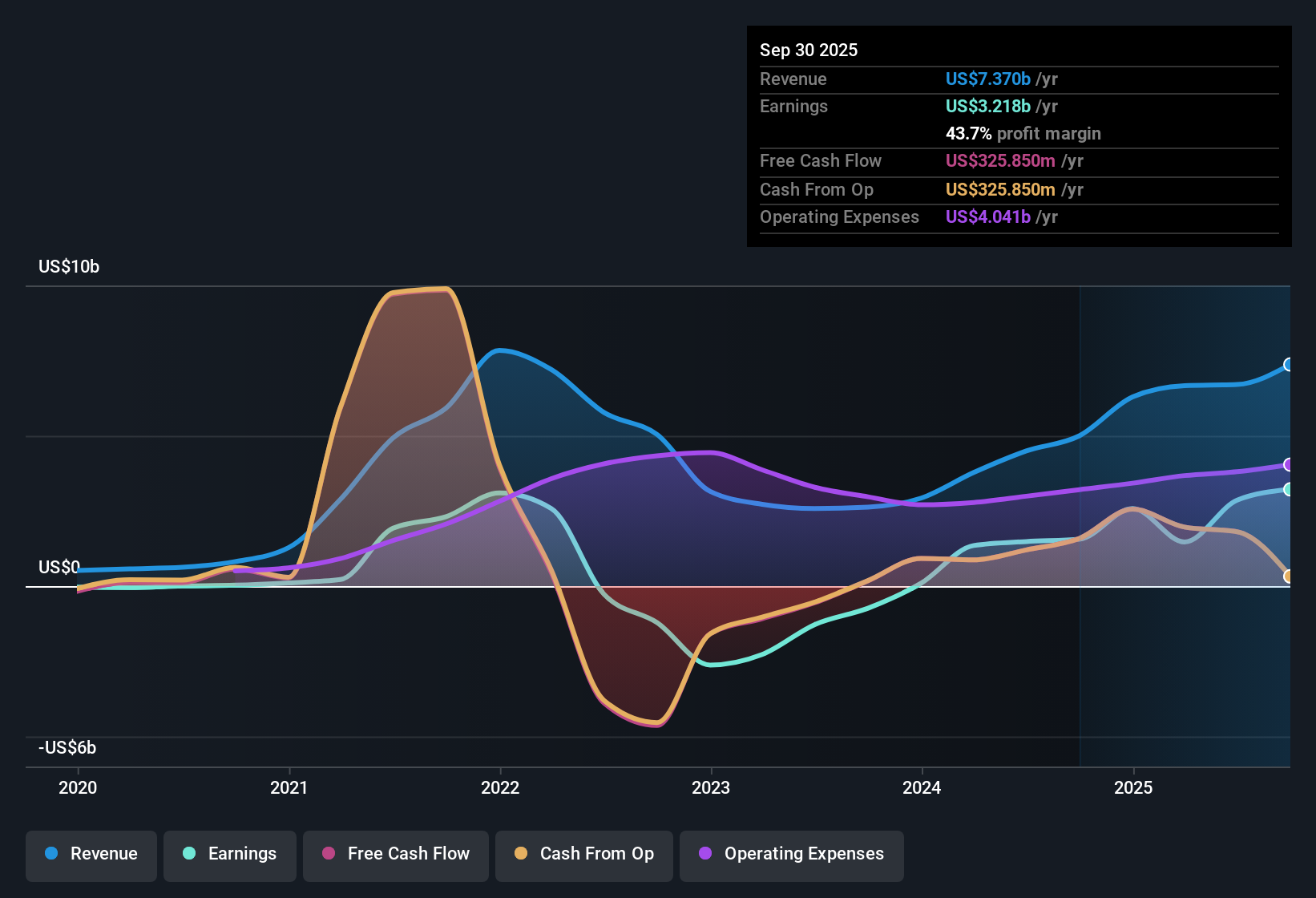

Coinbase Global (COIN) posted net profit margins of 42.4%, up from 31.2% last year, with five-year annual earnings growth running at 18.7%. Over the most recent year, earnings soared 106.2%, which is a surge well above the company’s long-term pace. Revenue is expected to grow at 7.4% per year, trailing the broader US market’s 10.4% forecast. While historical profitability remains a highlight, consensus points to earnings declining by 6.8% annually in the next three years, setting a cautious tone for the outlook.

See our full analysis for Coinbase Global.Now, let’s see how these headline figures stack up against the market’s narrative. Some expectations will be reinforced, and a few might get challenged.

See what the community is saying about Coinbase Global

Margins Expected to Compress Sharply

- Profit margins are forecast to shrink from 42.7% today to 24.3% in three years, a drop of nearly 20 percentage points that signals a significant challenge for long-term profitability.

- Analysts' consensus view emphasizes that while rising global adoption of blockchain rails could power recurring and higher-margin services, the heavy reliance on trading means profit margins remain highly vulnerable.

- Integration of decentralized exchanges and perpetual derivatives could give access to new revenue streams. However, ongoing fee competition and the risk that trading volumes stay subdued could lead to lasting margin compression.

- Even with focus on subscription and services, trading remains the main driver. This suggests consensus sees potential margin improvement only if diversification efforts deliver quickly and at scale.

- Consensus sees shrinking margins as a litmus test for Coinbase’s next era. Is this the turning point, or just a step on its bigger platform ambitions? 📊 Read the full Coinbase Global Consensus Narrative.

Valuation Gap Raises Debate

- Coinbase currently trades at $343.78, far above its DCF fair value of $140.60, yet short of the new analyst price target of $382.56, underscoring sharply divergent views on its future upside.

- Analysts' consensus narrative calls out this mismatch, noting that for the price target to be met by 2028, investors would need to believe in $8.5 billion revenues and $2.1 billion earnings at a lofty 62.1x PE ratio.

- The share price premium over DCF fair value highlights how investors weigh near-term growth catalysts and industry positioning over current bottom-line fundamentals.

- Disagreement among analysts is stark, with the widest range stretching from $185 to $510. This reflects deep splits about the durability of revenue streams and the sustainability of valuation multiples.

Trading Activity Still Central to Growth

- Coinbase reported a 40% drop in total trading volumes, with consumer spot trading revenue down 41% and institutional trading revenue off 38%. This underlines heavy cyclicality in its primary business stream.

- According to the analysts' consensus narrative, expansion into subscription and blockchain-based payment rails is pivotal. However, with so much of current profitability coming from trading, any prolonged downturn in volume would make diversification all the more critical.

- Bears argue that declining trading activity threatens revenue predictability and exposes the company to sharper swings in earnings. Management hopes to offset this by ramping newer business lines.

- Consensus holds that Coinbase’s future will ultimately be shaped by whether stability from services and subscriptions can meaningfully blunt the volatility inherent in transaction-driven revenues.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Coinbase Global on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Share your viewpoint and shape your own story in just a few minutes by clicking here: Do it your way

A great starting point for your Coinbase Global research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Coinbase faces shrinking profit margins, uncertain earnings growth, and volatility driven by trading activity. These factors make its long-term trajectory less predictable than many would like.

If you’d prefer stocks with pricing more in line with their fundamentals, check out these 832 undervalued stocks based on cash flows that may offer stronger value for your portfolio right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives