- United States

- /

- Capital Markets

- /

- BATS:CBOE

Cboe Global Markets (CBOE): Is the Stock Fairly Priced Based on Recent Valuation Analysis?

Reviewed by Simply Wall St

Cboe Global Markets (CBOE) has recently attracted attention from investors, thanks to its consistent long-term returns and its positioning at the intersection of financial markets and technology. Many are now evaluating whether current trends offer fresh value opportunities.

See our latest analysis for Cboe Global Markets.

Cboe’s 1-month share price return of 7.25% stands out against a year of steady momentum, while its impressive 111.8% total shareholder return over three years underscores how long-term investors have been rewarded. The stock’s strong year-to-date performance signals that optimism about Cboe’s growth potential is still building among investors.

If you’re curious about what else is driving outsized gains, consider broadening your search and uncovering fast growing stocks with high insider ownership.

But with shares near analyst target prices and recent results showing mixed growth trends, the key question is whether there is still room for upside, or if today’s price already reflects all of Cboe’s future growth potential.

Most Popular Narrative: Fairly Valued

Cboe Global Markets’ latest narrative suggests its fair value sits close to the recent closing price, implying the stock is trading near where analyst consensus thinks it should be. This positioning raises key questions about which factors are propping up the valuation now and what could shift it going forward.

Cboe is experiencing broad-based growth across derivatives, data, and global spot markets. This positions it to benefit from ongoing increases in electronic trading volume and automation. These trends are likely to drive higher transaction-based revenue and support further top-line growth.

Want to know the foundation for this pricing? The narrative’s fair value rests on projections that challenge typical sector expectations. There is a crucial mix of growth levers, margin ambitions, and bold profit targets driving this consensus. Wondering which pieces matter most? Discover the surprising assumptions behind the forecast.

Result: Fair Value of $256.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cboe’s heavy reliance on core index partnerships and rising fintech competition could challenge future earnings and the current fair value thesis.

Find out about the key risks to this Cboe Global Markets narrative.

Another View: Discounted Cash Flow Model Challenges the Status Quo

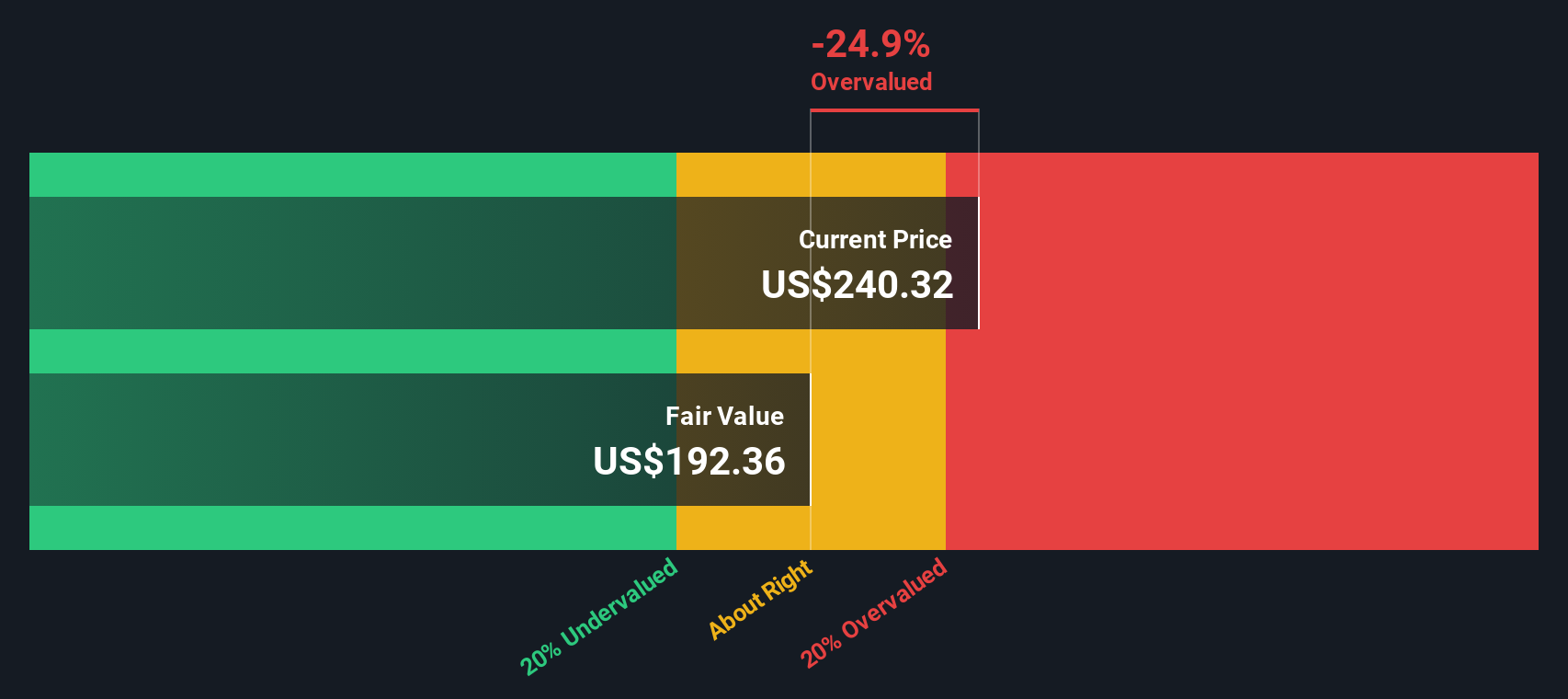

While analysts see Cboe as fairly valued based on consensus forecasts, our SWS DCF model suggests a different story. According to this model, Cboe's current price of $254.29 is above its estimated fair value of $204.59, which indicates the stock may be overvalued if future cash flows do not exceed moderate expectations. Could recent optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cboe Global Markets for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cboe Global Markets Narrative

If you have your own perspective or want to dig deeper into the numbers, you can build your narrative in just a few minutes using the following option: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cboe Global Markets.

Looking for more investment ideas?

Don't let opportunity pass you by. The right stock can change your path. Use Simply Wall Street's custom screeners to quickly target shares that fit exactly what you're after.

- Pinpoint future industry leaders by reviewing these 27 AI penny stocks, where artificial intelligence is reshaping profitability and growth potential in surprising ways.

- Target high yields for your portfolio by taking a look at these 15 dividend stocks with yields > 3% that consistently deliver dividends above 3%.

- Ride the next wave of financial innovation when you scan these 81 cryptocurrency and blockchain stocks moving fast in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives