- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm’s Return to Profit and New Funding Deal Could Be a Game Changer for Affirm Holdings (AFRM)

Reviewed by Sasha Jovanovic

- Affirm Holdings reported first quarter earnings for the period ended September 30, 2025, showing sales of US$439.53 million and revenue of US$933.34 million, with net income reaching US$80.69 million compared to a net loss in the prior year.

- In addition to the earnings report, Affirm expanded its partnership with New York Life, which agreed to purchase up to US$750 million in installment loans, securing funding to support US$1.75 billion in annual loan volume through 2026.

- We’ll examine how Affirm’s shift to profitability and strengthened funding from New York Life may impact its investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Affirm Holdings Investment Narrative Recap

To be a shareholder in Affirm Holdings, you need to believe in the long-term profitability of the buy now, pay later model and Affirm’s ability to widen its merchant and user base faster than competitors. The latest results, marked by Affirm’s first profitable quarter and a strengthened funding deal with New York Life, directly boost its most important near-term catalyst: maintaining robust loan volume through the coming holiday season. The biggest risk remains losing a key enterprise partner, but this outcome does not appear materially affected by the recent news.

The expanded funding partnership with New York Life stands out among recent announcements. Additional loan purchasing capacity should reinforce Affirm’s ability to sustain origination growth and support merchant partnerships, especially important at a time when broader funding and credit market conditions can constrain growth for consumer lenders.

However, despite Affirm’s progress, investors should still consider the implications if a large enterprise merchant partnership comes to an end…

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' narrative projects $6.0 billion revenue and $756.6 million earnings by 2028. This requires 22.9% yearly revenue growth and a $704.4 million increase in earnings from $52.2 million currently.

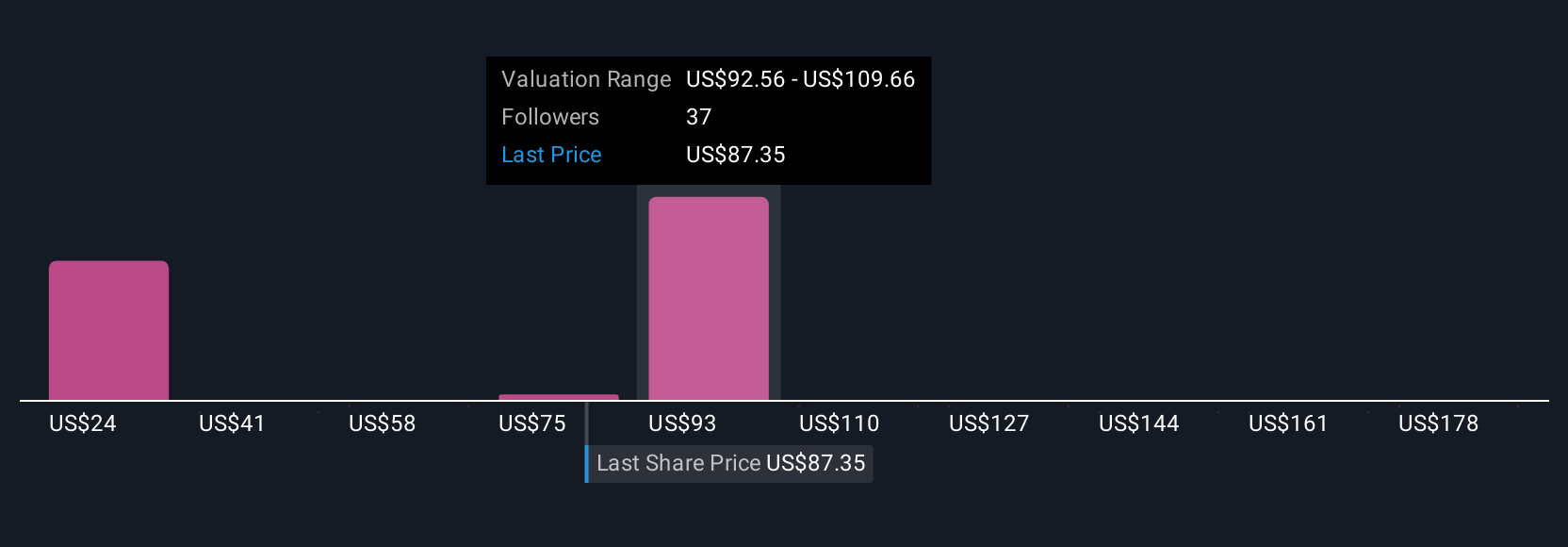

Uncover how Affirm Holdings' forecasts yield a $96.14 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared 18 individual fair value estimates for Affirm ranging from US$25.09 to US$140 per share. This wide dispersion of views reflects how Affirm’s funding access and rapid merchant adoption can encourage sharp differences in outlook, underscoring the need to weigh several perspectives before deciding whether to invest.

Explore 18 other fair value estimates on Affirm Holdings - why the stock might be worth as much as 90% more than the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives