- United States

- /

- Capital Markets

- /

- BATS:CBOE

Did Cboe's (CBOE) Launch of Tech and Crypto Derivatives Just Redefine Its Growth Story?

Reviewed by Sasha Jovanovic

- Cboe Global Markets has announced plans to launch futures and options on its new Magnificent 10 Index and soon-to-trade Bitcoin and Ether Continuous Futures, both designed to offer cash-settled exposure to high-profile equities and digital asset markets for institutional investors.

- These launches enable market participants to manage risk across top technology stocks and key cryptocurrencies within single, flexible derivative contracts, signaling Cboe's expansion into innovative trading solutions.

- We'll look at how introducing continuous futures on digital assets could influence Cboe's revenue mix and future growth trajectory.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cboe Global Markets Investment Narrative Recap

To feel confident as a Cboe Global Markets shareholder, you need to believe in the company's ability to innovate across market infrastructure and diversify its revenue beyond core S&P index options. While the recent launches of Magnificent 10 Index derivatives and Bitcoin and Ether Continuous Futures expand Cboe’s product offerings and may give a short-term boost to trading volumes and fee-based revenue, they do not meaningfully change the importance of Cboe’s dominant S&P index franchise, nor its concentration risk as the primary near-term concern.

Among the latest announcements, the introduction of S&P 500 Equal Weight Index options stands out for its connection to Cboe’s ongoing leadership in index-based products. This move broadens Cboe’s suite of equity derivatives and complements the new technology-focused contracts, reinforcing its ability to attract sophisticated traders and institutional clients even as competitive and regulatory pressures continue to evolve.

On the other hand, investors should be aware that significant changes with key index partners could impact the fundamental strength of Cboe’s…

Read the full narrative on Cboe Global Markets (it's free!)

Cboe Global Markets' outlook forecasts $2.6 billion in revenue and $1.1 billion in earnings by 2028. This is based on an anticipated 16.9% decline in annual revenue growth and an earnings increase of approximately $200 million from current earnings of $896.3 million.

Uncover how Cboe Global Markets' forecasts yield a $256.67 fair value, in line with its current price.

Exploring Other Perspectives

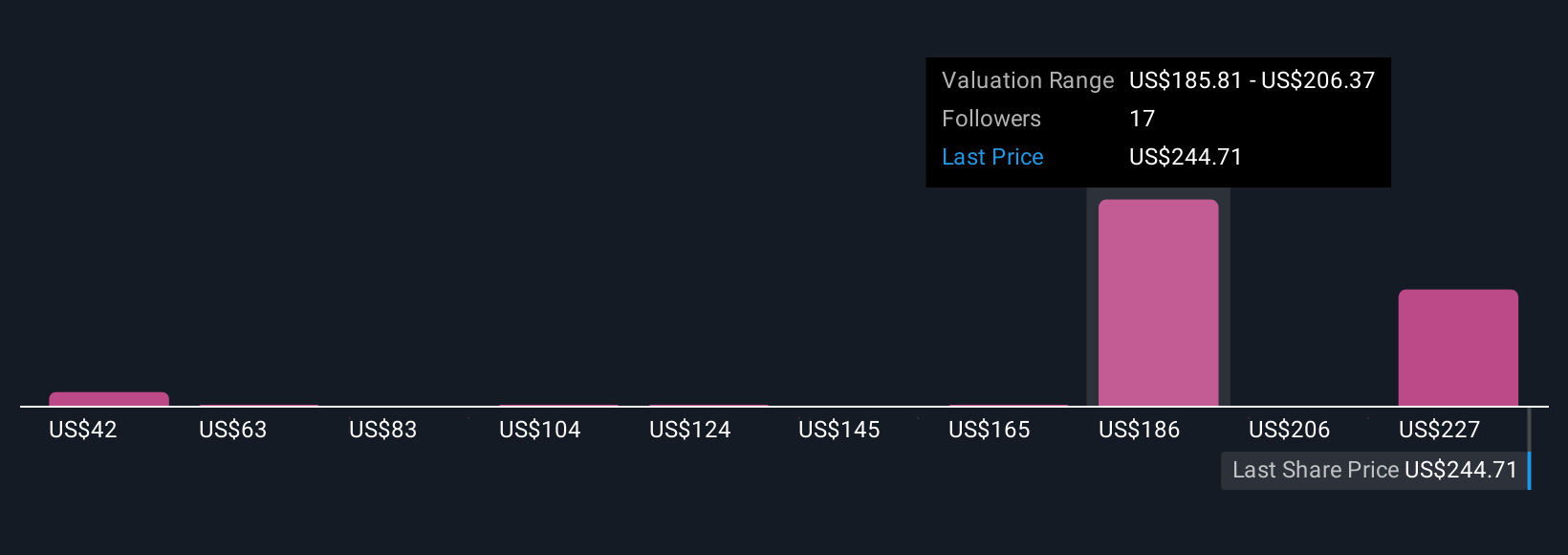

Fair value estimates from eight Simply Wall St Community members range from US$41.96 to US$256.67, highlighting wide differences in outlook. While some focus on growth from digital asset offerings, others point to Cboe's continued reliance on S&P index options as a source of both opportunity and risk.

Explore 8 other fair value estimates on Cboe Global Markets - why the stock might be worth less than half the current price!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cboe Global Markets' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success