- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM) Valuation in Focus as New Retail and Healthcare Partnerships Expand Growth Potential

Reviewed by Kshitija Bhandaru

Affirm Holdings (AFRM) is making headlines after securing two major partnerships. The company is teaming up with Ace Hardware to offer buy now, pay later in-store and expanding into healthcare financing with BoomerangFX. Both deals substantially widen Affirm’s offline presence and sector reach.

See our latest analysis for Affirm Holdings.

Affirm's recent string of partnerships has caught the market’s attention, resulting in a notable boost to its momentum. While the share price has seen some volatility, a 1-year total shareholder return of 90% shows sustained confidence in the business, especially as the company pushes further into offline retail and healthcare finance.

If Affirm’s expansion has you thinking about where the next growth stories might come from, now is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading more than 25% below consensus price targets, and recent partnerships opening new verticals, it begs the question: is the market undervaluing Affirm’s prospects, or has future growth already been priced in?

Most Popular Narrative: 21% Undervalued

Affirm’s most followed narrative points to a fair value solidly higher than the recent close, suggesting significant upside if the projection holds. The gap between analysts’ projected future and current reality draws attention to the core catalysts driving this optimism.

Rapid growth and strong engagement with Affirm Card, an actively invested product moving toward high attach rates and greater offline usage, expands Affirm's addressable market beyond online retail. This diversifies revenue streams and drives higher frequency of transactions, which should accelerate GMV and contribute to margin improvement.

Curious about the numbers behind this call? The entire foundation rests on analysts’ bold projections for revenue growth and future profit margins. Uncover the calculation where big bets on scaling, expanding markets, and rising returns create a fair value that could surprise even seasoned investors. Want to see which quantified milestones underpin this aggressive target? The narrative reveals all.

Result: Fair Value of $95.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with strong growth, the loss of a major merchant or intensifying BNPL competition could threaten Affirm’s revenue trajectory and valuation outlook.

Find out about the key risks to this Affirm Holdings narrative.

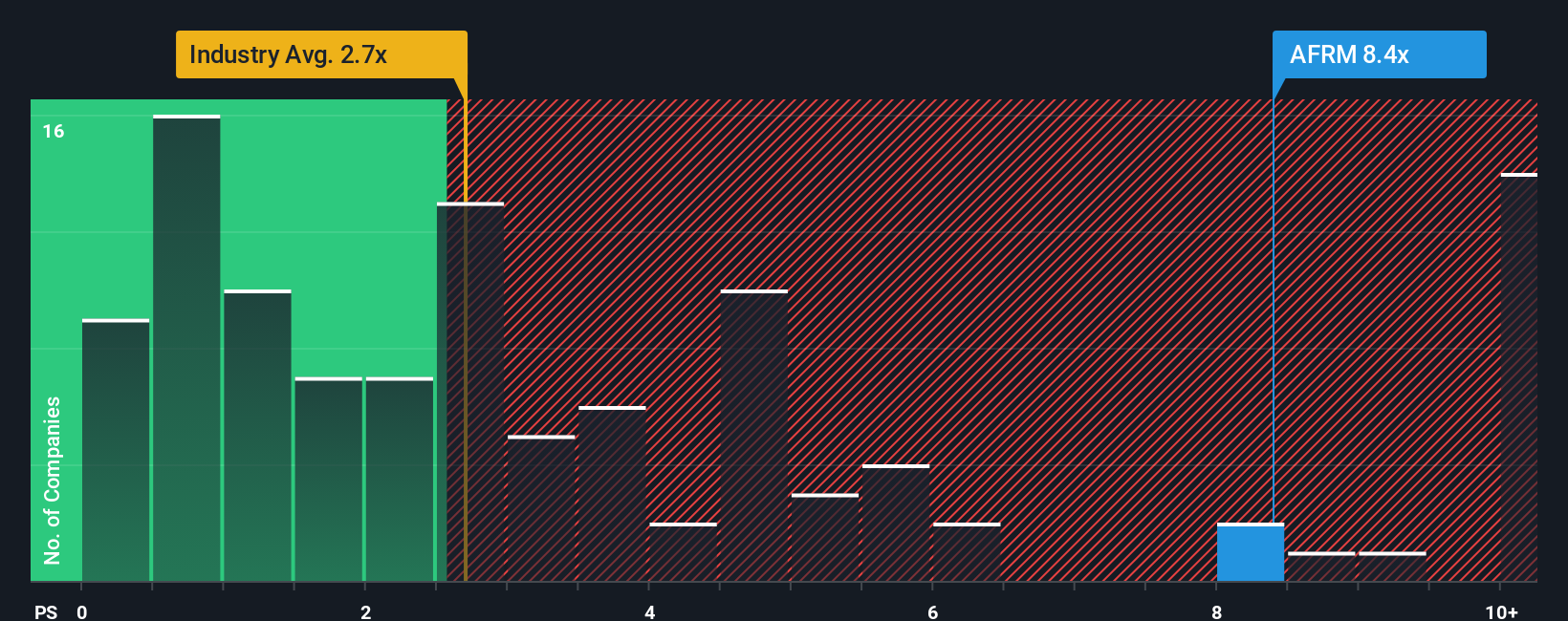

Another View: Comparing Valuation by Sales Ratio

While analyst projections hint at significant upside, a look at Affirm’s sales-based valuation tells a different story. The company’s price-to-sales ratio of 7.6x is well above both the US diversified financial industry average of 2.9x and the peer group at 4x. The fair ratio, which is what the market could gravitate toward, sits at 4.5x. This highlights that Affirm is currently priced at a premium. Could this gap narrow if growth slows or competition heats up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you prefer your own analysis or want to challenge these perspectives, you can build your personalized narrative using the available data in just a few minutes: Do it your way

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio a competitive edge by acting now. These tailored stock picks could take your strategy to the next level and help you stay ahead.

- Spot undervalued opportunities fast and see which companies are outshining rivals through improving cash flows with these 901 undervalued stocks based on cash flows.

- Capture the energy of high-yield opportunities by checking out these 19 dividend stocks with yields > 3% to target stocks with reliable income potential.

- Ride the next wave in artificial intelligence by reviewing these 24 AI penny stocks and uncovering visionary companies shaping tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives