- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Does Affirm’s Recent 14.6% Drop Signal a Chance for Fintech Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Affirm Holdings is a hidden gem or just another hype stock? If you’re curious about whether now is the right time to consider it, you’re in good company.

- Affirm’s share price has seen a choppy ride lately, dipping 8.7% in the past week and 14.6% over the last month, though it has still managed a modest 3.0% gain year-to-date.

- Market buzz lately has focused on broad fintech sentiment and shifts in consumer credit trends, which has put companies like Affirm in the spotlight. Investors are watching for updates to the company’s merchant partnerships and credit risk strategies amid a highly competitive lending landscape.

- When you look at the numbers, Affirm scores just 0 out of 6 on our core valuation checks, so traditional metrics suggest caution. However, as you will see, there is more to the story than these scores alone, and we will wrap up with an approach that could help you spot valuation opportunities others miss.

Affirm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

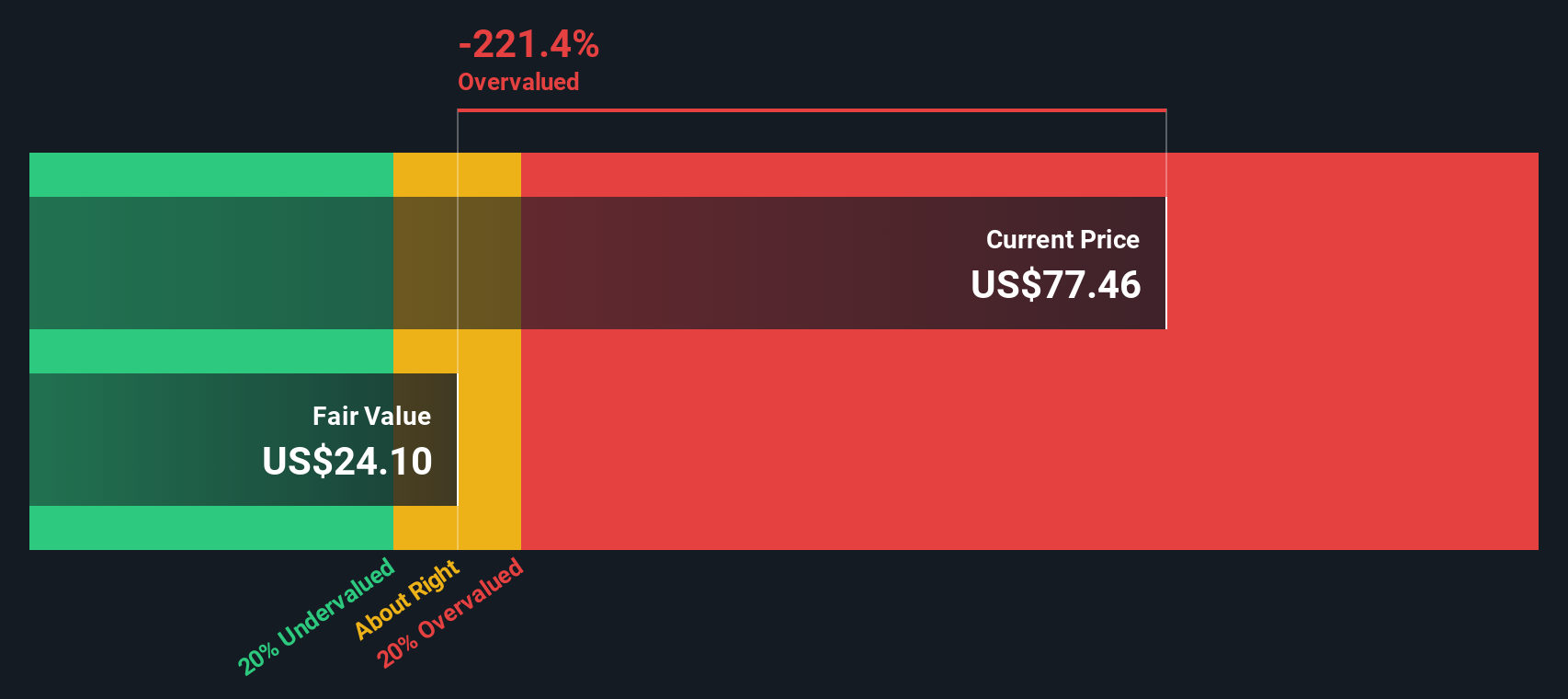

Approach 1: Affirm Holdings Excess Returns Analysis

The Excess Returns valuation method focuses on how much profit a company generates above what investors could expect from a typical level of risk. Rather than assuming all companies are equal, it looks at whether Affirm is earning more on its investments than it costs to raise capital. This model rests on key numbers: Affirm’s average return on equity is 14.26%, with a cost of equity at $1.10 per share, leading to an excess return of $0.85 per share. The company’s book value stands at $10.00 per share and is projected to grow to a stable $13.72 per share in future years. Analysts estimate a stable EPS of $1.96 per share, based on consensus from seven estimates.

When all of these inputs are factored in, the Excess Returns model suggests Affirm’s intrinsic value is $31.54 per share. This implies the current share price is 104.1% above what the company’s economic fundamentals justify. In short, while Affirm shows some financial strength, this method indicates the stock is significantly overvalued at current levels.

Result: OVERVALUED

Our Excess Returns analysis suggests Affirm Holdings may be overvalued by 104.1%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

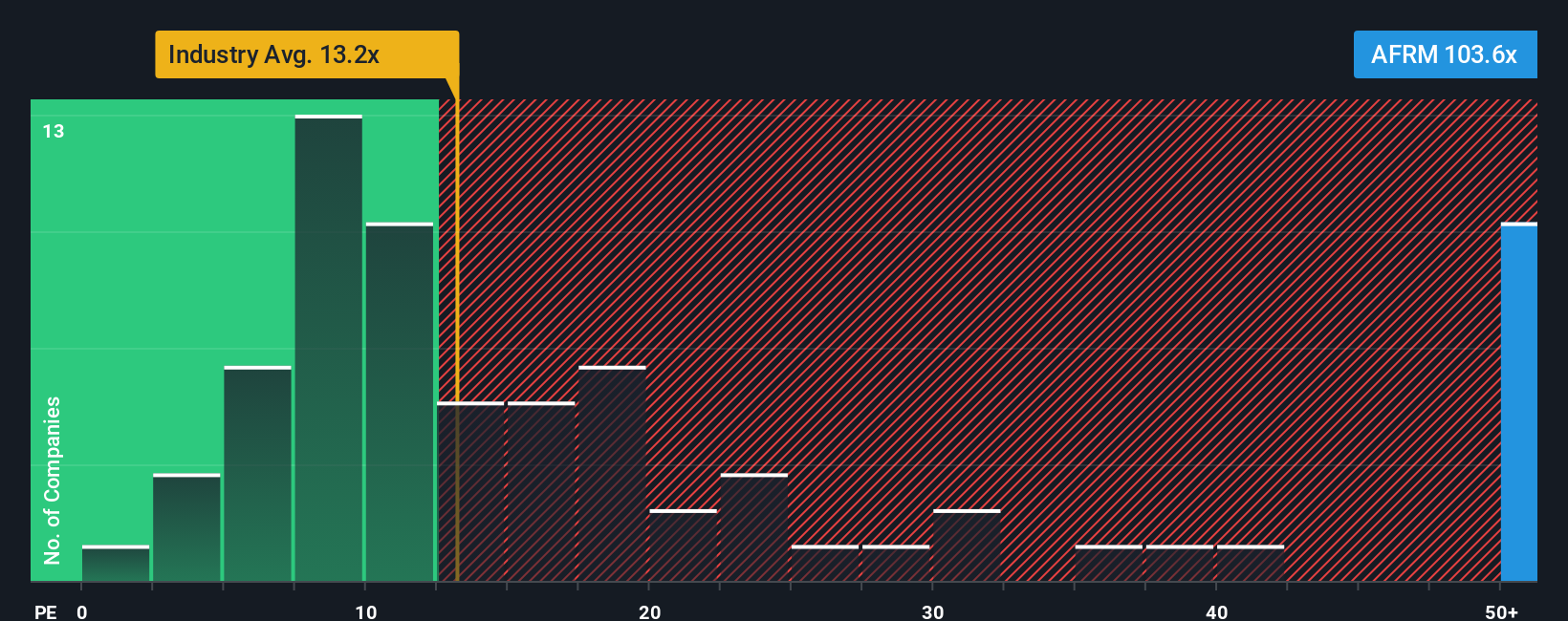

Approach 2: Affirm Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies like Affirm Holdings, as it directly links a company’s share price to its earnings. This ratio serves as a quick snapshot of how much investors are willing to pay for each dollar of earnings. It is a useful tool for comparing companies within the same industry or against the broader market.

What makes a “normal” or “fair” PE ratio is shaped by growth prospects and risk. In general, companies with strong expected earnings growth and lower risk can justify higher PE ratios, while companies with uncertain outlooks typically attract lower multiples. For Affirm, the current PE ratio stands at 91.16x, which is markedly higher than the Diversified Financial industry average of 13.15x and its listed peer average of 28.01x.

To get a clearer perspective, Simply Wall St calculates a “Fair Ratio” of 29.49x for Affirm. This incorporates factors like the company’s earnings growth potential, profit margins, risk profile, industry trends, and market capitalization. This Fair Ratio may be more relevant than simple peer or industry comparisons because it considers the unique characteristics and future prospects of Affirm itself, rather than relying solely on the scores of its competitors.

Since Affirm’s actual PE ratio is substantially higher than both its peer average and the Fair Ratio, the stock appears overvalued using this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affirm Holdings Narrative

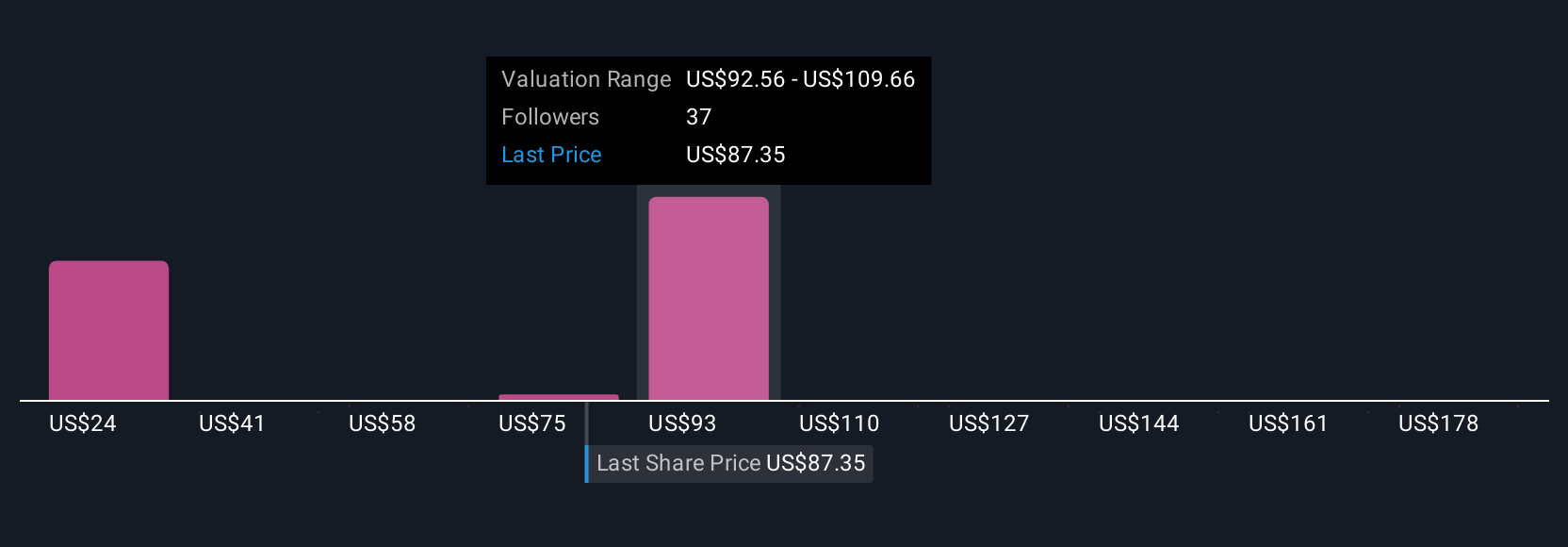

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, accessible way to connect your personal view of a company’s story and prospects with the financial forecasts and the fair value those forecasts imply. This approach allows you to see not just what a stock is worth, but why.

Simply Wall St’s Narratives tool lets you build and follow these stories directly on the Affirm Holdings Community page, just like millions of other investors do. Narratives link your assumptions about future revenue growth, margins, and risks to a specific fair value. This helps you visualize how your expectations (and those of other investors) compare to the current market price, making it much easier to decide whether to buy or sell based on your own logic, not just market chatter.

As new data comes in, such as earnings results, news events, or analyst updates, these Narratives are updated in real time so your investment perspective can keep pace with the latest developments. For example, some investors may build a Narrative for Affirm forecasting high international growth and margin expansion, leading to a bullish fair value above $115 per share. Others may see tough competition and margin pressure limiting upside, so their Narrative and fair value land closer to $64.

With Narratives, you get a dynamic and transparent decision-making framework that puts your perspective at the center of the investment process.

Do you think there's more to the story for Affirm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives