- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM): Assessing Valuation After Major New York Life Deal and Expanded Partnerships

Reviewed by Simply Wall St

Affirm Holdings (AFRM) is back in the spotlight after announcing a new agreement with New York Life Insurance to purchase up to $750 million in installment loans through 2026. The company is also expanding partnerships with both Wayfair and Worldpay.

See our latest analysis for Affirm Holdings.

Momentum around Affirm has been building in 2024, with the share price up 14.2% year-to-date after a wave of new partnerships and expanded deals. The 1-year total shareholder return, a more holistic measure including dividends, is a standout 56.6%, and the three-year figure sits at a remarkable 356.6%. This highlights growing investor confidence in Affirm’s long-term trajectory despite recent short-term volatility.

If you’re inspired by Affirm’s strategic moves, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with Affirm’s rapid expansion and recent share gains, the question remains: Is the current share price reflecting all this upside, or could the market be underestimating Affirm’s true growth potential?

Most Popular Narrative: 25.9% Undervalued

With the most-followed fair value estimate at $96.31, Affirm Holdings trades meaningfully below this target based on the last close of $71.41. This positions the current price at a sizable discount, leading to major discussions among investors about the future path for this growth story.

Affirm's differentiated technology and underwriting, shown by the success with 0% APR loans and high user repeat rates, should improve customer lifetime value and reduce credit losses. This could support enhanced net margins and sustained earnings as more users graduate to interest-bearing products.

Want to know what’s fueling this perceived upside? The core of the narrative is built on bold forecasts for recurring profits, improving margins, and a growth runway that rivals top innovators. Explore just how aggressive the underlying numbers are and see what else could be influencing that target.

Result: Fair Value of $96.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around losing a major enterprise client or mounting competition could quickly alter Affirm's growth trajectory and investor expectations.

Find out about the key risks to this Affirm Holdings narrative.

Another View: Market Ratios Tell a Different Story

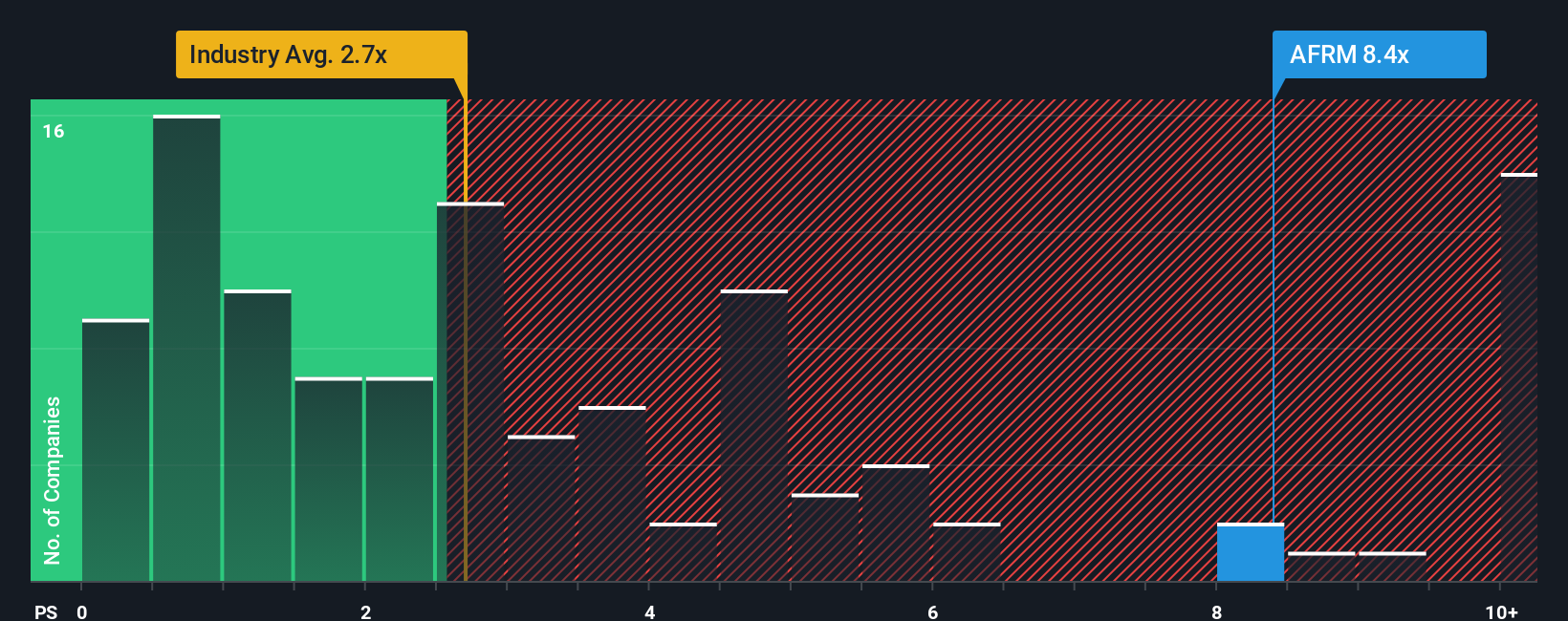

Looking at Affirm from another angle, its price-to-sales ratio stands at 7.2x. This is much higher than both the US Diversified Financial industry average of 2.4x and the peer average of 3.7x. Compared to its fair ratio of 4.2x, the current valuation implies investors are paying a significant premium for anticipated growth, leaving less margin for error if expectations are not met. Does the strong narrative fully justify this premium, or could sentiment reverse if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you’d rather dive into the numbers and build your own story around Affirm, you can easily craft your personal perspective in minutes: Do it your way

A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your strategy and don't settle for just one opportunity when you could hand-pick tomorrow’s biggest winners using the Simply Wall Street Screener. Think bigger than a single stock. These unique lists could reveal what everyone else is missing.

- Get ahead of the curve by jumping on these 27 AI penny stocks set to transform industries from healthcare to finance with disruptive artificial intelligence breakthroughs.

- Target market inefficiencies and seize opportunities with these 844 undervalued stocks based on cash flows that offer significant upside based on high conviction cash flow analysis.

- Lock in reliable returns even in uncertain markets by checking out these 20 dividend stocks with yields > 3% delivering solid yields and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives