- United States

- /

- Hospitality

- /

- NYSE:WH

Wyndham Hotels & Resorts: Assessing Valuation as Expansion Targets High-Growth Markets in Italy, India, and Greece

Reviewed by Kshitija Bhandaru

If you have ever wondered whether Wyndham Hotels & Resorts (WH) is ready for its next chapter, the latest headlines offer something to think about. The company has not just opened a renovated four-star hotel in Conegliano, Italy; it also inked a new property deal in Darbhanga, India, and is taking steps to cater to a rising wave of Indian travelers in Greece. These moves come as part of Wyndham’s ongoing push to expand into high-potential markets where competition is still up for grabs. This strategy could reshape how investors see future earnings and growth prospects.

Over the past year, the stock has delivered a modest 3% return, reflecting a measured but steady performance even as the broader market environment has sometimes been choppy. This momentum is interesting given the company’s long-term track record, with strong multi-year gains propelled by consistent efforts to scale up in new territories. Recent strategic wins in Italy and India are just the latest in a string of calculated moves focused on capturing untapped demand across underserved regions.

So as the market takes in these expansion headlines and the stock’s recent price swings, the big question is whether there is an undervalued opportunity here or if investors are already factoring in all the expected growth from Wyndham’s game plan?

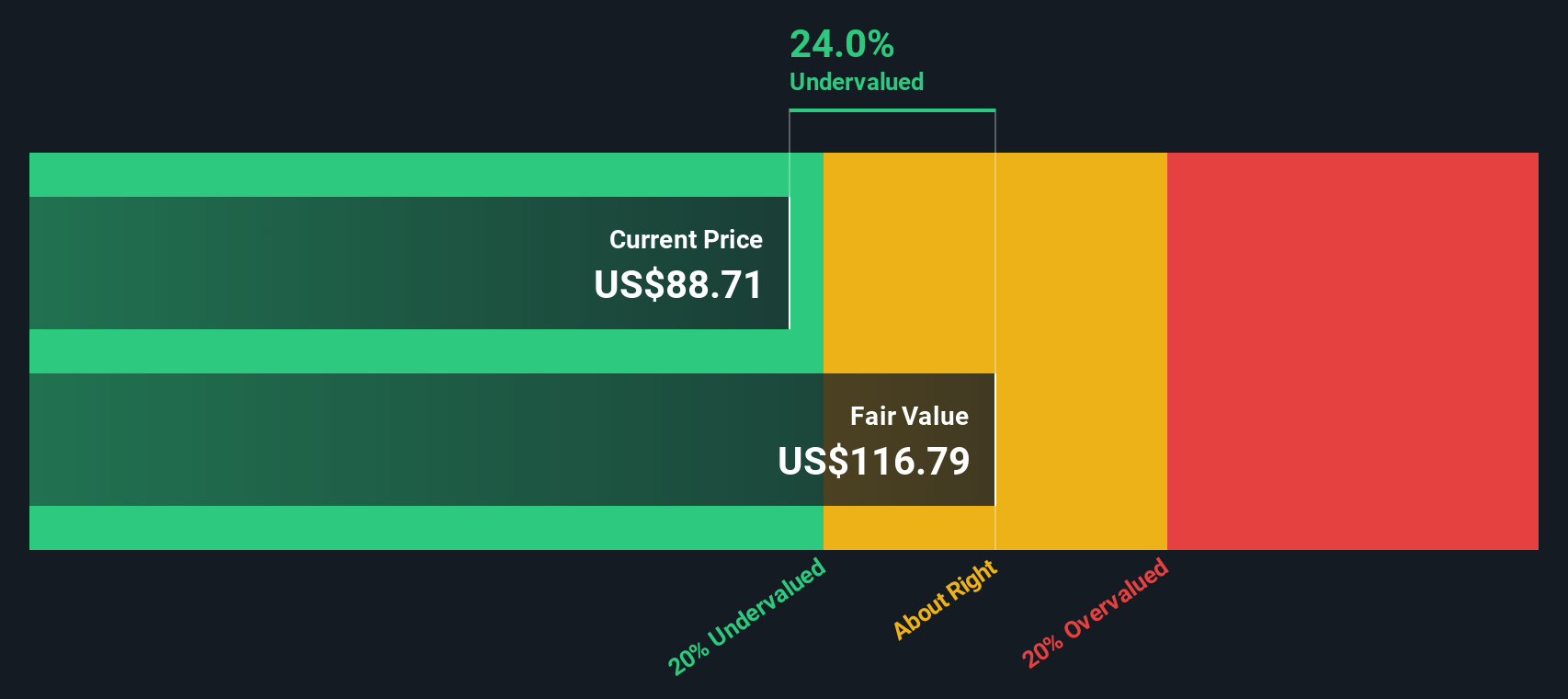

Most Popular Narrative: 23% Undervalued

According to the most popular narrative, Wyndham Hotels & Resorts is currently undervalued by a substantial margin. The narrative suggests that despite recent expansions and strong operating results, the stock trades at a meaningful discount to its estimated fair value.

Final big thing I want to talk about before I break into some of my projections is how they also have 120 Million Loyalty Members, which continues to grow every year. This large number not only shows how strong of a retention rate WH is able to hold, but it also demonstrates why their ancillary revenue has been increasing. These revenues mainly come from their co-branded credit card and their new co-branded debit card. By year end, they plan to have growth in the low-teens year over year, then raising that to mid-to-high teens by the end of 2026. This is only a small part of their business, but if they are able to continue growing it, there is significant potential.

What is driving this bullish outlook? Wyndham’s narrative is built around accelerating growth, surging membership, and ambitious global expansion. Want to see the secret figures this valuation is banking on? The story behind this fair value hinges on projections that could surprise even the most optimistic investor.

Result: Fair Value of $105.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing debt levels and unpredictable global travel demand could challenge Wyndham's expansion story and put pressure on future returns for investors.

Find out about the key risks to this Wyndham Hotels & Resorts narrative.Another View: Reinforcing the Numbers

The SWS DCF model also suggests Wyndham Hotels & Resorts is trading below its fair value. This aligns with the earlier bullish narrative. However, it raises an important question: can two different methods both be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wyndham Hotels & Resorts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wyndham Hotels & Resorts Narrative

If these perspectives do not fully match your own views or you enjoy diving into the details yourself, it is simple to explore the fundamentals and build your own case in just a few minutes. Do it your way

A great starting point for your Wyndham Hotels & Resorts research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop at one opportunity? Unlock a world of investment ideas with unique strategies most investors overlook. The right screener can reveal tomorrow’s winners today. Do not miss your shot to get ahead.

- Spot undervalued opportunities by using undervalued stocks based on cash flows to zero in on stocks that look primed for a value-driven comeback.

- Tap into unstoppable income streams by checking out companies that make the cut for dividend stocks with yields > 3% and could boost your portfolio yield.

- Ride the frontlines of technology by searching for innovators in AI penny stocks, where artificial intelligence is transforming tomorrow’s leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wyndham Hotels & Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WH

Wyndham Hotels & Resorts

Operates as a hotel franchisor in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives