- United States

- /

- Capital Markets

- /

- BATS:CBOE

Cboe Global Markets (CBOE): Assessing Valuation After Strong Results and Upbeat Growth Outlook

Reviewed by Simply Wall St

Cboe Global Markets (CBOE) reported impressive quarterly results, with both net income and revenue rising. In addition, the company raised its full-year organic revenue growth outlook, demonstrating confidence in continued momentum.

See our latest analysis for Cboe Global Markets.

Momentum has been building all year for Cboe Global Markets, with the company’s recent upbeat earnings, a higher revenue growth outlook, and a push into new retail investment products. These factors have contributed to a 25.05% year-to-date share price return and an 18.36% total shareholder return over the past year. Notably, Cboe’s five-year total shareholder return of 211.83% highlights impressive long-term value creation, along with more recent catalysts.

If you’re interested in what’s next for fast-moving financial and market innovators, now is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

After a substantial rally, strong financials, and new strategic initiatives, the key question is whether Cboe’s recent gains leave room for further upside or if the market has already priced in all of the expected growth.

Most Popular Narrative: Fairly Valued

With Cboe Global Markets’ last close at $245.64 and the widely followed fair value estimate set at $247.47, the narrative points to a market price that closely matches consensus valuation expectations. This close alignment signals an interesting pause between recent momentum and the company’s future potential.

Cboe is experiencing broad-based growth across derivatives, data, and global spot markets, positioning it to benefit from ongoing increases in electronic trading volume and automation. These trends are likely to drive higher transaction-based revenue and support further top-line growth.

What’s enabling this price? Delve into the forecasts behind this narrative. There is a future profit margin expansion story and some bold shifts in earnings quality. Think the current price captures all that growth? Only by reading the full narrative will you see exactly which projections move the needle.

Result: Fair Value of $247.47 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential headwinds remain, as overreliance on S&P index options and rising fintech competition could challenge Cboe’s growth outlook and long-term margins.

Find out about the key risks to this Cboe Global Markets narrative.

Another View: Market Ratios Raise Questions

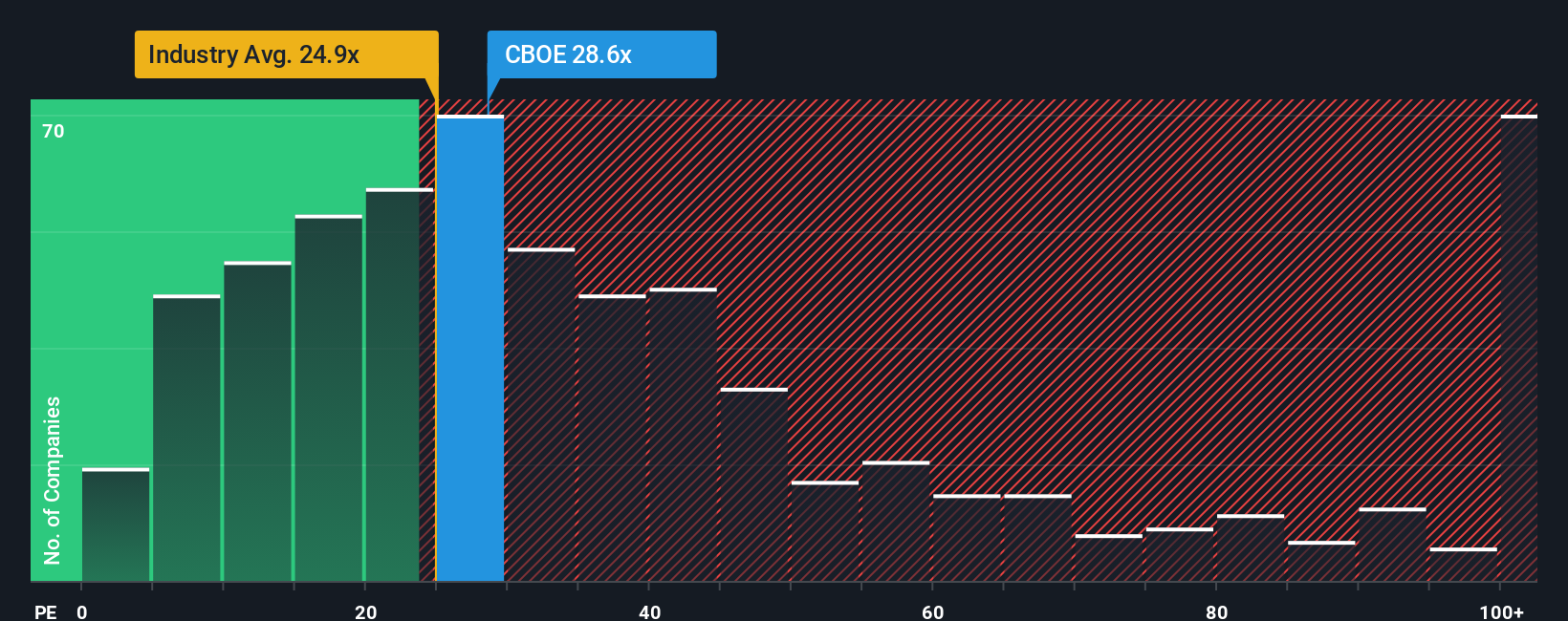

While consensus sees Cboe as fairly valued, a closer look at its price-to-earnings ratio tells a different story. At 26.3x, Cboe trades above the US Capital Markets industry average of 25.1x and over the fair ratio of 14.4x. Compared to its peers (29.7x), it looks reasonable, but the gap versus the fair ratio may mean investors are paying a premium. This premium could reflect quality and growth potential, or it might introduce extra valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cboe Global Markets Narrative

If you want to follow your own instincts or take a different perspective, you can dig into the numbers and build your view in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cboe Global Markets.

Looking for More Investment Ideas?

Don’t let smart opportunities slip away. Supercharge your search by spending a few minutes with these hand-picked screens and spot trends before everyone else notices.

- Unlock rising income streams and review these 22 dividend stocks with yields > 3%, which offers above-average yields for stronger, consistent returns.

- Tap into the world of cutting-edge health technology by browsing these 33 healthcare AI stocks, focused on AI-driven breakthroughs in medicine.

- Boost your portfolio’s edge with these 27 AI penny stocks, which taps artificial intelligence to power the next growth surge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives