- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase (COIN): Exploring the Valuation Case After Volatile Recent Share Movements

Reviewed by Simply Wall St

Coinbase Global (COIN) has seen its stock make some interesting moves recently, catching the eye of investors after a mixed performance over the past month. With crypto markets in flux, the company’s valuation continues to spark debate among market watchers.

See our latest analysis for Coinbase Global.

While Coinbase’s 1-day share price return of 6.47% caught attention, the stock has still retreated nearly 28% over the past month and is down fractionally year-to-date. However, its 3-year total shareholder return sits above 500%, which highlights how much long-term momentum remains despite current volatility.

If crypto’s volatility has you curious, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still well below analyst targets and recent volatility fresh on investors’ minds, the real question remains: does Coinbase Global offer genuine value at current levels, or is the market already accounting for all potential upside?

Most Popular Narrative: 33.6% Undervalued

Compared to the last closing price of $255.97, the most widely followed narrative assigns a fair value of $385.27. This sets expectations for significant upside if the narrative’s big-picture thesis plays out.

The company’s leadership in building trusted, compliant infrastructure has resulted in partnerships with major financial institutions (e.g., BlackRock, PNC, JPMorgan, Stripe, Shopify). This positions Coinbase as the preferred onramp for institutions entering the digital asset space and is likely to drive institutional trading volumes and custody revenues higher over time.

What’s fueling this high target? This narrative leans heavily on future revenue growth and margins tied to Coinbase’s biggest banking and blockchain bets. The most surprising element is bold profit forecasts built on scaling new lines of business and future products. Find out how these numbers stack up to see what else is behind the calculations.

Result: Fair Value of $385.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in trading volumes and mounting cybersecurity costs could quickly challenge assumptions about Coinbase's long-term growth and profit potential.

Find out about the key risks to this Coinbase Global narrative.

Another View: How Do Market Multiples Stack Up?

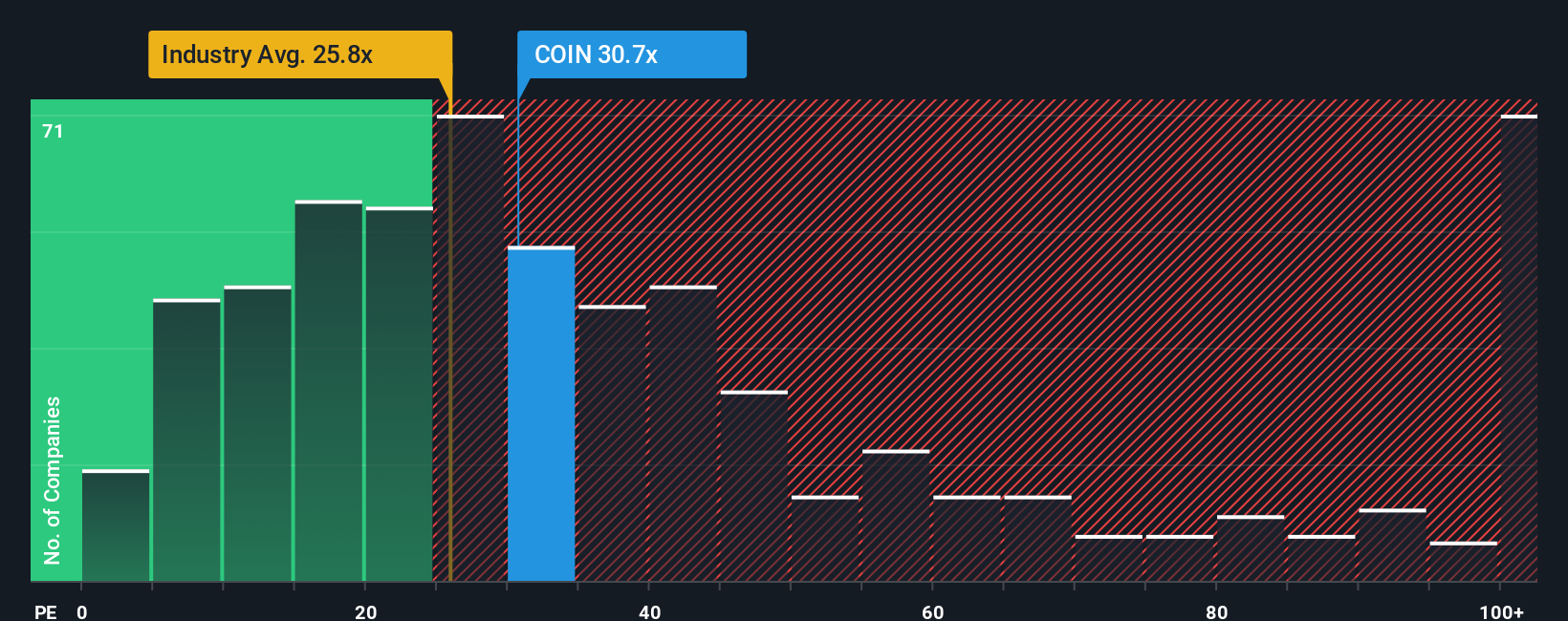

Looking at Coinbase Global from the lens of price-to-earnings, the story gets more complicated. The company trades at 21.5x earnings, which is lower than the peer average of 32.7x and the industry average of 23.6x. However, it still sits above its fair ratio of 19.6x. In plain terms, Coinbase might look attractive relative to competitors, but the market could gravitate toward that lower fair ratio if risks materialize. Is this a value trap, or just misunderstood opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coinbase Global Narrative

If you see things differently or prefer hands-on investigation, it's easy to dive into the data and craft your own perspective in just minutes. Do it your way

A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities. Uncover winning stocks and diversified strategies designed to fit every portfolio. These carefully selected screens let you spot trends ahead of the crowd.

- Capture regular income streams by tapping into these 14 dividend stocks with yields > 3% to spot companies with consistently strong yields above 3%.

- Seize the innovation edge with these 26 AI penny stocks, which focus on the biggest shifts in artificial intelligence and automation.

- Fuel your growth ambitions by jumping on these 924 undervalued stocks based on cash flows, bringing fresh cash flow bargains straight to your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success