- United States

- /

- Hospitality

- /

- NYSE:YUM

Yum! Brands (YUM): Evaluating Valuation After Operational Wins and Global Expansion Momentum

Reviewed by Kshitija Bhandaru

Yum! Brands (YUM) has been making headlines for its ongoing operational wins. Taco Bell is taking the lead in drive-thru efficiency, and Pizza Hut is launching new marketing efforts. The company’s expansion and financial stability continue to draw interest from investors.

See our latest analysis for Yum! Brands.

Recent upgrades such as Taco Bell’s industry-leading drive-thru efficiency and Pizza Hut’s marketing push have come alongside a steady 8.75% year-to-date share price return and a solid 10.28% total shareholder return over the past 12 months. With Yum! Brands expanding its global reach and margins holding strong, momentum appears to be building for investors focused on growth potential.

If you’re interested in broadening your search, now is a great time to discover fast growing stocks with high insider ownership.

Given its rising share price, solid financial growth, and ongoing operational wins, the key question is whether Yum! Brands is still undervalued or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 8.4% Undervalued

With Yum! Brands trading at $145.25, the prevailing narrative sees its fair value at $158.52. This sets expectations higher than the current share price and draws attention to what could be driving analyst optimism.

The rapid acceleration and global rollout of Yum!'s Byte digital platform, including AI-driven marketing, operational automation, and proprietary ordering or delivery solutions, positions the company to capture higher transaction volumes, expand check sizes, and enhance customer loyalty. This drives both top-line revenue growth and improves net margins over the long term.

Want to know why analysts have set their sights above today's price? The real story is in the aggressive tech transformation and expansion blueprint. Curious which bold profit and sales forecasts power that headline fair value? You’ll need to see the narrative to get the details.

Result: Fair Value of $158.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in certain regions or slower-than-expected returns on digital investment could challenge Yum! Brands’ optimistic expansion narrative.

Find out about the key risks to this Yum! Brands narrative.

Another View: Discounted Cash Flow Model

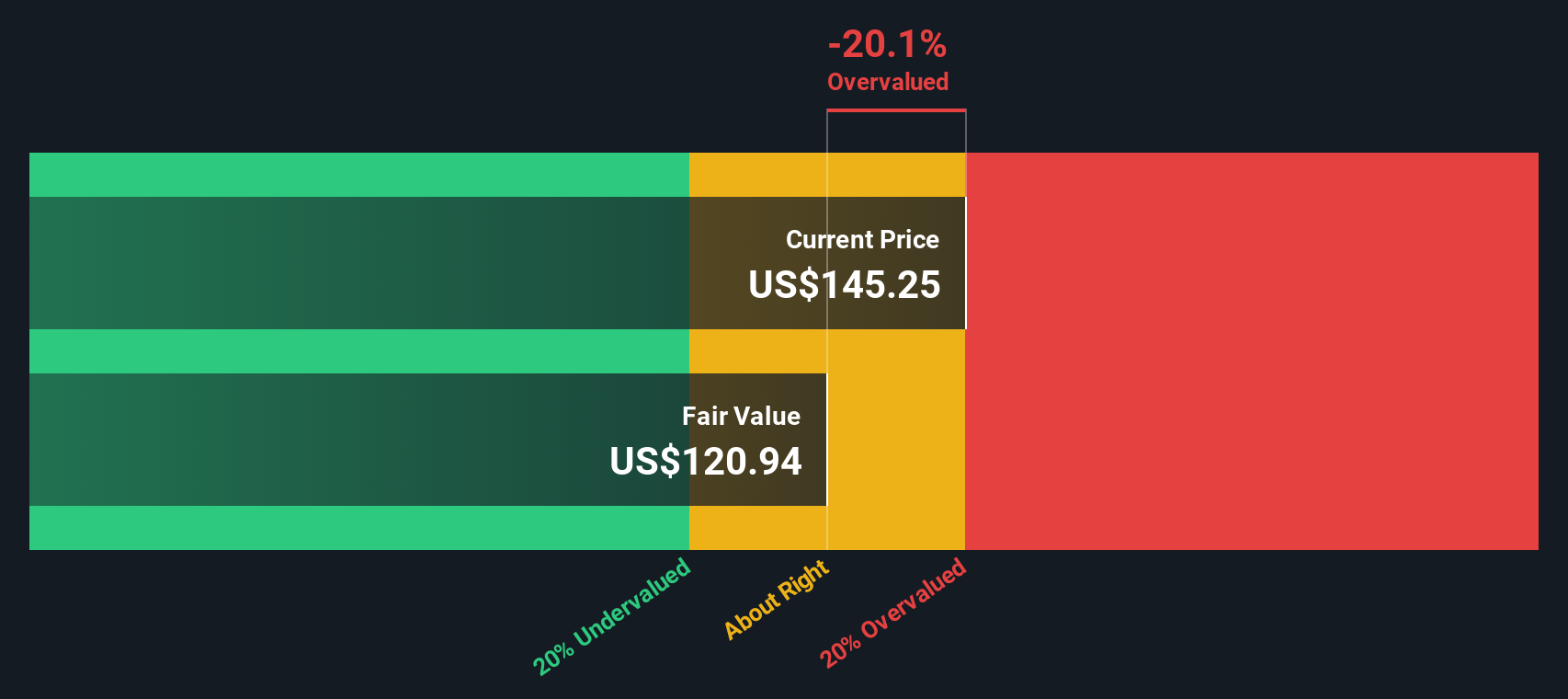

Switching gears, the SWS DCF model takes a different look at Yum! Brands by estimating its value based on projected future cash flows. According to this method, the current price of $145.25 actually sits above the model’s fair value of $120.94, suggesting the stock could be overvalued from this perspective. Could the market be pricing in more optimism than fundamentals, or is there long-term upside analysts may have missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yum! Brands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yum! Brands Narrative

If you have your own perspective or prefer to dig into the numbers yourself, you can quickly craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Yum! Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize smart opportunities and uncover stocks with breakthrough potential using these handpicked ideas. Don’t let the next top performer pass you by; your smartest move starts here.

- Capitalize on market mispricing and tap into growth potential by tracking these 878 undervalued stocks based on cash flows that show signs of strong upside.

- Capture income and build financial resilience by choosing these 18 dividend stocks with yields > 3% known for attractive dividend yields and steady payouts.

- Ride the wave of next-generation computing with these 26 quantum computing stocks paving the way in quantum breakthroughs and disruptive technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUM

Yum! Brands

Develops, operates, and franchises quick service restaurants worldwide.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives