- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Record Trading Volumes and Dividend Hike Might Change the Case for Investing in CME Group (CME)

Reviewed by Sasha Jovanovic

- On November 6, 2025, CME Group declared a fourth-quarter dividend of US$1.25 per share, payable on December 30 to shareholders of record as of December 12.

- This announcement came as CME Group reported record October average daily trading volumes, especially driven by very large gains in metals and cryptocurrency trading.

- We’ll explore how the surge in trading activity, particularly in metals and crypto, could influence CME Group’s broader investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CME Group Investment Narrative Recap

To be a shareholder in CME Group, it's important to believe in the enduring global demand for risk management solutions and the company's role as a leading derivatives marketplace. The recent record trading volumes in metals and cryptocurrencies add to the short-term momentum and support the main catalyst for growth, increased product engagement and global participation. However, while the dividend news confirms shareholder returns, it does not materially change the primary risk that periods of low volatility could dampen future trading activity.

Among the latest announcements, CME Group's move to expand trading hours for cryptocurrency products to 24/7 in early 2026 is particularly relevant. This development ties directly to the volume surge in crypto products seen in October, highlighting CME's willingness to capture new user segments and capitalize on evolving market trends tied to increased retail and institutional engagement.

On the other hand, investors should be aware that a significant decrease in market volatility could mean...

Read the full narrative on CME Group (it's free!)

CME Group's outlook anticipates $7.3 billion in revenue and $4.3 billion in earnings by 2028. This projection depends on a 4.4% annual revenue growth rate and an increase in earnings of $0.6 billion from the current $3.7 billion.

Uncover how CME Group's forecasts yield a $282.11 fair value, in line with its current price.

Exploring Other Perspectives

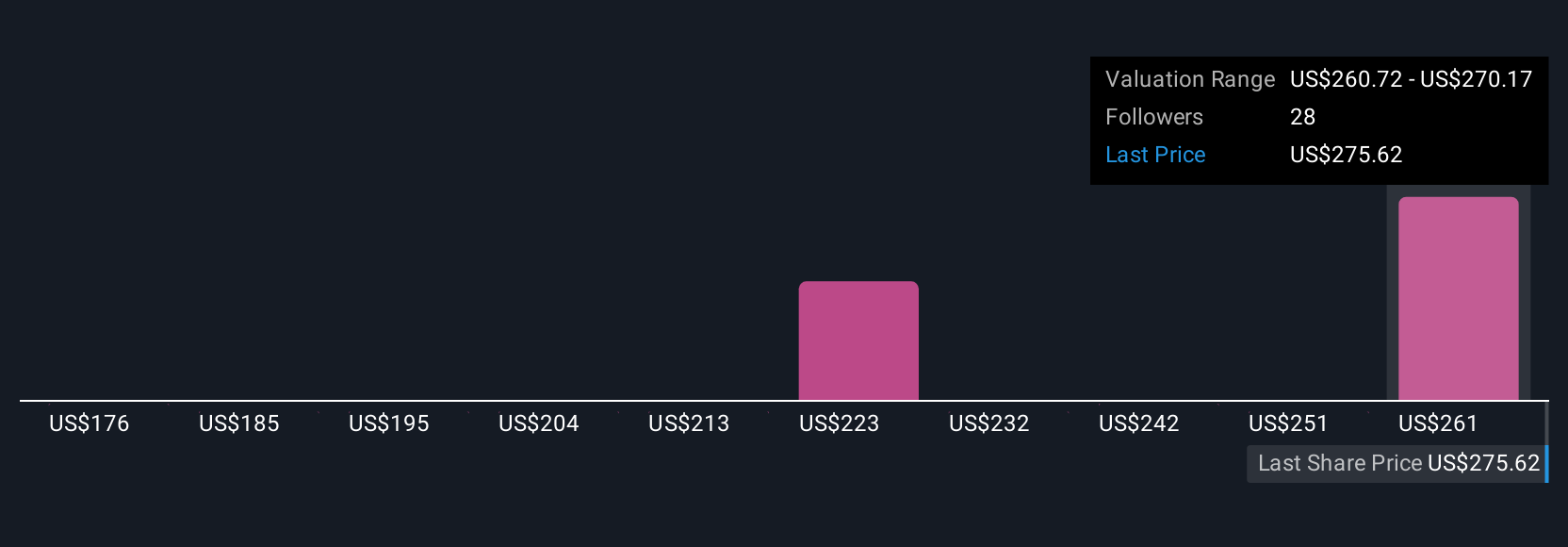

Four members of the Simply Wall St Community see CME Group's fair value ranging from US$193.99 to US$282.11 per share. With trading volumes hitting records, your assumptions about future global market volatility could shape very different outlooks, explore a range of perspectives before making any decisions.

Explore 4 other fair value estimates on CME Group - why the stock might be worth 30% less than the current price!

Build Your Own CME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CME Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CME Group's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives