- United States

- /

- Hospitality

- /

- NYSE:VIK

Exploring Viking Holdings (VIK) Valuation After 2% Stock Rebound and Strong Year-to-Date Gains

Reviewed by Simply Wall St

Viking Holdings (VIK) has seen its stock climb 2% over the past day, recovering from losses earlier in the week. Year to date, the company’s shares have returned 36%, attracting interest from investors watching the travel sector.

See our latest analysis for Viking Holdings.

That quick rebound comes after a modest dip last week. The momentum for Viking Holdings remains positive, with a 1-year total shareholder return of 34% and a 36% share price jump year-to-date. Investors seem to be warming up to the travel sector’s growth potential as confidence returns.

If the market’s renewed optimism in travel stocks has you interested, why not see what’s happening across the entire sector with our See the full list for free.

With strong recent gains and an optimistic outlook for the travel sector, investors now face a critical question: Is Viking Holdings undervalued, or is the market already factoring in the company’s potential growth?

Most Popular Narrative: 10.1% Undervalued

Viking Holdings’ most popular narrative attaches a fair value of $66.35 to the stock, putting it ahead of the recent close at $59.63. This assessment is grounded in expectations of robust earnings expansion and ambitious global fleet growth, setting the stage for a closer look at catalysts driving this perspective.

Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates. This indicates durable repeat demand and allows for mid-single-digit pricing growth that directly benefits company earnings and net margins.

Want to know which numbers are fueling this bullish price target? The narrative’s secret is rapid profit expansion, ambitious international moves, and surprisingly aggressive assumptions on future margins. The full story reveals the bold projections that drive this valuation. Are you ready to see what sets Viking’s path apart?

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on older, affluent travelers and tightening environmental regulations could challenge Viking’s long-term revenue growth and margin expansion if conditions change.

Find out about the key risks to this Viking Holdings narrative.

Another View: What Do Market Multiples Say?

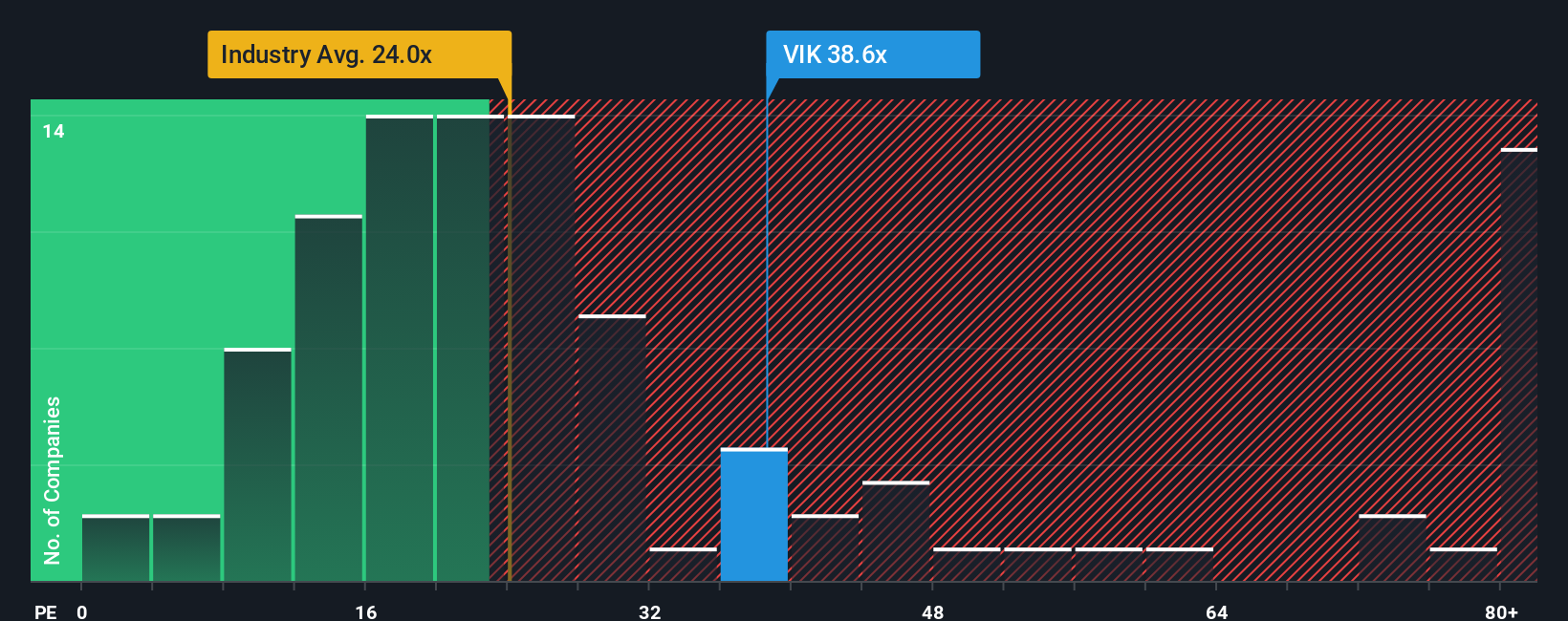

Looking at Viking Holdings through the lens of price-to-earnings, the story shifts. The company trades at 38.1x earnings, noticeably above both its peer average of 20.5x and the US hospitality sector at 21.2x. Even so, this level nearly matches its fair ratio of 38.2x, suggesting the market already prices in much of the optimism. Is this a sign to proceed with caution, or could further gains lie ahead if expectations are exceeded?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own story about Viking Holdings in just a few minutes: Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Ideas?

Don't let opportunity pass you by. Go beyond the obvious and target stocks poised for growth, stable returns, or exposure to tomorrow’s breakthrough markets with the right tools.

- Boost your pursuit of high-yield opportunities and tap into smart income plays through these 16 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Embrace the momentum of technological change and pinpoint game-changing breakthroughs by starting with these 24 AI penny stocks, powering the artificial intelligence revolution.

- Position yourself ahead of the crowd and uncover market gems trading below their intrinsic value by checking out these 865 undervalued stocks based on cash flows, based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives