- United States

- /

- Capital Markets

- /

- BATS:CBOE

How Record Options Growth and Retail Expansion Plans Will Impact Cboe Global Markets (CBOE) Investors

Reviewed by Sasha Jovanovic

- Cboe Global Markets recently announced record second quarter results, robust growth in options trading, and plans to close its Japanese equities business to prioritize higher-return activities, alongside a $0.72 quarterly dividend declared for Q4 2025 and a new executive appointed to lead retail expansion and alternative investment products.

- Management's focus on reallocating resources to derivatives and data-driven segments, as well as entering the retail alternatives space, highlights a targeted approach to growth amid evolving market and technology trends.

- We'll now explore how Cboe's strengthened focus on retail alternative investment products could influence its longer-term investment thesis and outlook.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cboe Global Markets Investment Narrative Recap

To invest in Cboe Global Markets, you need to believe in the ongoing expansion of global derivatives trading, the growth of data and analytics, and the company’s ability to keep innovating in a fast-evolving electronic markets environment. The recent record Q2 results and renewed focus on higher-return segments strengthen the most important near-term catalyst, rising transaction volumes, especially in options, while the biggest risk remains Cboe’s reliance on its S&P index options partnership, which these developments have not materially altered.

The recent appointment of JJ Kinahan to launch and oversee a new retail alternative investment products business is especially relevant. This move reflects how Cboe aims to capture rising retail trading demand, a key catalyst supporting volume growth and product expansion as competition intensifies across digital asset and event-driven trading markets.

Yet, it’s important to consider that, despite headline growth, the concentrated risk of the S&P index options franchise remains a factor investors should be aware of if ...

Read the full narrative on Cboe Global Markets (it's free!)

Cboe Global Markets is projected to reach $2.6 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes a yearly revenue decline of 16.9% and reflects an earnings increase of about $200 million from current earnings of $896.3 million.

Uncover how Cboe Global Markets' forecasts yield a $247.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

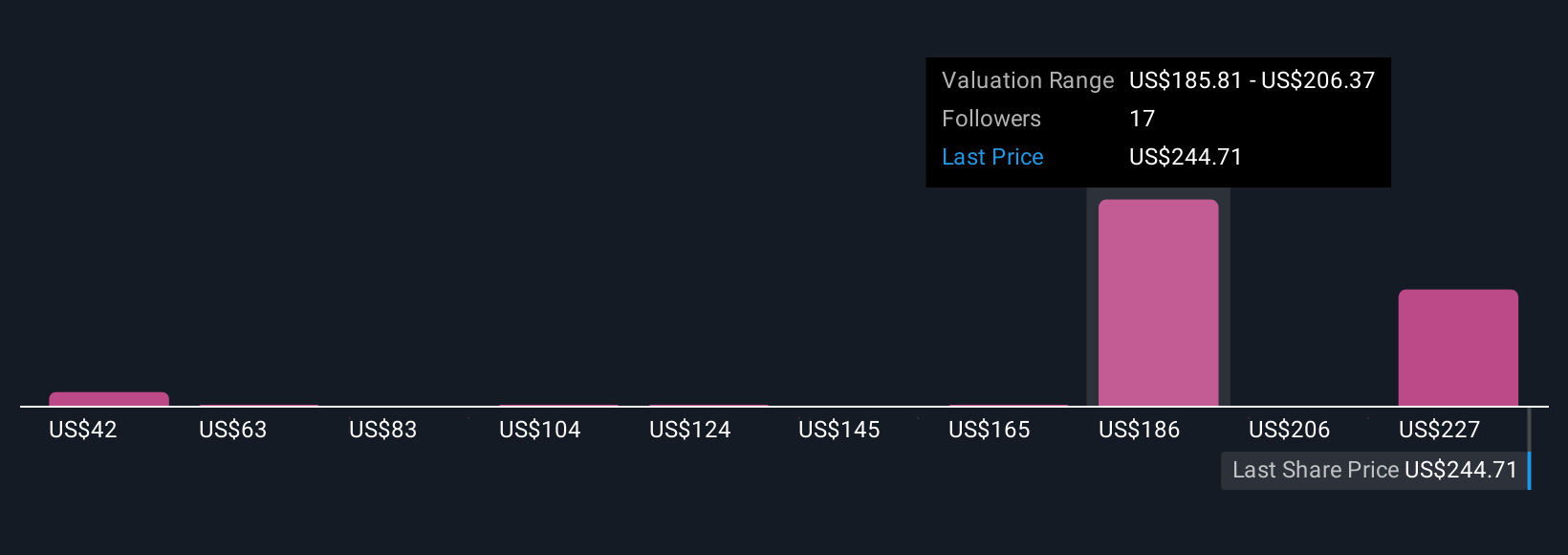

Eight members of the Simply Wall St Community see Cboe’s fair value ranging from as low as US$41.96 to as high as US$247.47. As you weigh these differing opinions, rising transaction volumes and the push into alternative investment products continue to shape future opportunities and risks, explore how your outlook compares to the broader community’s.

Explore 8 other fair value estimates on Cboe Global Markets - why the stock might be worth less than half the current price!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cboe Global Markets' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives